Employers have to offer a suitable workplace pension scheme as soon as they hire their first employee. Then, whenever a new staff member joins, the employer has to assess their eligibility and enrol them into the scheme automatically.

Complete Guide To Workplace Pensions For Small Businesses

Running your own small business is an exciting endeavour. However, there are many legal obligations you have to fulfil. One of which is to provide your employees with a Workplace Pension Scheme.

But where do you start? Putting a group pension scheme in place can be a daunting task. There’s a lot to consider, and it’s important to get it right. To help you get your head round it all, we’ve put together this guide on ‘Workplace Pensions For Small Businesses’.

Do Small Businesses Have To Provide A Workplace Pension?

The simple answer is yes. Reforms to the Pensions Act 2008 back in 2012 states all employers, regardless of size, must provide a workplace pension.

So, even if you only hire one employee, you have a legal obligation to set up a pension scheme. The scheme must also qualify for ‘automatic enrolment‘.

What Is Automatic Enrolment?

The government implemented automatic enrolment to help employees save more money for retirement. It helps to make joining a workplace pension scheme easier and quicker.

Employers must set up an auto-enrolment workplace pension scheme from the date they first hire someone. Eligible staff will then be automatically enrolled without needing to do anything.

Who Is Eligible For Automatic Enrolment?

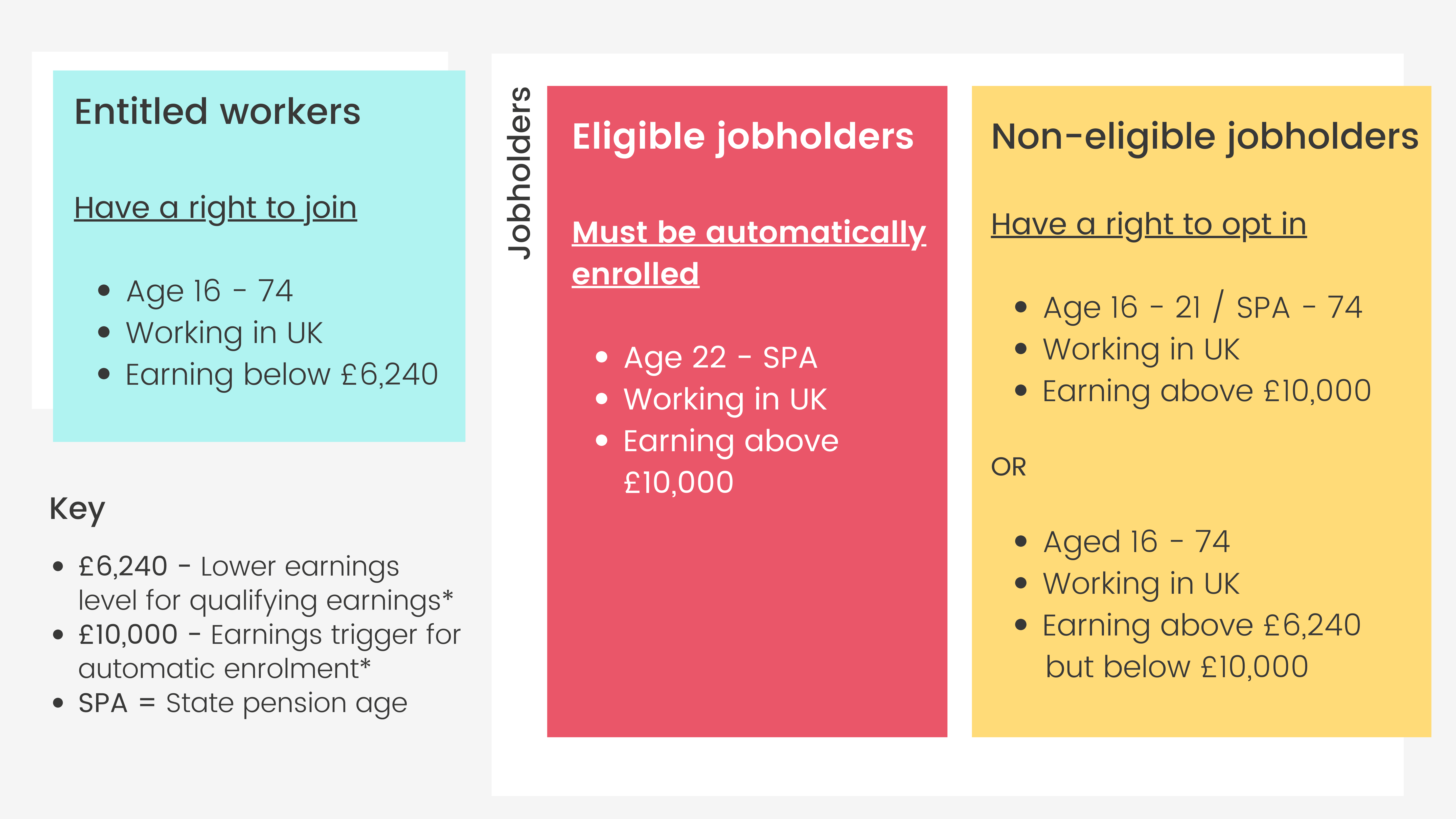

Employers must enrol any employees who:

- Are aged between 22 and State Pension Age

- Earn at least £10,000 a year

- Normally work in the UK and paid via PAYE.

How Does A Small Businesses Workplace Pension Scheme Work?

The most common type of workplace pension for small businesses is a ‘Defined Contribution Scheme‘. With this type of scheme, an employer and an employee make monthly contributions.

These then get invested into the scheme’s chosen pension fund, with the aim of increasing its value overtime. The final pension amount will depend on:

- The amount of money paid in by employer and employee

- How long an employee contributed

- Investment performance

- Charges deducted.

What Level Of Contributions Are Required?

Auto-enrolment sets out that 8% of an employee’s qualifying earnings must be contributed into a workplace pension. As the employer, you have to pay a minimum of 3%. The remaining 5% would come from your employee.

You could offer more than 3% and allow your employees to contribute less. For example, you could pay 5% while your employees pay 3%, as long as the total amounts to 8%.

How Are Workplace Pensions For Small Businesses Managed?

Defined contribution schemes can be trust based, which is what makes them suitable for small businesses. A trust-based scheme is managed by a board of trustees who oversee the management and investments on behalf of your employees. Generally, trust-based schemes are used by a single employer rather than having multiple companies using the same one.

The good thing about a trust-based scheme is that the funds are kept separate from the company. This means if the employer goes out of business, the employees still get their pension pot.

Master Trusts

There are also master trusts, such as Nest. This type of trust is managed externally and allows different, unrelated employers to use it. You could join a scheme and be one of 1,000 other employers using it.

Master trusts such as Nest are chosen by small businesses, as they are easy to set up and fulfil their legal obligation.

In some cases, small business owners don’t think there are any alternatives to the likes of Nest and The Peoples Pension. However, there often is. This is why it’s important to consider all the options before choosing a workplace pension. Not doing so could result in you setting up a scheme that isn’t necessarily the best for your specific setup.

You may have heard of defined benefit schemes as well. These pension schemes offer employees a set benefit each year after they retire. Also known as a Final Salary Pension, it’s based on the member’s final salary or career average.

These used to be far more common, however today they are really only provided by large employers or the public sector. They aren’t suitable for small businesses.

Nick Nelms

Senior Consultant, Employee Benefits

Benefits Of Small Business Workplace Pensions

Workplace pensions are more than just a legal requirement for small businesses. When set up correctly, it’s a highly valuable benefit for you and your employees. We show you how below:

- Attract & retain top talent

Attracting and holding on to top talent is crucial for small businesses. Providing a workplace pension that stands out from your competitors can help give you the competitive edge - Tax benefits

Allowing contributions to be made via salary sacrifice can provide you and your employees with big tax savings. It can also reduce the amount you pay in National Insurance Contributions - Improved employee engagement

Helping your employees save for their future can help reduce financial pressures. This can lead to lower levels of stress and enhance their overall wellbeing. Ultimately, helping to increase their levels of engagement and boost their performance at work - Enhance reputation

As a small business, offering a well thought out workplace pension can boost your reputation. This is especially true if you provide additional contributions above the required 3%. Employees look for employers who show that they care and value their staff - Being compliant

Staying on top of your workplace pension can provide peace of mind. As an employer, you know that you are fulfilling your responsibilities and helping your employees save for their future.

Additional pension contributions are one of the most sought after employee benefits. With this in mind, it’s important to make sure you provide the best workplace pension you can.

56% of employees believe that pension provisions are an important factor when considering a new employer. In order to be competitive, a strong workplace pension is key.

What To Consider When Choosing A Small Business Pension Scheme

Setting up a small business workplace pension starts with research. It’s a good idea to see what’s available to evaluate your options and choose the right provider.

The best pension provider for a small business will depend on a variety of factors, such as:

Your Small Business Needs

Before you can pick a pension provider, you need to know what your small business needs from a scheme. Some questions to consider:

- Are you looking for a low-cost pension scheme?

- Do you need a pension plan that is quick and easy to set up?

- Do you or your employees need any extra support?

- Do you want to offer a salary sacrifice workplace pension?

The above will help you identify the right workplace pension scheme for your small business.

Eligibility And Automatic Enrolment Duties

Most workplace pension schemes facilitate automatic enrolment. But it’s always best to double check that the provider you’re considering complies. This will enable you to fulfil your duties as an employer with ease.

Major providers often have a five employee minimum. This refers to how many employees you have employed, not how many you are going to enrol. Make sure to check your business meets the provider’s criteria. You should also check if you can complete your employer automatic enrolment duties.

EXPERT TIP 🤓

Not all providers accommodate small businesses. Some have restrictions on the size of a business they allow, depending on how many members of staff you have hired.

The Costs And Charges

When setting up a workplace pension for a small business, it’s important to factor in the setup and ongoing costs into your budget. This is key if you’re a small company, as you might not have the same financial freedom as a large corporation.

Here are some of the potential charges to think about:

- Set-up fees

- Annual Management Charge (AMC)

- Payroll configuration

- Cost of working with a financial adviser if necessary

- Pension contributions as an employer

- Monthly administration fees.

Tax Relief Methods

Another key consideration is the tax relief methods offered by a scheme. There are different options and the one you choose will determine how workplace pension contributions are taxed.

Relief At Source (RAS)

Relief at source takes an employee’s contribution from their salary after tax. This is the method most workplace pensions use.

For basic taxpayers (20%), the provider tops up the pension pot by 20%. The provider will then claim this back from the government as tax relief.

Here’s an example. For an employee earning a monthly salary of £2,000 and paying a 5% contribution of £100, £80 comes from their take home pay. The provider then tops it up by £20 and claims that amount back from HMRC.

Staff on a higher tax rate (40% or 45% dependent on earnings) will have to claim their full tax relief via HMRC.

Net Pay

With net pay, employee contributions come from their salary before tax. They then only pay tax on their remaining income, meaning they get full tax relief immediately.

Basic rate taxpayers receive full tax relief straight away. Higher or additional taxpayers have to claim back tax on their annual tax return. It’s important to note that any employees earning below the personal allowance of £12,750 won’t get any tax relief via the net pay method.

An employee earning £2,000 a month who contributes 5% (£100) will only pay income tax on the remaining £1,900. As they don’t pay tax on the £100 contribution, they save £20. The contribution really costs the employee just £80 due to the tax relief top up.

Nick Nelms

Senior Consultant, Employee Benefits

Salary Sacrifice

Small business workplace pensions can also be set up using salary sacrifice. This arrangement provides you and your staff with significant tax benefits.

Salary sacrifice is when an employee sacrifices part of their gross salary in return for a non-cash benefit, like a pension scheme. It means they don’t pay Income Tax or National Insurance (NI) on the money they sacrifice.

Staff can contribute to their pension pot without lowering their tax home pay. They can also enjoy higher pension contributions if you decide to pass back your NI savings.

EXPERT TIP 🤓

Allowing contributions to be made via salary sacrifice is an easy way of helping your employees save more for their retirement. The good news is, it won’t cost you any more to do this.

How Pension Contributions Are Invested

To help an employee’s pension pot grow over time, contributions are invested into funds. These funds vary in terms of risk. The higher the risk, the better the return is likely to be, however, this is not guaranteed. Pension providers will have multiple investment funds to choose from. Some even have hundreds.

Small businesses often opt for the default investment strategy, as it caters to the average member’s needs. However, this isn’t always the best option, as they might not provide the best return. Therefore, it’s important to look at all the funds a scheme offers and how they have performed.

Ethical & Sharia Funds

Your staff demographic may also want more specific funds. Some may want to invest in an ethical way. This would require a pension scheme with ethical investment options. Or, you may you have staff practising Islamic faith who would want Sharia-compliant funds.

Time And Admin Required

Setting up and managing a workplace pension scheme is time-consuming. There are many legal duties to fulfil, as well as continuous tasks to ensure you meet regulations.

One of these is the payroll setup. You need to be able to make adjustments to the payroll and ensure contributions are paid on time. This could result in extra admin and costs if your payroll software isn’t compatible. Other tasks include:

- Managing scheme leavers

You need to allow employees to leave the scheme if they wish and manage this process. If staff opt out within one month of enrolment, you must also refund their contributions - Rejoining staff

You must let staff rejoin the pension scheme at least once a year if they’ve opted out. You must also re-enrol workers back in at least every three years if they have opted out and are eligible - Scheme certification

You must provide certification every 18 months to The Pensions Regulator. This is if the scheme is on a basis other than qualifying earnings - Communication

Employees need to be kept up to date about all relevant pension scheme information - General admin

You’ll need to keep records of how you’ve met your legal duties. You must also review the pension scheme every three years (Triennial Review) to ensure it remains a qualifying scheme.

All small businesses should evaluate whether they have the resources to complete these tasks or if getting expert help would be a better option.

At Drewberry™, our financial advisers can take the workload off you and help complete the admin tasks. We can also ensure you pick the right scheme and meet all legal requirements. For help, pop us a call on 02074425880 or email help@drewberry.co.uk.

Support And Resources Provided

Most workplace pension scheme providers have a wealth of resources for employers and employees. Welcome packs, webinars, and online portals are just a few examples.

The level of support your small business needs, however, will depend on you and your eligible employees.

Think about:

- How much extra support might your team need?

- What resources does the provider offer to help staff better understand their pension?

- How is the workplace pension scheme managed?

- Does the provider offer a user friendly online platform to help with employee engagement and scheme management?

Make sure to check what’s on offer when researching workplace pension schemes. Support can be beneficial to a small business, especially if you don’t have the time to offer it yourself.

Workplace Pension Provider Reviews

How To Set Up A Pension Scheme For A Small Business

There are several steps to consider when setting up a workplace pension for a small business. These are:

1. Confirm Your Small Business Is An Employer

Is your small business classed as an employer? If your company is liable for tax and National Insurance Contributions for one or more employees, you are an employer. You’re therefore obliged by law to provide a pension scheme.

2. Assess Your Workforce

Next step is to assess your workforce. Which members of staff meet the criteria for automatic enrolment? We listed the necessary criteria at the start of this guide. This is a vital step, as it provides you with the information you need to enrol your eligible employees.

Some things to think about:

- Do you have any low earners?

- Any seasonal or temporary staff?

- Are you planning to postpone your auto enrolment duties?

The above can affect who is eligible to enrol in your new workplace pension scheme.

3. Ensure You Can Pay Minimum Contributions

You have to contribute to your employees’ pension pots. This is an ongoing cost for your business. Employers must pay at least 3% of an employee’s qualifying earnings into their pot each month. Although employers can contribute more if they wish, but not less.

4. Choose A Pension Provider

Choosing the right workplace pension scheme isn’t easy, as demonstrated in the factors you need to consider. Some employers may need extra help when it comes to this step. Fortunately, there is support available.

The use of a third party, like our team at Drewberry, is a great idea if you can afford it. Using their expertise, our advisers can recommend a pension scheme for your small business.

5. Ensure Your Scheme Is Compliant

There are several things to do for a pension scheme to be compliant with The Pensions Regulator, including:

- Declaring compliance with The Pensions Regulator

- Assessing your workforce

- Informing your employees of the scheme in writing

- Allowing staff to opt out if they wish

- Paying contributions on time

- Completing re-enrolment duties every three years

- Keeping records of your scheme and duties performed.

6. Communicate To Employees

Communication is key when it comes to workplace pensions. You are legally obliged to provide certain information, but it’s important to go one step further. For your team to truly value their pension, they need to understand the benefit and its worth.

The good news is, your employees want to know more about their pensions too. Our latest Workplace Pension Survey found:

- 27% of employees aren’t satisfied with the level of communication from their employers about their pension

- 58% want help to better understand if they are saving enough for retirement

- 48% don’t understand tax relief or salary sacrifice.

Ensuring your staff clearly understand their workplace pension can help them to value it as a benefit. You’d be surprised at the impact good benefits can have.

27% of staff say that employee benefits and perks make them happy and it’s well known that a happy and healthy workforce is a more productive one.

As a small business, you might not have the time and resource to provide regular communications about your workplace pension. Many providers offer resources, such as webinars and guides, which you can utilise.

Or, if you get the help of an independent expert such as Drewberry, we can help you provide all the communication you need.

Nick Nelms

Senior Consultant, Employee Benefits

Common Workplace Pension Questions

When do you have to offer a workplace pension scheme?

How can small businesses prepare their employees for retirement?

A small business can help prepare their employees for retirement by providing a workplace pension scheme that suits their employees’ needs. Employers can also further their knowledge of pensions and retirement planning by offering financial education in the workplace.

Not only will this help staff to have a better understanding of what they need to do to achieve a comfortable retirement, it can also support general financial wellbeing.

How much does it cost to match my employees’ pension contributions?

If you want to offer employer pension contributions above the 3% minimum, the cost will vary on several factors. To match your employees’ contributions, the price depends on how much your eligible staff earn and how many members you have enrolled in the scheme.

The Pensions Regulator has a handy online contributions calculator to help you estimate the cost.

Compare Workplace Pension Providers And Get Expert Advice

It’s essential to compare pension providers to find the right one for your small business. Without adequate research, you might pick a scheme that isn’t cost effective or doesn’t suit your needs. Ultimately, choosing the wrong provider may cost your small business more than necessary.

We know that workplace pensions can be confusing, as there’s so much information to absorb. It’s also not a straightforward decision to make for your employees.

If you’d like extra support when choosing your small business pension, speak to one of our advisers. We help many small businesses with choosing and setting up their employee benefits. As experts in the UK pension market, our team can provide recommendations for your company. We can also help you set the scheme up and assist with admin.

For expert advice, don’t hesitate to get in touch with us. You can call us on 02074425880 or email at help@drewberry.co.uk.

Why Speak to Us?

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to talk to us.

- We are award winning 🏆 independent insurance advisers who work with all the leading UK insurers

- You’ll speak to a dedicated expert from start to finish

- We are very proud of the 3955 and growing independent client reviews rating us at 4.92 / 5

- We are authorised and regulated by the Financial Conduct Authority. You can find us on the financial services register here 🧐

- Claims support when you need it most.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.