The basic way Life Insurance works really couldn’t be much simpler – if you have an active policy in place when you die, a payment will be made to your estate, or to a trust that you have set up (providing you have a valid claim).

However, while the basic premise is quite simple there can be a surprisingly large number of variations, with many policy types and options to choose from.

The broadest distinction, but by no means the only one, is between Term Life Insurance – which covers you for a defined period, e.g. 25 years – and Whole of Life Insurance, which guarantees a payout whenever you die.

You decide at the outset the amount of money you’d like to insure yourself for and – with term insurance – for what period of time.

Both of these decisions play an important part in determining how much you pay in monthly premiums. Understanding how the different policies work is key to getting the right one for your needs, so try to get to grips with the options.

How Does Term Life Insurance Work?

A Term Life Insurance policy covers you if you die within a set period of time and pays out a lump sum. You choose that length of time at the outset.

Given that such policies last for a set period, they’re often used to cover the term of a mortgage, or the time until a child becomes an adult and financially independent.

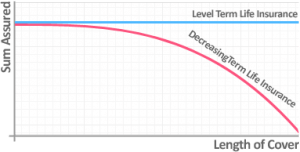

The main choice with term insurance is usually deciding whether to opt for a decreasing policy – where the payout falls over time, perhaps in line with a repayment mortgage – or a level term plan, where the sum insured would remain the same across the entire term of the policy.

Decreasing term insurance is typically cheaper than level term insurance because the amount you’re insured for falls over the length of the policy, reaching zero by the end of the policy’s term.

This means as you get older and the risk of you claiming increases, the amount the insurer will have to pay out is decreasing, hence the lower premiums compared with level cover, where the risk to the insurer remains the same over time.

As mentioned, decreasing cover is typically used to cover a straightforward repayment mortgage, where the amount outstanding and therefore the amount insured falls over time.

With level cover, because the benefit remains fixed across the policy, it’s typically more suited to family protection or covering an interest-only mortgage loan.

Family Income Benefit

Family Income Benefit is a type of term insurance that pays out a regular income to your loved ones should you die during the policy term.

This is opposed to policies that only pay out once in a lump sum, as described above.

Family Income Benefit can be useful for maintaining household expenditure over time, as it’s easier to plan for how much you feel your family will spend on a month-to-month basis than figuring out how large a lump sum is necessary to keep them afloat long-term.

Many people use it to plan for eventualities such as school fees or childcare costs, where they know there will be tangible, regular expenses over a set period.

How Does Whole of Life Insurance Work?

Unlike term insurance, Whole of Life Insurance offers a guaranteed payout whenever you die, assuming you’ve kept up premium payments and haven’t breached the policy terms.

This guarantee of a payout means that premiums are typically much higher than with term policies.

According to the ABI, the average whole of life payout in 2017 was £4,511.16, while the average term insurance payout was £78,323.35.

Rather than being used to cover a mortgage or the raising of a child, Whole of Life cover is typically seen as an option to pay for a funeral or to cover an inheritance tax liability.

Over 50s Life Insurance

You may see advertised so-called ‘over 50s life insurance’ policies. This is a particular type of Whole of Life Insurance, usually sold on the fact that those aged 50-80 are guaranteed to be accepted without a medical.

Be careful, though, as there are downsides to such policies, including long initial ‘wait periods’ when no payout will be made if you die within a certain period of time after taking out cover.

With all Whole of Life policies, you need to be aware that:

- You could end up paying more in premiums than your beneficiaries receive in a payout

- If you stop paying premiums before an agreed date, your cover will cease

- There’s typically no cash-in value on the policy

- It’s possible that you could leave more to your estate by paying the premiums into savings and / or investments instead.

How Life and Critical Illness Insurance Works

Buying Critical Illness Cover alongside Life Insurance will increase your premiums, although it will typically be more cost-effective to ‘package’ the two insurances together than buying two separate policies.

Critical Illness Insurance provides you with a payout if you become critically ill during the life of the policy, as defined by the policy’s terms.

You need to meet the specifications of the critical illnesses listed in the policy to make a claim – including being ill to a set severity.

A typical Critical Illness Insurance policy covers around 40 different illnesses, although there are some policies which cover more than 100 and others which cover fewer than 10, so it pays to read the terms and conditions carefully.

When packaging Life and Critical Illness Insurance together, it’s important to realise that on most plans there can only typically be one payout. This means if you become sufficiently critically ill to make a 100% claim on the Critical Illness element of the policy, there won’t be any money left to provide Life Insurance going forward.

Life Insurance Application Process

The way the application process for Life Insurance works involves a series of medical questions.

These will centre around your lifestyle and current health, such as whether you’re a smoker, your weight, if you have any health conditions and your family’s medical history.

For the majority of clients, this will be all the information the insurer will need to price the risk and provide you with terms.

However, for certain people, your age combined with your medical history and the level of cover you’re seeking could see the insurer to ask for additional medical reports from your GP.

Types of Medical Screening

There are typically three levels of medical reporting:

- Nurse screening

A basic medical which will look at things such as blood pressure, height, weight and whether you’re a smoker. - GP report

The next stage is a GP report, where the insurer will write to your GP and ask to see your medical records. This may be a targeted report if you’ve made a disclosure such as high blood pressure that looks specifically at that condition. - Full medical exam

This may involve taking a far more in-depth look at your health, including blood and urine analysis and potentially an ECG to monitor your heart activity.

It’s not an onerous process, with medical and nurse screenings being fully paid for by the insurer and able to come to your home or place or work at a time and date to suit you, including evenings and weekends. We help clients arrange all of this so you don’t need to lift a finger.

Robert Harvey

Head of Protection Advice at Drewberry

Fortunately, unless a pre-existing condition is disclosed, it’s unlikely an insurer will require further medical evidence unless you’re trying to cover very high amounts, e.g. in the millions.

Pre-Existing Medical Conditions

Pre-existing conditions must be declared to an insurer in the application process and, based on your medical history, the insurer may do one of three things:

- Offer the policy on its standard terms

- Place an exclusion on the policy relating to the pre-existing condition

- Cover the pre-existing condition but charge a higher premium to reflect the increased risk.

How Life Insurance Trusts Work

Writing a life insurance policy into a trust means that, when a claim is made, the payout goes from the life insurer directly into the trust.

It is then up to the trustees of the trust to distribute these funds to the nominated beneficiaries. This avoids the payout going into the deceased’s estate, where it may be subject to inheritance tax.

Your adviser will be able to facilitate writing the policy into trust for you.

There’s typically minimal paperwork involved and, these days, many insurers do this process electronically, saving even more time.

Samantha Haffenden-Angear

Independent Protection Expert at Drewberry

Guaranteed or Reviewable Premiums?

Note also that premiums can be guaranteed – meaning they won’t change in the course of a policy – or reviewable.

Choosing a reviewable premium may be cheaper at the outset, but it could prove significantly more expensive in the longer term as insurers are free to raise your premiums over time.

This may happen if, for example, the provider experiences higher claim levels than it had anticipated, or if a major change in interest rates increases its cost base.

How the Claims Process Works for Life Insurance

Should a policyholder die in the term of a policy, the process followed is:

- The family makes a claim to the insurer with the death certificate as evidence

- Assuming a claim is valid, the insurer pays out according to the terms of the policy (note that payout rates are typically well above 95%).

The insurer would either pay the funds into…

- A trust which was set up when the policy was taken out

- To the estate of the deceased policyholder.

If a trust was set up then the trustees (who will be named in the trust and determined when the policy was set up) can distribute the funds according to your wishes when the trust was formed.

If no trust was set up then the money would be paid into the estate of the deceased policyholder and it may be necessary to go through probate to determine who those funds should be paid to.

It is usually best to set up a trust so the funds end up in the intended hands, avoiding any delay in receiving the funds that probate can cause and potentially removing an inheritance tax liability.

Get Expert Life Insurance Advice

If the options seem too confusing and you’re still wondering how Life Insurance works, why not speak to an expert adviser who can help you find the right cover?

Contact us on 02084327333, or pop in your details to get an instant life insurance quote here →

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated expert from start to finish

You will speak to a named expert with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 3943 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

- Topics

- Life Insurance

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.