What Is The UK’s Best Mortgage Insurance In 2025?

Mortgage Life Insurance

Quote

Receive an upfront cash lump sum for your loved ones to pay off the mortgage in full should you pass away during the term of your mortgage

Get My Instant Quotes

Mortgage Payment Protection

Quote

Receive an income to cover your monthly mortgage repayments should you be unable to work due toaccident, sickness or unemployment

Get My Instant QuotesEveryone’s circumstances are different, so one size doesn’t fit all when it comes to finding the best Mortgage Insurance.

This guide should help you review your options for covering your mortgage and help you find the most suitable cover for your needs. There are two types of Mortgage Protection Insurance that you should consider:

- Mortgage Life Insurance

Protects your life and pays a lump sum to your beneficiaries on your death (or potentially if you develop a critical illness if you add this to your policy) to pay-off your remaining mortgage debt. - Mortgage Payment Protection

Offers short-term relief if you are unable to work due to accident or sickness or potentially unemployment, covering your monthly mortgage payments for up to two years.

The first thing you need to do before you begin looking at policies is decide what you are want to protect.

What is the Best Mortgage Payment Protection?

When looking at different policies to protect your monthly mortgage repayments, there’s a lot you’ll have to consider if you want to find the best Mortgage Payment Protection Insurance for your circumstances.

What Mortgage Protection Do You Need?

MPPI is solely designed to cover your mortgage repayments if you are unable to earn an income for a relatively short period of time. You can protect against ill-health or redundancy or choose to combine cover to protect both risks.

- Accident & Sickness Cover

If you can’t work due to illness or injury, this policy will cover your monthly mortgage repayments until you’re well enough to return to work or the policy ends - Unemployment Only

Unemployment Insurance will exclusively cover you if you are made redundant through no fault of your own and were unaware of the risk of redundancy before you took out the policy - Accident, Sickness & Unemployment

This is the best Mortgage Payment Protection available because it’s the most comprehensive, although it will still only cover your mortgage repayments short-term.

With the right level of cover, you can continue meeting your monthly mortgage repayments and still have a bit extra to help you cover some of your other expenses.

However, most MPPI policies are able to cover no more than 125% of your monthly mortgage payments or £2,000 per month, whichever is lower.

Mortgage Payment Protection is only a short-term solution – policies only pay out for a maximum of 1 or 2 years. Keep in mind the length of cover you get from your policy and think about how long it might last if you needed to take time off work.

Is Income Protection the Best Mortgage Insurance?

A good alternative to Mortgage Payment Protection that you may want to consider is Income Protection Insurance.

While Mortgage Payment Protection Insurance covers your monthly repayments in the short term, with Income Protection Insurance you can protect a proportion of your total income and so the benefit is typically larger.

Moreover, Income Protection can cover you for a longer period of time – up until retirement potentially instead of just for 1-2 years.

Like Mortgage Payment Insurance, Income Protection pays out a monthly benefit if you are unable to work. However, Income Protection pays out a proportion of your typical monthly income to help you cover not only your mortgage payments, but also other necessary expenses.

One reason why you might choose Income Protection over Mortgage Payment Protection Insurance is the different definition of incapacity.

Mortgage PPI typically uses a ‘Suited Occupation‘ to define incapacity, which means that you cannot claim on your insurance if you are still capable of working in a job that is suited to your qualifications or experience.

With an Income Protection policy, however, you can choose ‘Own Occupation‘, which means that your insurer will approve your claim if you are unable to carry out work in your own occupation.

What is the Best Mortgage Life Insurance in 2025?

To find the best Mortgage Life Insurance, you first need to look at your options and find out what kind of policy is right for you. There are quite a few choices you will need to make before you have your policy up and running.

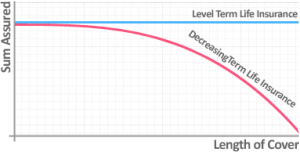

Is Level Term or Decreasing Life Insurance Cover Best?

Different types of life cover are suited to different circumstances. To know which type of Mortgage Life Insurance is best for you, we’d have to know more about your circumstances and the type of mortgage you have.

Level Term Mortgage Life Insurance is better-suited to interest-only mortgages. This is because the amount of cover that you have will be consistent over time.

This works for interest-only mortgages because you don’t repay the principle capital until the end of the loan, so the amount of cover you require to repay your mortgage balance stays fixed.

Some people also use Level Term Mortgage Insurance to provide a lump sum for loved ones over and above what’s used for paying off the mortgage.

Decreasing Mortgage Life Insurance is better suited for capital repayment mortgages. This type of policy sees the benefit fall over time in line with your outstanding mortgage balance, reaching zero by the end of the term.

Are Guaranteed Premiums Better than Reviewable?

With Life Insurance you have the option to guarantee your insurance premiums. This means that the price of your premiums will always be the same throughout the length of your policy.

If you take out your Life Insurance policy when you’re young and healthy, you could guarantee your premiums when they are at their lowest and save on your insurance. On the other hand with reviewable premiums your insurer will review them regularly and revalue them as you get older.

Generally speaking if you’re young and healthy it makes sense to lock in cheaper guaranteed premiums at the start, as although reviewable premiums tend to be cheaper to begin with they usually to rise to surpass guaranteed premiums by the end of the policy.

Does Critical Illness Insurance make for Better Mortgage Protection?

When combined with your Mortgage Life Insurance policy, Critical Illness Cover protects you financially against the risk of serious illnesses such as:

- Heart attacks

- Cancers

- Strokes

It is important to bear in mind the likelihood of the average person dying is far lower than the likelihood of them developing a serious illness. Given the additional risks you are protecting including Critical Illness cover it is likely to have a considerable effect on the cost of premiums.

This said, combining Critical Illness Insurance with Mortgage Life Insurance offers more comprehensive level of cover.

Critical Illness Insurance can be very valuable under the right circumstances and provide you with some extra cover to protect yourself and your loved ones.

What is the best Critical Illness Cover?

When you’re looking for the best Critical Illness Cover, the first thing you should look at are the critical illnesses defined in the policy. You can only make a claim if the illness you have is one that is specified in your insurance policy.

This list can start off with as few as 5 illnesses and go up to more than 120 depending on your insurer.

When reviewing your options you really need to be considering not only the number of conditions covered but also reading through definitions of the illnesses which are covered.

Some insurance policies won’t cover ‘mild’ incidences of critical conditions, so check the policy wording carefully or, better yet, ask an expert insurance adviser to do it for you.

Terminal Illness is not Critical Illness Insurance

It is important to recognise that Terminal Illness Cover is not Critical Illness Insurance. Terminal Illness Cover comes as standard with most Life Insurance policies at no extra cost. If you’re diagnosed with a terminal illness with less than 12 months to live, this benefit will allow you to receive your policy’s payout early.

One caveat with terminal illness cover is that you can’t claim on your terminal illness benefit if you’re in the last 12 months of your Mortgage Life Insurance policy.

Is Single or Joint Mortgage Insurance Better?

When taking out mortgage protection with a partner you can choose to take out a Joint Mortgage Insurance policy that covers both people at the same time.

Joint Mortgage Insurance can be better for mortgages where two people are contributing; however, it’s not always the best option for everyone.

In some instances, it may be that two single policies are better than Joint Mortgage Life Insurance. Of course, this depends entirely on your circumstances, so it’s best to check with an adviser first.

Are Two Mortgage Insurance Policies Better Than One?

One issue with joint cover is that most policies are written on a Joint Life, First Death basis, so your insurance plan will only ever pay out once and for only one partner.

So, if you were to die during your policy’s term, your policy wouldn’t pay out again on your partner’s death – it would be finished.

For some couples, this might not be a problem. For example, if neither of you have children, you might not be too concerned with still having Life Insurance in place after the death of the first partner triggers a payout and clears the mortgage.

However, for those with children who are keen to leave an additional lump sum, having your Life Insurance end after the first death could be problematic.

This is because the surviving partner would have to get re-insured at a later date, when the cost of Life Insurance could increase considerably due to your age and health.

EXPERT TIP 🤓

In this scenario, if the couple had taken out two single policies they would have paid slightly more initially but would have effectively been covered for twice the amount with each being covered regardless of what happened to their partner.

Is Mortgage Life Insurance Best Written into Trust?

Writing a Life Insurance policy into trust is a precaution that can be taken to separate your insurance policy from the rest of your assets and keeps it outside your estate. This means that when the payout goes to your loved ones, it won’t be subject to inheritance tax.

Whether or not you would need to write yourLife Insurance policy in trust will depend on your circumstances, although it doesn’t cost anything to set up. It is really quite a painless process – we can help set up your trust when you first take out your policy.

If you have a Joint Mortgage Insurance policy with your spouse, then writing your policy in trust may not be entirely necessary because insurance payouts transferred between spouses are not subject to inheritance tax.

How Much Does Mortgage Insurance Cost?

Given that Mortgage Payment Protection and Mortgage Life Insurance do two very different things, the cost of these policies varies considerably.

Cost of Mortgage Payment Protection in 2025

Where Mortgage Payment Protection covers your monthly mortgage repayments against illness or injury we have had to make certain assumptions to provide some example costings.

- The individual is healthy

- They’re a non-smoker

- They’re an office worker

- They want a 4 week deferral period

- They’re looking for £1,000 a month of cover to protect their mortgage.

|

Age |

Accident & Sickness |

Accident, Sickness & Unemployment |

|---|---|---|

|

30 years old |

£7.38 per month |

£29.68 per month |

|

40 years old |

£12.13 per month |

£39.53 per month |

|

50 years old |

£29.87 per month |

£60.37 per month |

Cost of Mortgage Life Insurance in 2025

Where Mortgage Life Insurance pays out a lump sum, we’ve had to make some assumptions around the total value of the outstanding mortgage to provide some examples costs. We’ve assumed:

- The individual is healthy

- They’re a non-smoker

- They’re an office worker

- They’re looking for £250,000 worth of cover decreasing over 25 years.

|

Age |

Mortgage Life Insurance |

|---|---|

|

30 years old |

£6.88 per month |

|

40 years old |

£12.35 per month |

| 50 years old |

£29.32 per month |

Compare 10 Best UK Mortgage Protection Providers In 2025

The provider you choose to supply your Mortgage Insurance plan will have a significant impact on its value and the level of cover it will offer you.

When looking at different insurance providers, there are a few key details that you should take into consideration, such as their successful claims rates, their reputation, and prices.

AegonAegon was founded as Scottish Equitable in 1831 in Edinburgh and their main headquarters still remain there today. In 2018 it won the ‘Life Insurer of the Year’ Award at the British Claims Awards.

|

AIGAIG was founded in 2008 as Aegas Protect and was eventually acquired by insurance giant American International Group Inc. in 2014. In 2018, the company won the ‘Best New Product (Income Protection)’ Award at the Protection Review Awards.

|

AvivaAviva first began as Norwich Union in 1797, which merged with CGU PLC in 2000 to become Aviva. Today, it is the largest insurance group in the UK. In 2017 it won the ‘Best Customer Service’ Award for the second year running.

|

|

With links going back as far as 1888, The Exeter as it is today was founded in 2008 when two friendly societies joined forces: The Exeter Friendly Society and Pioneer Friendly Society. As a mutual friendly society, it operates for the benefit of its members. The Exeter won for three years in a row the ‘Best Income Protection Provider’ Award between 2011 and 2013

|

Legal & GeneralLegal & General was founded in 1836 in a Chancery Lane coffee shop. In 2018, the company won the ‘Protection Provider of the Year’ Award at the Personal Touch Financial Excellence Awards.

|

LVLiverpool Victoria has won the ‘Best Income Protection Provider’ Award at the Investment Life & Pensions Moneyfacts Awards for 9 years in a row between 2010 and 2018.

|

Royal LondonThe Royal London mutual society was originally founded in 1861, although originally as a friendly society. Today it is one of the largest mutual insurance providers in the country. In 2018, it received a 5-star rating for its protection service for the fifth year in a row at the Financial Adviser Service Awards.

|

VitalityIn 2017, Vitality’s policy received a 5 star Defaqto rating and has done so for the past 8 years running.

|

Get Expert Mortgage Insurance Advice

Given taking out a mortgage is usually one of our biggest financial commitments it is important to make sure you have adequate protection in place should something go wrong.

We exist to help you make better financial decisions, helping you find the most suitable cover at the most competitive premium.

Why Speak to Us?

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to issues as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.

- There is no fee for our service

- We are an award winning 🏆 independent insurance broker who works with all the leading UK insurers

- You’ll speak to a dedicated expert from start to finish

- We are very proud of the 3953 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most.

- We are authorised and regulated by the Financial Conduct Authority. You can find us on the financial services register here 🧐

- Topics

- Mortgage Insurance

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.