A bit morbid we know, but this tool works out the risk of you passing away based on ONS Life Expectancy Data

Decreasing Term Mortgage Life Insurance pays out a cash lump sum to repay your mortgage should you pass away. The amount insured is designed to fall alongside a repayment mortgage, reaching zero just like the loan balance by the end of the policy term.

Should you die within the term of the policy this cover pays out a lump sum that can be used repay the mortgage loan.

Most leading Life Assurance policies will also pay out early if you are diagnosed with less than 12 months to live by a medical practitioner.

This option also enables the plan to pay out if you were to suffer any one of the conditions named in the policy terms, which usually includes cancer, heart attacks and strokes.

Critical conditions covered typically number around 40, but there are policies which will cover fewer than 10 conditions and those which will cover more than 100, so read your policy terms carefully.

As the chances of suffering a critical illness is far higher than death it often makes sense to consider adding this option to your policy.

The purpose of Decreasing Mortgage Life Cover is to protect a principal repayment mortgage.

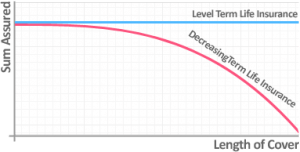

The amount of cover falls over time to match your decreasing mortgage liability. The policy assumes an interest rate – providing this equals your mortgage interest rate, the cover will decline in step with your debt.

As the amount of cover you receive from your policy falls over time to reflect the amount of mortgage debt outstanding, costs are typically lower than if you were applying for a policy with a level benefit where the risk to the insurer remains constant over time.

We’ve used our Life Expectancy Calculator below to determine the risk of death for a healthy male of three different ages over the course of a 25 year mortgage term.

Generally speaking, the public at large underestimates the risk of passing away by a considerable margin.

According to our Health and Protection Survey, the public believes their risk of death to be SIX TIMES lower than reality.

What’s more, according to another Drewberry survey, a quarter of UK adults would have a mortgage of more than £100,000 to repay tomorrow if their income suddenly stopped, either through death or illness.

As such, given the risk is greater than many people assume, it can pay to have Mortgage Life Insurance to protect your home and loved ones should the worst happen.

Age 25 | Age 35 | Age 45 |

|---|---|---|

1 in 33 | 1 in 15 | 1 in 6 |

Life Insurance is not usually costly; this said, there are still some features of your cover that you may be able to adjust to reduce your policy’s premiums. You can find out how much your policy might cost by using our Mortgage Protection Insurance Calculator.

In the below table, we’ve highlighted the cost of a £250,000 Decreasing Mortgage Life Insurance policy which runs for 25 years. The individual is a healthy office worker of three different ages.

Prices were collected in October 2025, and represent the cheapest premiums from across the entire UK market.

| Age |

🚭

|

🚬

|

|---|---|---|

| 30 Years Old | £6.23 | £9.84 |

| 40 Years Old | £11.26 | £19.17 |

| 50 Years Old | £23.84 | £54.08 |

A Decreasing Term Mortgage Life policy is designed to cover a repayment mortgage.

If you have an interest-only mortgage – where you only need to pay off the interest and so the mortgage balance doesn’t fall over time – then you would likely need a Level Term Life Insurance policy.

While the coverage of a Decreasing Term policy will fall over time, a Level Term policy will stay the same and give you the same level of cover at the end of your policy as you had at the start.

Level Life Insurance would also be better suited if you intend your insurance payout to do more than simply pay off your mortgage, like help your family afford your funeral or give them a bit of financial support in the coming years over and above repaying the mortgage.

To find out which type of Life Insurance is better suited to your needs, you can read our Level vs Decreasing Life Insurance guide.

If you want to expand the cover that you receive from your Decreasing Term Life Insurance policy, most insurers will offer the option to add Critical Illness Insurance.

Critical Illness Insurance will cover you for a list of critical health conditions specified by your provider.

Policies can cover anywhere between 40 to more than 100 conditions. The most common claims on these policies are cancer, heart attacks and strokes.

If you are diagnosed with any of the conditions included on your policy document’s list of covered critical illnesses, then your policy will pay out a lump sum to you.

The risk of becoming critically ill is much higher than the risk of passing away, which is why adding Critical Illness Insurance to Mortgage Life Insurance adds to the cost significantly.

However, if you’re concerned about getting some kind of sickness insurance in place, this can be a cost-effective means of securing it as it’s usually cheaper to buy a combined Life and Critical Illness policy than two separate policies.

It’s important to remember that any combined policy will only pay out once, regardless of whether you claim for a critical illness or a covered life.

Providing you are using your policy to protect your mortgage, this would not be an issue. Regardless of how or when the policy paid out, it would still cover your mortgage and allow you to pay off your debt.

However, if you wanted some form of Life Insurance to remain after being diagnosed as critically ill, a combined policy wouldn’t provide that.

You’d have to buy a new Life Insurance policy at a time where you’re older and have had a critical illness, which will significantly increase premiums.

If you are looking for an insurance policy that can support your finances while you are injured or unwell, we often recommend Income Protection over Critical Illness Insurance. This is because Income Protection will cover any health condition that prevents you from working rather than just an insurer-specified critical illness and the best policies will support you with long-term monthly payouts right up until retirement.

Victoria Slade

Independent Protection Specialist at Drewberry

Waiver of premium means that your insurance provider will ‘waive’ your premiums if you are unable to work due to illness or injury. Effectively, this means they’ll pay the premium for you until you recover.

Please note that there is often an excess period before the waiver of premium would kick in. However, once it does begin, it can last until you either return to work or the decreasing term insurance policy ends.

If you share a mortgage with your partner and both require Life Cover, you can share a joint policy that will pay out if either person dies or is diagnosed with a terminal illness.

Typically, these policies will only pay out once on the first instance of death or terminal illness. This means that after the first partner dies and the payout has been used to pay off the mortgage, the policy will end and the other surviving partner will be left without Life Insurance.

While the mortgage would then be repaid, this could be problematic for the surviving individual.

In such instances, it may make more sense to purchase two separate policies, one for each partner. This typically only costs around 15-20% more than buying joint insurance but effectively secures two payouts, once for each death.

The best Mortgage Life Insurance for your needs will depend on your individual circumstances. It’s usually something that’s best discussed with your adviser to ensure you take out the most appropriate cover for you.

However, you can compare the top 10 UK Life Insurance companies below. Included in the table are links through to a more thorough review page for each insurer mentioned.

AegonAegon’s Scotland-based UK operations are wholly owned and operated by Dutch insurer Aegon N.V.

|

AIGUS insurance giant American International Group, Inc. (AIG) was first founded in 1919 and since then has grown to operate on a global scale. It provides a range of protection products for both individuals and businesses.

|

AvivaAviva was founded in 1797, but the Aviva brand as it is today was formed in 2000 by the merger of Norwich Union and CGU PLC.

|

GuardianGuardian is a relaunched protection brand with a number of unique features to its policies.

|

Legal & GeneralL&G was formed as an insurance company for lawyers, by lawyers in 1836. It has since grown to become one of the country’s best-known financial services companies

|

Liverpool VictoriaLV is the UK’s largest friendly society, with more than 5.8 million customers, 1.1 million of whom are members.

|

Royal LondonRoyal London previously operated Scottish Provident and Bright Grey as separate brands providing Critical Illness Insurance under the Royal London umbrella. From 2016, both were merged into the main Royal London brand.

|

Scottish WidowsFounded in 1812, Scottish Widows is today part of Lloyds Banking Group.

|

VitalityVitality entered the UK market in 2007 with a joint venture with PruHealth and PruProtect, part of the Prudential Group. It has since bought out Prudential and is now branded solely as Vitality.

|

ZurichZurich is a Swiss-based global insurance giant, operating in more than 170 countries. It employs around 55,000 employees worldwide, including 4,500 in the UK.

|

If you would like some more information or need help finding and comparing Decreasing Term Life Insurance quotes, please do not hesitate to get in touch.

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

We are here to make your life easier by providing you with all of the information you need to decide for yourself on the right policy.

Please don’t hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director at Drewberry

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.