Yes, employees can consolidate other pensions into their Nest workplace scheme. Employees can do this through their online account. There are no additional fees for transferring other pensions. Employees can also transfer money out of a Nest pension into another UK pension, or a recognised overseas scheme.

Nest Workplace Pension [Review]

Who Is Nest?

Nest (National Employment Savings Trust) is a workplace pension scheme which was established by the government in 2010. It’s the UK’s largest Workplace Pension master trust by membership, managing more than 500,000 employers as of 2025. The provider has a public service obligation, similar to the NHS and BBC.

Nest: Workplace Pension Overview

Nest, otherwise known as the ‘National Employment Savings Trust’, is a pension provider that offers a low cost, defined contribution group auto-enrolment pension scheme.

It was initially designed to be the last resort for smaller employers who couldn’t find an alternative pension provider. However, a great number of SMEs still use it today.

Nest Workplace Pension Key Facts | |

|---|---|

✅ | Defaqto rating: 5⭐ |

✅ | Type of scheme: Master trust |

✅ | Suitable for: Popular with SMEs |

✅ | Funds available: 6 |

✅ | Financial strength: N/A: government-run scheme |

✅ | Tax relief method: Net Pay / salary sacrifice (simple) |

✅ | Employee charges: AMC 0.30 % + contribution charge 1.80% |

✅ | Employer fees: £0 employer set-up |

✅ | Ethical funds: Ethical and Sharia options available |

Who Might Need A Nest Workplace Pension?

While a Nest scheme is open to employers of all sizes, smaller business that are just starting out may consider Nest over larger, more established organisations. Its offering is designed with simplicity and scale in mind, making it an appealing option for smaller employers or those seeking a low-maintenance default solution.

However, there are some potential drawbacks to be aware of. Many SMEs opt for a NEST workplace pension not realising that there are a range of alternative providers who could offer a much better scheme for their business and employees. If your pension scheme is with NEST and you would like to review it, don’t hesitate to get in touch on 02074425880 or email help@drewberry.co.uk.

We have taken care to ensure that information in this review is accurate. However, the market changes frequently, and we do not guarantee 100% accuracy. For the most up-to-date provider information, call 02074425880 or email help@drewberry.co.uk to talk to one of our specialist consultants.

How Does A Nest Pension Scheme Work?

Nest is classed as a “Master Trust” or “Multi-Employer” pension scheme. This means it can be used by multiple employers, unlike other Workplace Pensions which were set up by companies specifically for its own employees.

It’s a defined contribution scheme, so the employee and employer make monthly payments into it. Independent trustees are responsible for managing and investing pension savings on behalf of all Nest members. Although they do all the hard work for you, employers can still control certain aspects of the workplace pension, such as:

- How much they contribute

- Contribution limits

- How pension savings are invested.

Who Can Contribute To Nest Pensions?

For an employee, there are minimum pension contributions for both the employee and the employer. These contributions are deducted from their salary and then topped up by the government.

Although the majority of people who join Nest are employees who get enrolled by their employer, others can join. For example, if you’re self-employed or you have received a share of a partner’s retirement fund as part of a divorce.

What Are The Nest Pension Charges?

There are no charges for employers when setting up a Nest scheme, but employees will be charged the following fees:

- Contribution Charge (1.8%)

Each contribution made by the member will be charged the contribution fee. For example, if they pay in £50 a month they will be charged 90p a month - Annual Management Charge (0.3%)

Members will be charged an annual fee based on the total amount in their pension pot. For example, if they have £11,000, they would be charged £33 a year.

Our Workplace Pension specialists can help you find the most suitable scheme for your company. We’ll do the heavy lifting, allowing you to run your business without the additional stress. Make an enquiry to find out your options.

Richard Noble

Senior Consultant, Employee Benefits

How Much Can Be Paid Into A Nest Workplace Pension?

Just like other defined contribution pensions, both employers and employees pay into the scheme. However, the amount that is contributed will vary based on certain circumstances.

Employee Pension Contributions

Employees will pay a percentage of their qualifying earnings to Nest. The minimum amount, which is set by the government, is 5% of an employee’s qualifying earnings.

Each month, contributions will get deducted from their salary before tax. This means they receive tax relief on the savings they make through their pension. For example, of the 5% contributed, 1% will actually be paid by the government in the form of tax relief.

Employees can contribute more than 5% if they wish. The maximum amount will be dictated by the amounts set out by you, the employer, or by the employee’s annual allowance, whichever is lower.

Employer Pension Contributions

On top of the 5% employees save each month, employers will also contribute a minimum of 3%. This takes the minimum total contributions to 8%.

As an employer, you can also contribute more than 3% if you wish to. Some companies offer higher pension contributions as part of their employee benefits package,which helps to attract and retain the best staff.

Where Do Contributions To Nest Get Invested?

Nest has 6 investment funds for members to choose from. When an employee enrols on the scheme, their pension contributions will automatically get invested into the default Nest pension fund, also known as the Nest Retirement Date Fund.

Nest Pension Funds

Although more than 90% of people choose to stay within the default fund, members can move their savings into one of the other 6 funds:

- Sharia Fund

- Ethical Growth Fund

- Higher Risk Fund

- Pre Retirement Fund CPI

- Lower Growth Fund

- Guided Retirement Fund.

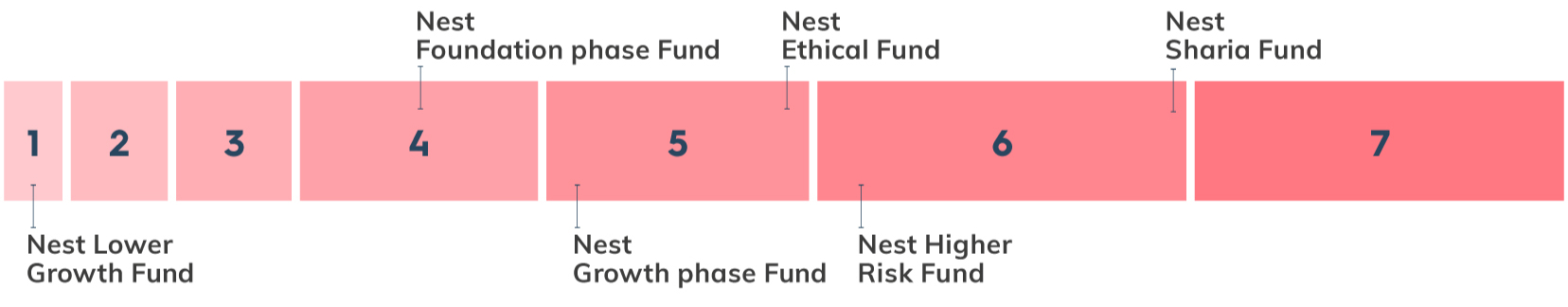

Nest Risk Fund Profiles

The different funds offer different levels of risk. This means members can move their savings into a fund, which aligns with their risk appetite.

The below image illustrates the level of risk associated with each fund. One on the scale represents the lowest risk fund and seven the highest.

Ethical Investments

As well as high or low risk, there are also funds which focus more on ethical investments or that align with certain faiths.

The Ethical Growth Fund, for example, would be suitable for members concerned with the impact their money has on the environment or society. The Sharia Fund, on the other-hand, would be suitable for members who wish to invest in a way that complies with Islamic law.

Who Manages The Nest Investment Funds?

Once members’ savings are in a Nest pension scheme, the money gets invested by an in-house team of financial specialists.

It is the job of these specialists to have a clear understanding of the economy and the performance of different markets. This enables them to make decisions about how funds are invested and how much risk should be taken.

Nest Workplace Pension FAQs

Does Nest Allow Employees To Transfer Other Pension Pots Into The Scheme?

When Can Employees Access Their Nest Pension?

Savings in a Nest pension or any other defined contribution scheme cannot be accessed until the employee reaches their 55th birthday.

Once they reach 55, they are able to withdraw 25% of their pension pot as a tax-free lump sum. This is the same as with any other personal pension fund. Employees must take all of their savings out of the scheme by their 75th birthday.

What Happens If An Employee Leaves?

If an employee leaves your company and is a member of the Nest pension, you will need to inform Nest. Once the provider is aware, they will remove the employee from future contribution schedules.

It’s important to make sure that you do notify the provider. If you don’t, they will expect the usual contributions for that employee. If they don’t receive the payment, they may issue your company with a late payment notice.

Is Nest The Same As A State Pension?

Nest is not the same as a state pension. State pensions are provided by the government once you hit retirement age and are funded by taxpayers.

Nest is a pension which is organised by employers for their staff. Both employers and employees contribute to the pension, helping employees save so they have a retirement income for the future.

Can Employees Opt Out Of A Nest pension?

Yes, they can. Once an employee is enrolled, they have an opt out period of one month. This period begins three days after enrolment.

Once they have opted out, their Nest pension will be closed. Any contributions made will be returned to you as their employer within 10 working days.

An employee cannot opt-out after the opt-out period ends. However, they can stop making future contributions. Any savings they have previously made will remain within their Nest pension pot until they can access it at age 55.

What Happens To A Nest Pension If An Employee Dies?

During automatic-enrolment, your employee will be asked to nominate a beneficiary. It is this beneficiary who would then inherit their Nest pension pot if the worst were to happen.

As circumstances change, beneficiaries can be updated at any point.

How Does Nest Pension Compare?

When you choose a Workplace Pension scheme for your employees, there are several factors to consider. A good place to start is by reviewing its advantages and disadvantages.

Advantages Of Nest Pensions

Backed By Government

Nest is a low-risk scheme which is backed by the government. As a result, it offers more security than other private schemes available and can be a safer investment option for employees and their employers.

Free To Set up

For employers looking to arrange a workplace pension for its employees, Nest is an attractive option as it is free to set up. Not only this, as pension schemes go, it is also relatively straightforward to implement.

Low-Cost

Employees do get charged management and contribution fees on their pension savings. However, Nest is seen as being low cost compared to other providers.

Disadvantages Of Nest Pensions

Charges On New Contributions

Unlike many other workplace pension schemes, Nest charge 1.8% on new contributions. For example, if an employee paid £10,000 into the Nest pension, the contribution charge would be £180.

Lower Returns

Due to Nest being a low-risk scheme, it also means that the return on money invested is lower than other schemes that make high-risk investments.

If employees are looking for higher returns, a scheme that invests in high-risk funds may be more suitable.

Limited Investment Choices

It’s no surprise that as Nest offers a lower-risk pension scheme option, the choices of investment funds is limited compared to other providers.

Subject To Inheritance Tax

When enrolling into a Nest pension scheme, employees will be asked who they would like to inherit their pension pot should they pass away. There are a couple of ways they can do this. Either as a nomination or as an expression of wish.

An expression of wish usually will not be affected by inheritance tax charges (IHT). However, if employees nominate someone, it will get paid to them, but form part of your estate, which is subject to IHT.

It’s important that your staff understand the difference between the two options so they can make appropriate decisions that align with their own personal circumstances.

Alternatives To A Nest Pension Scheme

If you’re looking for a company pension for your team, you’ll find a range of options available. Each Workplace Pension provider will offer different funds, tax relief models, and employee criteria. So, to ensure you find the right scheme for your staff, it’s a good idea to compare your options to see which is the best fit. You can find out more in our guide to the best Workplace Pension providers.

There’s plenty to consider when choosing a Workplace Pension. Some schemes might be appealing at a glance, but might not be suitable for your employees or industry. It’s essential to figure out what your team and your business really needs before committing to a provider.

Adam Gibbs

Senior Consultant, Workplace Pensions

Workplace Pension Provider Reviews

Compare Workplace Pension Providers and Get Specialist Advice

Choosing the right Workplace Pension for your employees is important to get right. After all, it will ensure that your team has the best chance to build up a good savings pot for their retirement.

We know that searching for a company pension scheme may feel daunting. But that’s where we can help. Our pension specialists can help you find the right Workplace Pension scheme for your company. We’ll do the heavy lifting, allowing you to run your business without the additional stress.

Get in touch by calling 02074425880 or emailing us at help@drewberry.co.uk.

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4074 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.