For years there has been a misconception surrounding the cost of putting Life Insurance in place, with many people believing it is a lot more expensive than it really is.

In reality this isn’t the case. Compared to Income Protection and Health Insurance, Life Insurance is actually one of the cheapest protection policies you can get.

Our survey of 3,000 workers in the UK found that on average we overestimate the cost of Life Insurance by a whopping 200%.

Hopefully this guide will help combat this misconception and help you gain a much better understanding of how life insurance is priced and the key factors that will affect the cost.

What Is Life Insurance?

We know it can be uncomfortable to think about death, however it’s important that we do so we can put plans in place just in case the worst were to happen.

Life insurance is a form of protection that pays out a tax free cash lump sum to your loved ones if you were to pass away. Having a policy in place can give peace of mind knowing that if something were to happen to you, your family would be taken care of financially.

What Are The Different Types Of Life Insurance?

There are a number of different types of Life Insurance available so it’s important to understand what they are to ensure you get the right cover for your circumstances.

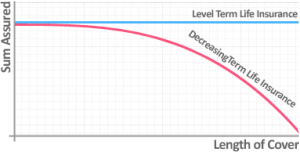

Some provide you with a set amount of cover for the duration of your policy, whereas others provide a benefit which decreases over time. What you need will depend on what you want to protect.

The different types of Life Cover include:

- Decreasing Term Life Insurance

Often used to cover a repayment mortgage it covers you for a set period of time with the level of cover declining to zero over the life of the policy.

- Level Term Life Insurance

It covers you for a set period of time and the level of cover remains the same throughout the term of the plan.

- Whole Of Life Insurance

It covers you for the rest of your life paying a fixed amount at the point you pass away.

- Family Income Benefit

Pays out an annual income should the policyholder die for the remainder of the term on the policy.

How Much Does Life Insurance Cost?

How much you pay for Life Insurance will depend on a number of personal and policy factors such as your age, health and the benefit amount you need. Everyone’s circumstances and needs are different so it’s important to get cover which is tailored specifically to you.

To give you an idea of how much you could expect to pay for different types of Life Insurance, we’ve calculated the monthly premiums for a 30 year old who:

- has no pre-existing conditions

- is a non-smoker

- is in a low risk office based job

We have compared Life insurance quotes from all the top UK insurers including Vitality and Liverpool Victoria, using the cheapest option for each example.

Cost Of Decreasing Term Life Insurance

This is probably the most common form of Life Insurance. The reason it is known as term insurance is because when putting a policy in place, you choose a period of time (term) for it to run for.

For example a 30 year old taking out a Term Life Insurance policy, might choose a term of 35 years meaning the policy would end at age 65.

The cost of a policy will vary depending on how long you want the term to be and if you want a level or decreasing benefit.

![Life Insurance Graph]()

Decreasing Life Insurance sees the benefit amount which gets paid out reduce over time. Because of this people tend to align it with any outstanding debt they have such as a repayment mortgage.

As the outstanding debt reduces so does the benefit amount until eventually both equal zero.

Average Cost Of Decreasing Life Insurance In 2025

Decreasing Term Insurance is the most cost-effective form of Life Insurance as the risk to an insurer declines over time as the level of cover falls.

As a result the monthly premiums are lower than a Level Life Insurance policy.

Cost Of Level Term Life Insurance

Unlike Decreasing Term Insurance, Level Term Life Insurance would provide you with a fixed benefit amount throughout the life of a policy, paying out exactly the same if you died in the first year as if you died in the final year.

Average Cost Of Level Term Life Insurance In 2025

As the benefit amount doesn’t reduce over time you can expect to pay around 40% more for Level Term Life Insurance.

Cost Of Whole of Life Insurance

Whole of Life Insurance is just that. It is a policy which has no term and lasts until the day you die regardless of your age, as long as you keep paying your premiums.

The permanent nature of this cover means it’s often used to cover liabilities that will definitely arise on death, such as funeral expenses or meeting an inheritance tax bill.

As you can imagine, as the payout is guaranteed, it’s usually the most expensive form of Life Insurance.

Because of this people tend to cover a smaller benefit amount than when taking out Term Insurance or Family Income Benefit.

Cost Of Family Income Benefit

Unlike Decreasing or Level Term insurance which pays out a tax free cash lump sum, Family Income Benefit offers your loved ones a regular monthly income if you were to pass away.

Some people prefer this option as it can make it easier to manage finances after the loss of a loved one.

It is often used for school fees or can be used to maintain the standard of living of your children up to an age where they should be self-sufficient.

If you know exactly what you are looking for you can use our life insurance quote tool below to compare instant quotes from the top UK insurers including Aviva & Vitality →

Policy Factors Affecting The Cost Of Life Insurance

Just as there are certain personal factors that can affect the cost of Life Insurance, there are also certain policy factors that could affect how much you pay.

Increasing The Level Of Benefit Increases The Cost

When it comes to the level of cover needed most people will align their benefit amount with any outstanding debt that they have e.g. a mortgage or loan. This is to ensure that should they pass away, those left behind can afford to pay the remaining debt off.

The more cover you need the more the insurer will need to pay out and so the higher your premiums to cover this risk.

The Longer You Need Cover The Higher The Premiums

The length of time you would like your policy to run for will also affect how much you pay for your cover.

As mentioned above, with Term Insurance your policy will run for a set amount of time until you reach a certain age, where as a Whole Life Policy will pay out regardless of when you die.

The longer you need cover the higher the risk of you dying and this is reflected in higher monthly premiums.

Because there is no end date on a Whole Of Life policy you can expect to pay a significant amount more than you would for Decreasing or Level Term Insurance as the term is indefinite.

It Costs A Lot More To Include Critical Illness Cover

One option you have when it comes to Life Insurance is to add Critical Illness cover to your policy. By adding this optional extra to your cover, as well as paying out on your death, your policy would pay out if you were to become critically ill with illnesses such as:

- Cancer

- Heart Attacks

- Strokes

The chance of suffering a serious illness is significantly higher than passing away. Because of this opting to add Critical Illness Cover to your policy will results in a severe hike in your monthly premiums.

Including A Spouse Increases The Cost

When it comes to taking out a Life Insurance cover you can protect two lives on one policy, however this can be 80% more expensive than a single policy.

It’s also important to remember that it will only pay out on the first death. This means that the remaining policy holder would no longer be covered by life insurance once the claim has paid out.

Because of this it might be worth considering taking out 2 separate policies to ensure both parties are fully covered, however this would be a more expensive option.

Choose Your Premiums Wisely

When choosing a Life Insurance policy you will have the option of opting for reviewable or guaranteed premiums. There is a significant difference between the two and the cost of a policy will vary depending on which one you choose.

- Guaranteed Premiums

Usually are more expensive compared to reviewable when taking out a policy. This is because monthly premiums remain fixed over the term of the policy.

- Reviewable Premiums

These tend to start off cheaper, however the total cost is usually higher over the life of the policy relative to plans with guaranteed premiums.

Personal Factors Affecting The Cost Of Life Insurance

When it comes to putting Life Insurance in place there are a number of personal and policy factors that will affect the amount you pay. We’ve outlined these below.

Age Can Affect The Cost Of Life Insurance

As unfair as it may seem, age does affect the cost of Life Insurance. This is because sadly, with every year we get older the more at risk we become to certain health conditions.

As a result of this insurers charge a higher premium for older people, this is due to the fact they are more likely to make a claim than a younger person.

Using the same policy options for Decreasing Term Life Insurance, the cost of Life Insurance for our 30 year old goes from £6.24 to £12.77 for a 40 year old.

Smoking Can Cost You A Packet

It will probably come as no surprise that if you are a smoker you will be charged more for Life Insurance.

This is because most insurers will put you in a higher risk category compared to non-smokers in terms of developing certain health conditions. To offset this higher risk, a smokers premiums will be increased.

If I Give Up Smoking Will My Premiums Go Down?

Yes. The good news is that if you can prove you have been nicotine free for the last 12 months, most insurers will re-evaluate your status and change it to a ‘Non-Smoker’. As a result of this your premiums should go down.

Pre-Existing Health Conditions Can Affect Your Premiums

When it comes to putting Life Insurance in place, insurers will look at your medical history to determine what cover they can offer, if any, and at what cost.

If you do have a known pre-existing medical condition which is life-limiting or that affects your health, providers will tend to:

- Provide cover but with increased premiums

- Exclude the condition you suffer from but offer discounted premiums

- Cover you without any exclusions and no premium loading.

If you have a pre-existing condition it’s best to speak with a specialist, such as one of the team here at Drewberry to ensure you’re getting the best policy for your circumstances.

You can pop us a call on 02084327333 or email help@drewberry.co.uk.

Do You Partake in Extreme Sports?

If you are an adrenaline junky and take part in hazardous hobbies such as base jumping or volcano boarding (yes that’s an actual thing), you could find yourself paying higher premiums. This is because insurers will class you as higher risk than someone who takes part in less extreme sports and could charge you up to 25% more.

Hazardous sports which you can expect to increase your premiums include:

- Big wave surfing

- Off-piste skiing

- BASE jumping

- Kiteboarding

- Free climbing

- Scuba diving

- Hand gliding

As each provider will class hazardous sports differently its always best to review the whole market before taking out Life Insurance. It can be quite confusing when comparing different providers so its best to speak to a specialist such as one of the team here at Drewberry.

Just pop us a call on 02084327333 or email help@drewberry.co.uk.

Has Covid-19 Affected The Cost?

In a recent survey we found that 68% of people believed that the pandemic had caused the cost of Life Insurance to increase. Not only this 44% of people thought that less than 50% of covid related Life Insurance claims had been paid out by insurers. In reality this just isn’t the case.

Insurers Continue To Pay Out Claims

We monitored the cost of all protection products and saw no significant change in the price of premiums and when it comes to successful claims, 97.4% of Life claims were paid out totalling over £3 million, with an average value of over £77,000.

Does Vaping Or Nicotine Replacement Impact The Cost?

It’s important to understand an insurers definition of a smoker , as it might not be what you think. For most people when you say smoker you think someone who smokes cigarettes, however this isn’t the case.

Insurers will class anyone who has consumed any form of nicotine in the last 12 months as a ‘Smoker’. This includes anyone who vapes or uses nicotine patches.

Who Are The Top UK Life Insurance Companies In 2021?

When it comes to Life Insurance there are a range of providers and policies to choose from which of course will bring varying costs.

However rather than focus on getting the cheapest deal, it’s important to look for cover that gives you and your family the best protection and that meets your particular circumstances.

For a comprehensive review of the best Life Insurance you can read our specialist guide comparing all the leading insurers side by side.

Where some insurers are more competitive with higher risk occupations or covering certain medical conditions we compare all the leading insurers when finding you the most cost-effective cover for your needs.

This will include:

Our whole of market access and experience offering advice means we can match you with the best provider and the best policy.

It is important to obtain quotes from all of the top UK providers when doing your research as premiums can vary considerably based on your age and your current circumstances.

You can use our handy Life Insurance quote tool to compare pricing from all the leading UK insurers.

Top Free Additional Life Insurance Benefits

Although there are a number of additional options which can add to the cost of Life Insurance the majority of providers now offer a number of FREE additional benefits which sit outside of your core cover.

It’s important when looking at the cost of your premiums what other benefits are included as these could add real value to your policy. For example some additional services include:

- 24/7 Video GP Service

- Online Prescription Service

- Nurse Staffed Medical Advice Helpline

- High Street and Fitness Discounts

Compare Life Insurance Quotes & Get Specialist Advice

When protecting something as important as your family it’s essential to understand what you’re buying in terms of Life Insurance. Making a mistake could have expensive consequences.

The team at Drewberry is here to help you make an informed decision. We can help you decide which type of Life Insurance is most suitable for your individual circumstances and source the most cost-effective provider.

Why Speak to Us?

When it comes to protecting yourself and your finances, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4072 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- We’re authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

For help and fee-free life insurance advice, don’t hesitate to give us a call on 02084327333 or email help@drewberry.co.uk.