Female Breadwinners: Do You Have a Financial Safety Net?

Recent research has shown that 40% of women are the main earners in their family; the proportion of women earning more than men has almost doubled in the last 30 years. The female breadwinners also earn on average £14,000 a year more than their partners.

Whilst this is great news it is worrying that fewer than half of these women have protection insurance in place for the family to fall back on if they are ill or pass away.

LV insurance researched female breadwinners and found that:

- Over 50% lacked life cover

- 80% lacked critical illness cover

- 89% lacked income protection

The average female breadwinner’s salary was £51,965 and their partner’s salary £37,965 and 40% of the households surveyed said they would not be able to survive on the male income alone.

Income protection

If the female in the household was to fall ill without an income protection plan in place then the monthly income for the family could drop from a gross income of £7,494 per month to £3,163. With government sick pay and incapacity benefits currently a maximum of £86.70 and £106.50 per week respectively they would certainly not go far to make up for the lost income.

As only 11% of the female main earners had income protection the other 89% would need to consider:

- How long their employer will pay them full pay if they are off sick

- How long the family could live off savings.

It is important to consider that many people are off sick long term. 10% of people are off sick for more than 6 months in their lifetime and LV’s average length of claim in 2012 was 7 years.

An income protection plan can cover you for up to 70% of your gross income in case you are ill or injured and unable to work in your current role. Long term plans can potentially pay out until retirement age in case you are unable to go back to your job.

Unemployment

In the current economic climate the female breadwinner should consider what would happen if she were to be made redundant.

Employer redundancy pay policies vary but you only qualify for statutory redundancy pay after working for the employer for two years. Then you will get an average of one week’s pay for each year of service. The exact figure depends the age you were during each year of service. However, the weekly pay amount is capped at £450. So the average women surveyed with an average weekly income of £999 might only walk away with £900, if they had been at their company for two years.

Unemployment insurance is available to cover redundancy (and in some cases dismissal). As a general rule you are able to insure 65% of your pre tax earnings or £3,000 per month (whichever is less).

Life insurance and critical illness cover

Mortgage payments are usually calculated based on both incomes so if one partner were to suffer from a critical illness or pass away the loss of income might mean that the remaining partner was unable to meet the monthly payments.

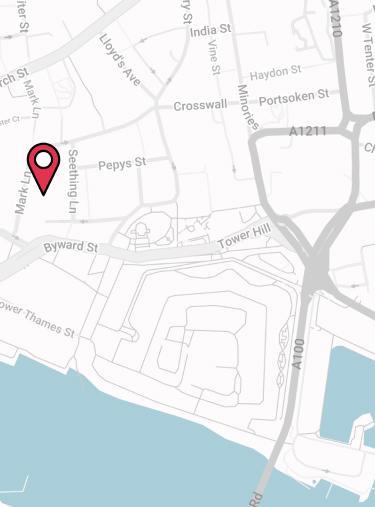

Although it is not a cheerful thought, the chances of passing away during the term of your mortgage are not as slim as you might think. Take a look at Drewberry insurance’s life expectancy calculator.

The families without life insurance and critical illness cover for the main breadwinner would need to consider how they would cope financially if the worst was to happen. Life insurance and critical illness insurances pay out a lump sum if the person covered dies or gets a very serious illness or injury. The exact illnesses covered vary according to the insurer. The lump sum can be used to pay off the remaining mortgage or for other expenses.

Family income benefit is similar to life insurance in that it pays out if the person covered passes away. However, it pays a monthly benefit, thereby more directly replacing the income lost. It will continue to pay a monthly amount until the end of the term. Families often select a term end date to coincide with when their children leave home or university.

Mark Jones, head of protection at LV said “…it is worrying that so few have any financial safeguards in place for protecting their lifestyle as it can put them in a precarious position.

“Whether it’s the man or the woman that is the higher earner, the responsibility of having others relying on your salary means it’s important to consider what would happen if you were unexpectedly unable to work due to illness, accident or unemployment?”

- Topics

- Income Protection

Contact Us

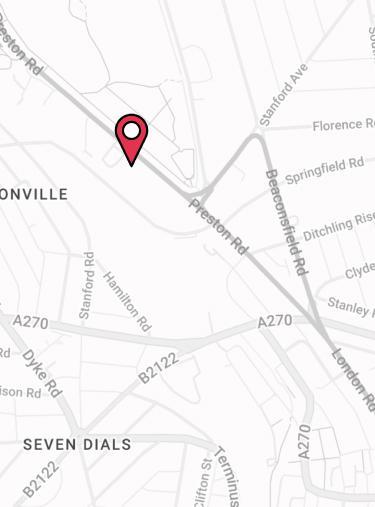

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.