Time to Stub Out the Habit? How to Quit Smoking and Make Yourself Richer

To coincide with National No Smoking Day on 8 March 2017, we conducted our own research into how the money saved from giving up smoking could be more usefully invested for the future.

Although every smoker knows the financial costs associated with their habit and is aware that they could save themselves a lot of money if they were to quit smoking, the actual figures revealing just how much cash a smoker loses over the course of even a year or two, let alone a lifetime, make harrowing reading.

The research by Drewberry into the cash benefits open to those who stop smoking revealed three main findings:

- Quitting smoking could more than halve your insurance premiums – due the higher health risks smokers face, most UK insurers charge them more

- Going ‘smoke free’ for a year could be worth thousands of pounds – the high cost of cigarettes coupled with the recent robust performance of the stock market means that smokers who quit last year and invested their savings could already be sitting on attractive nest eggs

- If you stop smoking, you could close the ‘retirement gap’ – many people’s pension pots simply aren’t sufficient to sustain them through retirement in the manner they’d prefer, but by stopping smoking and investing the savings into a pension, you could generate a pension pot worth more than three times the current average pot at retirement.

Give up smoking for cheap Life Insurance and Income Protection

Despite the success of national campaigns such as Stoptober and National No Smoking Day, there are still at least eight million smokers in the UK according to government data.

Insurers tend to take a dim view of smokers and if you do smoke, most companies will load your premiums because of the additional health risks associated with smoking.

The health risks of smoking are highlighted by the Health & Social Care Information Centre, which reveals that smoking is thought to account for around 80,000 UK mortalities a year and is implicated in around 17% of the deaths in people aged 35+.

The good news is that many Britons are successfully quitting smoking. However, while it’s estimated that around 500,000 people stopped smoking in the year leading up to National No Smoking Day on 8 March 2017, there are few signs that Britain’s army of quitters are making the most of the financial opportunity this presents.

More than half a million Brits could reduce Income Protection and Life Insurance premiums

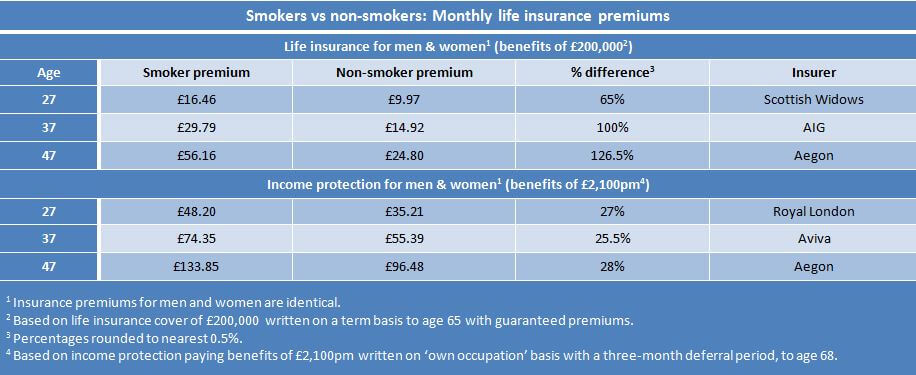

Apart from a few UK friendly societies, Life Insurance for smokers will cost more than for non-smokers. The same is true for Income Protection – although again some friendly societies will discount your smoking status, most insurers find that the risk is too big to ignore and Income Protection for smokers will also be more expensive.

Life insurance premiums are generally twice as high for smokers and they rise even higher if you haven’t given up smoking by your 40s.

While the loading on Income Protection insurance for those who smoke is less at a little over 25%, Income Protection premiums for smokers are higher in the first place.

That means this 25% loading represents a significant additional cost – even for someone with modest insurance cover.

Even if you’re only a ‘social smoker’ you’ll likely face the same price hike as someone who smokes regularly.

Most insurers ask if you’ve used any nicotine or nicotine replacement products at all in the past 12 months when you take out the cover, so it doesn’t matter if you’ve smoked 1 cigarette or 1,000 cigarettes in the past year – the loading will be the same.

Rob Harvey

Independent Protection Expert at Drewberry

You can see the impact that even being an occasional smoker might have in the following table:

Will my insurance get cheaper after I stop smoking?

Unless you’re with one of the handful of insurers who are smoker neutral – i.e. they’ll ignore the fact you’re a smoker – then you can apply to have your insurance re-rated one year after you’ve quit smoking. That means most smokers with Life Insurance can cut the cost of premiums when they give up smoking.

It’s actually quite easy to cut the cost of your Life Insurance and Income Protection Insurance by stopping smoking. After a year on the wagon, former smokers can apply to have their insurance re-rated.

All they have to do is sign a non-smoker declaration and have a simple cotinine test administered by their doctor. This usually involves a saliva sample that is tested for cotinine, a byproduct residue from the breakdown of nicotine in the body.

Egle Blusiute

Business Protection Expert at Drewberry

There’s at least half a million people who could be re-rating their insurance and potentially halving the price of their insurance, but many ex-smokers are forgetting to cash in on their hard work.

Once you’ve stopped smoking and successfully had your insurance re-rated, ex-smokers have two main options:

- Take the savings you make and either spend or invest them

- Continue paying the same premiums but get a higher benefit as a result.

If you give up smoking then you can also negotiate new cover with a different insurer at non-smoker rates.

However, it’s important to remember that the older you are, the less likely it is that a new insurer will offer improved terms. That means you’ll probably get a better deal from your existing insurer.

Sam Barr-Worsfold

Independent Protection Expert at Drewberry

How quitting smoking could build a nest egg worth more than £2,000 in a year

The Health & Social Care Information Centre indicates that the average UK smoker smokes 11 cigarettes per day.

With cigarettes now close to £10 a pack according to the Tobacco Manufacturers Association, the average smoker who quit last year and invested the savings into a FTSE 100 ISA would now have an investment worth £2,195.05.

For someone smoking a pack a day, the savings and investment growth adds up to £3,839.39.

As part of its research, Drewberry looked at how much someone who stopped smoking two years ago would now have, and they’d also be making savings on their Life Insurance.

On this basis, the average smoker who quit back in March 2015 could now have an ISA worth £4,882.43, while a pack-a-day smoker could have £8,202.67 built up in a stocks and shares ISA.

The table below illustrates the potential value of an ISA if a smoker used the money they saved on cigarettes and life insurance premiums to invest in the UK stock market.

How to stop smoking and triple your pension

In financial terms, the most rewarding home for the sudden new income stream that giving up smoking can deliver will probably be a pension thanks to the availability of pensions tax relief.

Smokers who quit and feed the savings into a pension will go from paying tax of around 75% on every pack of cigarettes to receiving tax relief back from the government at their highest marginal rate.

How much could you save into a pension by quitting smoking?

The research from Drewberry found that an average 11-a-day smoker aged 27 who quits this year and funds a pension to age 67 could create an additional pension pot worth around £270,400.

According to standard pension industry assumptions, this would equate to £102,000 in today’s money or well over triple the current average pension pot at age 65 – a meagre £29,417 according to research from asset management firm Close Brothers.

For a 37 year-old who quits smoking to fund a pension, their future pot would be worth approximately £171,270, while for someone aged 47 the future pension pot could still be worth over £106,000 or £65,300 in today’s money – still more than twice the current average at age 65.

We based these pension figures on standard industry pension growth projections, which assume ‘medium’ growth projections of 2.5% pa, inflation of 2.5% and annual management charges of 1%.

The table below – which assumes the smoker is a basic-rate taxpayer and an annual growth rate of 5% – illustrates the potential future value of a pension pot and its value in today’s terms if a smoker choose to contribute the money they saved on cigarettes and life insurance premiums to a UK pension contract.

Higher-rate taxpayer? Increase your pension further with the savings from quitting smoking

The above projections are based on an average smoker being a basic-rate taxpayer. However, as you get pensions tax relief at your highest marginal rate of tax, higher-rate taxpayers have an even greater incentive to quit smoking and funnel the proceeds into a pension as they’ll receive 40% tax relief on pension contributions.

Jonathan Cooper

Senior Paraplanner at Drewberry

Once higher-rate tax relief is taken into consideration, if the smoker in the above example had contributed the savings from a pension they’d be sitting on a retirement savings pot of:

- around £360,000 if they stopped smoking at age 27

- more than £227,000 for someone who quits smoking at age 37

- close to £142,000 if they delayed giving up smoking until the age of 47.

The same calculation for a basic rate taxpayer who smokes a pack-a-day, rather than the average 11 cigarettes assumed in our main case, would generate pension pots of:

- £450,000 by quitting smoking at age 27

- around £276,000 if they stopped smoking aged 37

- approximately £162,000 if they gave up smoking at the age of 47.

If that pack-a-day smoker was a higher rate taxpayer, the savings would obviously be even greater, standing at:

- £600,000 if they stopped smoking at the age of 27

- £369,000 if they quit smoking aged 37

- £216,000 if they gave up smoking at age 47.

The chance to transform your retirement prospects is probably the strongest financial argument for smokers to give up.

It’s also worth remembering that, if the UK’s growing army of quitters is serious about living longer, its members will need to build far better pensions than they have so far.

Tom Conner

Director at Drewberry

- Topics

- Life Insurance

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.