In today’s competitive UK job market, a good salary alone isn’t enough to attract and retain top talent. To truly stand out, businesses need to offer a comprehensive employee benefits package that goes beyond the basics and provides meaningful value to employees.

This is where employee discount schemes come into play. They don’t cost much to implement, but provide real value to your staff by helping their salary go further each month. In the guide below, we’ll explore this benefit in more detail, covering how it works, the advantages for your employees, and how to select the right staff discounts for your business.

What Are UK Employee Discount Schemes?

An employee discount scheme is a benefit that allows your staff to enjoy savings on a wide range of products and services. From everyday essentials like groceries and clothing to bigger purchases like travel, electronics, or insurance, these discounts can help employees stretch their pay further.

What’s The Purpose Of A Scheme?

The purpose of a staff discount scheme is simple: to make life a little easier by helping employees save on things they’re already spending money on. It’s an easy-to-understand benefit that can make a real difference, showing employees that their well-being is a priority.

For employers, offering this kind of scheme is a great way to boost morale, improve retention, and attract new talent. It’s also relatively low-maintenance once set up, making it a cost-effective benefit that works for businesses of all sizes. Whether you’re a small business or a larger company, employee discount schemes are a flexible way to support your team’s financial well-being and show that you care about life beyond the workplace.

GOOD TO KNOW 🤓

Employers can negotiate discounts directly with retailers, but this is time-consuming and usually offers a limited range of deals. Partnering with a third-party provider is a more efficient way to give employees access to a wider variety of offers with less administrative effort.

How Do Employee Discount Schemes Work?

Employee discount schemes are typically offered through third-party providers who negotiate exclusive deals with a wide range of retailers. Once a company partners with a provider, the scheme becomes available to employees, usually via an online platform such as My.Drewberry.

Here’s how it works:

- Set Up

Employers sign up with a discount scheme provider, which takes care of everything from sourcing deals to maintaining the platform. This makes the process easy and low-maintenance for businesses.

- Employee Access

Employees receive access to the scheme through a secure portal or mobile app. From there, they can browse a wide range of discounts, view the terms, and redeem offers either online or in-store.

- Redeeming Discounts

Discounts are applied through various methods depending on the retailer, for example online codes, cashback offers or reloadable cards.

- Ongoing Updates

The scheme provider continuously updates the available discounts, adding new offers and removing expired deals, ensuring employees always have fresh options. This means minimal effort is required from employers to maintain the scheme.

Which Type Of Retailers Offer Discounts?

Your employees would have access to discounts on a wide range of products and services, including supermarkets, gym memberships, travel, insurance, homeware, and technology.

With deals available from almost every type of retailer you can imagine, there’s something for everyone. This ensures that all employees, no matter their age or interests, can find discounts that suit their needs.

Retailer Categories

The most common categories of retailers include:

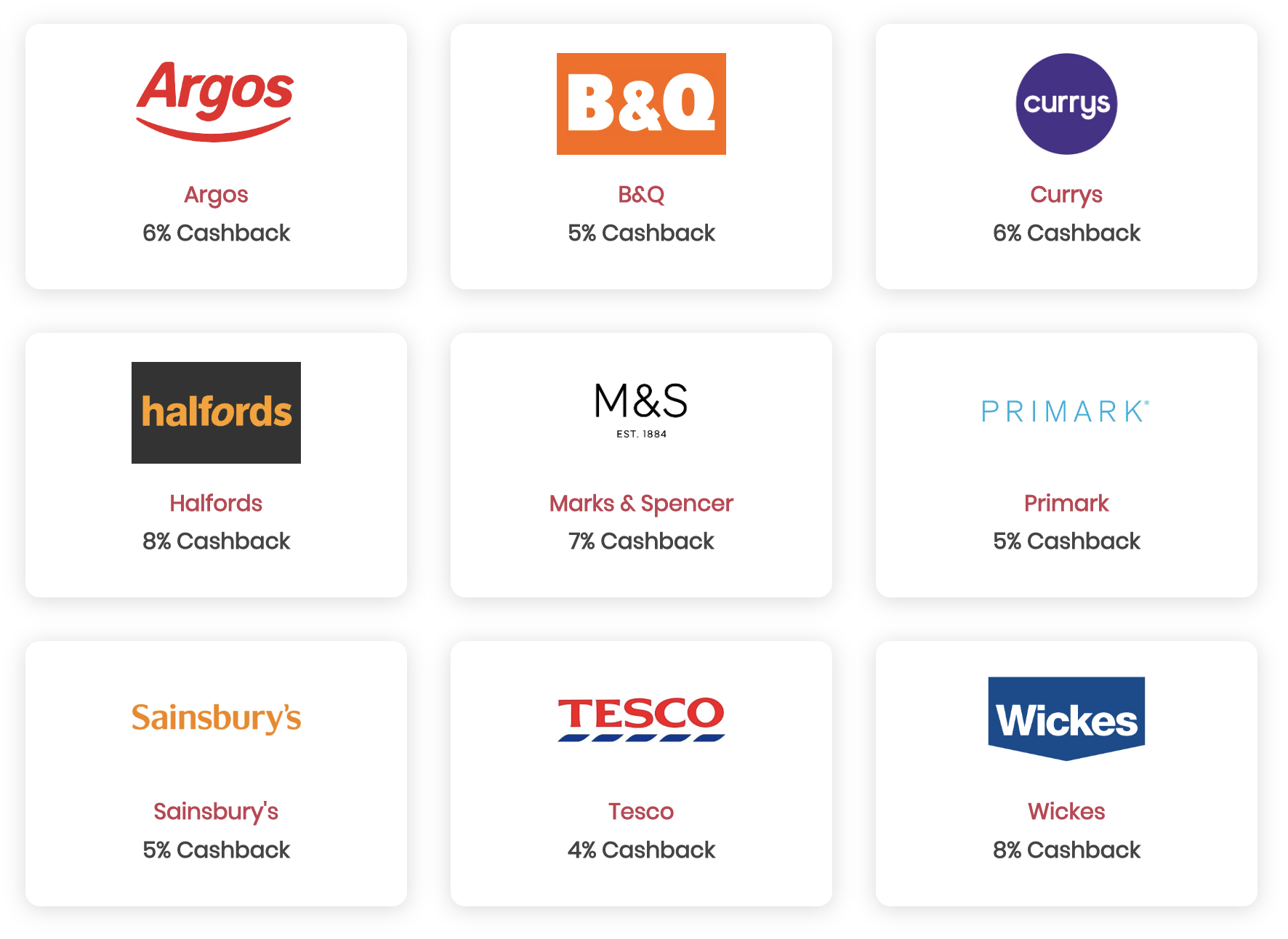

Within these categories, employees can benefit from discounts offered by leading retailers such as Tesco, Sainsbury’s, John Lewis, and ASOS, as well as popular travel providers like Expedia and British Airways.

From everyday shopping to luxury items and holidays, these top brands provide valuable savings that make a real difference to your staff’s finances.

![Drewberry employee discount scheme retailers]()

What Type Of Discounts Are Offered?

Each discount scheme provider is different and the discounts they offer will vary. Some offer online cashback and online discount codes; others offer physical reloadable cards.

Here is a better breakdown of each of the discount formats you may find on an employee discounts scheme.

- Online cashback

Cashback offers employees a percentage of savings when they shop through the discount platform for particular retailers. For example, they might receive 7% cashback on purchases from Marks & Spencer. After completing their purchase, the cashback is credited to their account within the discount platform, and from there, it can be transferred directly to their bank account. While online cashback typically offers smaller savings compared to other types of discounts, it’s still a simple and rewarding way for employees to earn back on everyday purchases

- Digital vouchers

Staff can purchase vouchers for different values, e.g. £25, £50 or £100 to use in a particular shop, such as Tesco. They then receive cashback on the value of the vouchers. Unlike online cashback, which provides cashback on a onetime purchase, digital vouchers allow an employee to get a discount on the value of their vouchers, which can be used on different occasions

- Reloadable cards

Like a gift card, reloadable cards allow staff to add a monetary value to a physical card which they can then use at a specific retailer. They receive cashback on the amount added to the card, which is paid back into the discount platform for them to use later

- Discount codes

Certain retailers will provide specific codes that your workers can use online through their website when making a purchase. An employee simply adds the code when paying and the discount is applied there and then.

What Are The Benefits Of Staff Discount Schemes For Employers?

Employee discount schemes offer so much more than just discounts. As part of a comprehensive employee benefits package, they offer a number of benefits for employers, such as:

It’s A Cost Effective Employee Benefit

Not all employers can provide benefits, such as Group Income Protection or Group Health Insurance, because of the price. Employee discount schemes are a cost-effective benefit. You can expect to pay a minimum of £5 per employee per month for a decent scheme.

Schemes Are Easy To Set Up And Use

Unlike other employee benefits, such as salary sacrifice schemes, discount schemes are easy to set up. Most online staff discount platforms do all the legwork for you, so you don’t actually do much to offer such a valuable and affordable benefit to staff.

This is why it’s such a popular perk for companies. It provides great value without too much admin or management.

Increased Employee Engagement

Good benefits help with employee engagement within your workforce. Helping them save money shows that you care about their overall wellbeing and not just how they perform at work. When an employee feels valued by their employer, they’re naturally more engaged with their company.

Increased Productivity

With better employee engagement comes higher levels of productivity—it has a great knock-on effect. As an employer, staff who are more present and happy in their work are more productive.

This is part of the reason it’s important for employers to provide benefits, like staff discount schemes, to help improve employee engagement and productivity. You benefit just as much as your employees by offering a scheme like this.

GOOD TO KNOW 🤓

It’s been shown that highly engaged teams are 18% more productive than those that aren’t.

Higher Employee Retention

The average cost of replacing an employee is around £25,000 per employee in the UK. Not only is it expensive to hire new members of staff, it’s also time consuming. This makes it all the more important to treat your employees well. Doing so can help keep your top talent onboard.

Implementing meaningful employee perks can help boost employee retention rates and avoid high turnover.

Helps You Hire Top Talent

Not only can a great corporate discount scheme help to reduce turnover, it can also help your company with its recruitment efforts. Valuable employee benefits look great to future employees and can help you to attract candidates from a wider talent pool.

What Are The Benefits Of Discount Schemes For Employees?

There are also plenty of benefits for your employees to enjoy. These include:

Unbeatable Savings

The most obvious benefit of employee discounts is the money your staff can save on everyday purchases. In a time where the cost of living is high in the UK, being able to make their income stretch further each month can help with the general living increases.

For example, a household spending £600 a month on food could save up to £336 a year and that’s just for groceries. There are hundreds of other discounts waiting for your employees to discover and save some cash!

Feeling Valued

Employees report feeling more positive in their job when they feel valued by their employer. Employee discount schemes are a great way to help achieve improved workplace satisfaction.

Helping employees save money helps to show that, as an employer, you care about them outside of the office and value them as people.

Improved Financial And Mental Wellbeing

Our 2024 Employee Benefits survey revealed 40% of employees are stressed about money. Providing everyday discounts can help reduce the cost of living and the impact it has on an individual.

By paying less for food, travel, and insurance, for example, your employees can make their income stretch much further each month. This then has the power to relieve money worries and associated stress.

How Much Can Be Saved Using A UK Employee Discounts Scheme?

Depending on the lifestyle an employee lives and the platform you choose, thousands of pounds can be saved each year.

Different shops have different levels of discount, some higher than others. Employees could expect to save the following at different retailers:

- Supermarkets: up to 7%

- Restaurants, bars and food delivery: up to 12%

- Fashion and accessories: up to 15%

- Electrical’s: up to 9%

- Days out and experiences: up to 20%

- Entertainment: up to 20%

- Travel: up to 15%

- Health and wellness: up to 20%

- Home and garden: up to 10%.

Examples Of Employee Yearly Savings

The average family in the UK (two adults and two children) spends around £157 on food each week (£117 on a weekly shop and £40 on restaurant and takeaway meals). With up to 7% off at some supermarkets, as much as £336 can be saved each year just on groceries—that’s two weeks of food for free!

It’s clear that the more employees engage with their discount scheme, the more they stand to gain. Salaries can stretch further, financial well-being can improve, and stress can be reduced, ultimately leading to better mental health.

How Much Do UK Employee Discount Schemes Cost To Set Up?

When it comes to value for money, employee discount schemes are easily one of the most cost-effective benefits an employer can provide. So, what’s the cost to set one up?

The great news is that there are no setup fees. Employers simply pay a small, ongoing monthly subscription. The cost of this fee can vary depending on several factors, so it’s important to understand what influences the pricing:

The Size Of Your Business

The more employees you want to offer the corporate discount scheme to, the more expensive your monthly fee will be.

For example, if you have 10 employees and opt for a scheme with a monthly fee of £5 per person, you will be charged £50 per month. For a team of 20, you would pay £100.

Most providers offer tiered plans based on features and number of employees. This means that there are options for companies of all sizes and different budget needs.

What Your Company Wants

If you’re looking for an all-singing, all-dancing discounts platform, naturally, you’ll be looking at a bigger monthly bill.

An employee discounts platform that offers the biggest range of discounts and largest savings will come at a higher cost.

If you’re happy to go for a basic plan, then you can keep the cost lower. You’ll still give your employees access to a range of different discounts, but they might not be the most desirable.

The Corporate Discount Scheme You Choose

Different discount schemes will charge different monthly fees. Most platforms cost below £10 per employee, per month. Some of the most basic packages are as little as £5 per employee.

Like with everything in life, though, you get what you pay for. The higher the monthly subscription you choose, the better services and discounts you and your employees can expect.

How Do I Start An Employee Discount Scheme?

To start an employee discounts scheme, you first need to pick a provider before it can be set up. As every business is different with unique needs, it’s worthwhile asking yourself the following questions. These can help you make an informed decision when choosing the best employee discount scheme for your team.

- Why do you want to offer a discount platform?

Do you want the employee discounts platform to improve engagement? Help reduce absenteeism? Or attract new employees? By understanding what you want, you will be able to measure more accurately if the scheme is having the desired effect

- What do you want the platform to do?

Some platforms will offer more than just discounts. Additional features can include rewards and recognition or HR management. It’s worth understanding what it is you need the platform to do. If you don’t, you could find yourself paying for something that isn’t fit for purpose

- How will an employee discount scheme work alongside your existing benefits?

It’s important if you have an existing employee benefits package to think about how another benefit, such as a discount platform, will fit in

- What is your budget?

The cost of schemes will vary depending on what they offer. It’s important to understand how much budget you have, so you can research the platforms in your price range.

Do Your Research

Based on the answers to the above, you can start looking at the different platforms on offer with a clear understanding of what you want. This will help you to narrow down which providers could be a good fit.

For the schemes left in your shortlist, think about:

- Value for money

Which platform is the best value for money, based on what you’re looking for and your benefit budget?

- Features available

Which platform has the most features and, more importantly, the most features that are useful and relevant to your business and employees?

- Discounts on offer

What platforms offer the best discounts? Are the discounts for common retailers your employees will actually use?

- Ease of use

Do any of the platforms you’ve seen stand out from a convenience standpoint? Perhaps they make a point of how user-friendly their software is, or the ongoing support they provide?

Enquire With Your Chosen Discounts Platform

Once you’ve decided which platform you want to learn more about, it’s enquiry time.

When you get in touch with a provider, you’ll need to provide some basic information, such as the number of employees you have and your contact details.

At this point, you’ll receive more accurate information on pricing, features and the discounts available. You can also get a good idea of how to integrate a discounts scheme into your business.

It’s important to get the following information when discussing with the provider:

- What terms and conditions come with using the platform?

- Can the platform be white labelled with your company’s branding?

- How will your employees be enrolled and what data is needed?

- How long does it take to set the platform up?

- What ongoing support is offered with the platform?

Integrate Your Discount Scheme Into Your Company

One of the many great things about company discount schemes is that they’re easy to get up and running. Most providers will do all the legwork for you to make the process as simple as possible.

In most cases, you will just need to send your provider a list of employees who need access and they will generate logins for them.

Communicate New Benefit To Employees

Once everything is set up, you need to think about how to communicate the benefit to staff. Without effective communication, the likelihood is that the employee discount scheme won’t be used.

When introducing any new employee benefit, you need to let your employees know it’s available and how to access it. It can be tricky to get them to engage in internal communications, but this is something that is vital for the success of your new employee benefit.

If you want your staff to pay attention, it’s important to reiterate the benefits your company provides. You can do this regularly through channels, such as:

- Email

- 1 to 1’s

- Staff meetings

- Annual pay reviews

- Interviews.

Tailor Communications

When communicating the benefits of a discounts scheme, put them into context for your employees.

For some people, a 4% discount at their local supermarket isn’t that inspiring. However, if you explain that over the course of a year, it could save them enough money to pay for multiple weekly food shops, the discounts have more value.

Measure Engagement

As an employer, it’s in your best interest to keep track of how your employees are engaging with their new shiny discounts platform.

If you don’t have the time or resources to do this in-house, check with the scheme provider, as they may be able to help you.

It’s also worth checking how the provider reports engagement with the scheme (and if they do). Being able to see how and if employees are using the platform helps to determine whether the benefit is a valuable perk for your company.

Review Regularly

It’s not enough to check engagement in the first couple of months of implementing the platform. By reviewing employee engagement on a regular basis, you can see the benefits value.

If your employees aren’t using the scheme, it might be that you need to choose a different employee benefit. After all, there’s no point in paying for a product no one is using.

Best 6 Employee Discount Schemes / Platform Providers

There are a number of discount scheme providers in the UK, each offering a range of discounts and features. It’s important to compare them to make sure you pick the one that aligns with your business needs.

Top Providers

- My.Drewberry

Our all-in-one employee benefits platform is flexible and easy to use. The employee discounts feature gives your staff access to hundreds of discounts for many brands. You can also easily add and manage other benefits, including Group Income Protection, Group Health Insurance, Death In Service and your Workplace Pension

- Perkbox

This platform provides employees with access to a range of discounts, as well as benefits relating to wellbeing, recognition and engagement. These are all wrapped up into one employee experience platform

- Reward Gateway

One of the largest all-in-one engagement platforms on the market. Reward Gateway offers a range of over 900 retail discounts. It’s a flexible platform that allows employers to pick and choose which engagement tools are right for them

- Staff Treats

This is a simple platform offering employees discounts on groceries, entertainment, travel, and more. Staff Treats has a tiered pricing system, starting from just £2.50 per employee, per month

- People Value

Provides some of the best discounts on an easy-to-use platform which can be personalised to your company

- Edenred Savings

Edenred Savings offers an easy to use digital platform. This makes the discounts easy for you to put in place for your employees. Edenred also provides dedicated support via their customer service personnel.

The best employee discount scheme is the one that suits your business best and provides value to your employees. There’s no one-size-fits-all approach. Every company is different, so it’s important your discounts scheme is the right one for your needs.

What is the difference between staff discount and a discount scheme for employees?

Employee discount schemes often get confused with a staff discount, however they are very different.

A staff discount is a percentage saving for employees on what the company they work for sells. For example, one of the best staff discounts is from Lush, where the employees get 50% off Lush products and Lush spa treatments.

This is a great saving for Lush employees who use their products. However, for those that don’t, it isn’t a valuable benefit.

Employee discounts schemes differ, as they provide a wide range of savings from hundreds of retailers and services. Even though you have to pay to access these discounts, they provide savings for everyone. These are savings that make a real difference in reducing an employee’s everyday costs.

Are employee discount schemes a taxable benefit/benefit-in-kind?

As a non-cash perk, company discount schemes are classed as a non-taxable benefit in kind.

They can be deemed as a ‘Trivial Benefit’, which means that as an employer you can provide each of your employees with a gift or benefit up to the value of £50 tax free and without having to include it on your P11D.

To be deemed non-taxable, a trivial benefit cannot:

- Cost you more than £50 to provide

- Be cash or a cash voucher

- Be a reward for an employee’s work or performance

- Sit within the terms of an employee’s contract.

There is no limit to the number of trivial benefits an employee can receive unless they’re a director, then the total value cannot exceed £300 a year.

Like when adding any perk to your company employee benefits, it’s always best to check the tax implications with an accountant.

Do employees pay anything to access a discount scheme?

No. As an employer, you pay the monthly subscription fee. This gives your employees free access to the discounts.

Compare Employee Benefits Quotes & Get Specialist Advice

Company discount schemes are easy to set up, but sometimes a helping hand from the benefits specialists can be of value. We can help you to compare providers and find the right platform for your employees.

Our team at Drewberry has knowledge and experience of all employee benefits. If you want to add an employee discount scheme to your benefits package, get in touch with us. Give us a call on 02074425880 or email help@drewberry.co.uk.

Why Speak to Us?

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.