Thinking about getting Directors Health Insurance? You’ve come to the right place. If you’re a director, or even a contractor, Private Health Insurance is something you should consider.

In this guide, we’ll tell you everything you need to know about it. What it is, what you need to consider before buying a policy and how much it can cost.

A Quick Video Introduction To Directors Health Insurance

Not got enough time to read this guide, but want a specialist overview of Directors Health Insurance? Our very own Alex Weir is here to provide exactly that. Just press play. 👇

What Is Directors Health Insurance?

Firstly, let’s look at what Health Insurance for Directors is. To put it simply, it’s the same as personal Private Medical Insurance. It gives you access to private healthcare facilities when you need it most and can:

- Allow you to skip long NHS waiting lists

- Provide you with more choice over any treatment

- Give you access to drugs which are not yet available on the NHS.

But what makes it different to a personal policy? Well, rather than you paying for the policy yourself, your limited company does.

Why Is It Important?

As a director, time is of the essence and you can’t afford to take long periods off sick. If you do, it has the potential to disrupt business, which is why being able to get back on your feet as soon as possible is pivotal. Not just in terms of your business’s productivity but your finances will be affected by time off too.

Directors Health Insurance can help to ensure you get the right treatment, by giving you access to broader facilities and treatment at a time you need it.

How Does Directors Health Insurance Work?

Directors Health Insurance is the same as personal Private Medical Insurance (PMI). There is one key difference, and that’s how it’s paid for.

Unlike a personal policy, where you pay for your premiums from your own bank account, Directors Health Insurance is paid through your limited company.

Once a policy is in place, you’re then be able to make a claim when needed and receive care and treatment privately if your plan covers it.

Does It Replace The NHS?

No, it’s designed to work alongside it. So when you take out a policy, you aren’t saying goodbye to the NHS altogether.

The level of interaction you have with the NHS depends on the level of cover you have (we touch on this later). You’ll still see your GP, however, the point at which they refer you to a private facility will differ depending on your policy.

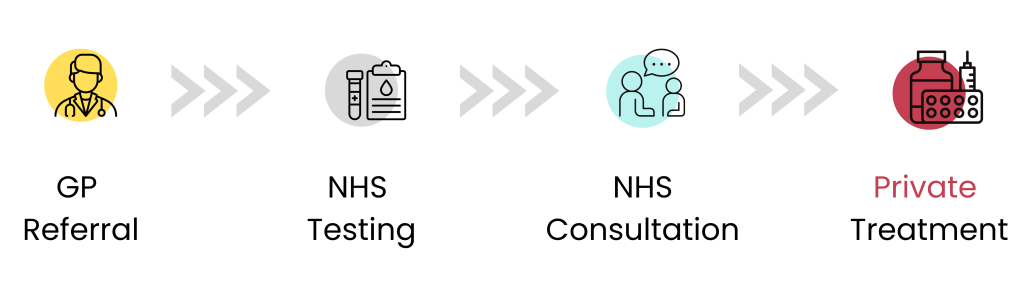

No Outpatient Cover

If you have a basic policy that doesn’t include out-patient cover, your GP will refer you to the NHS for tests, consultations, and diagnostics. Once these tests have been carried out, you’d then be referred to a private facility for treatment.

![NHS Treatment Process]()

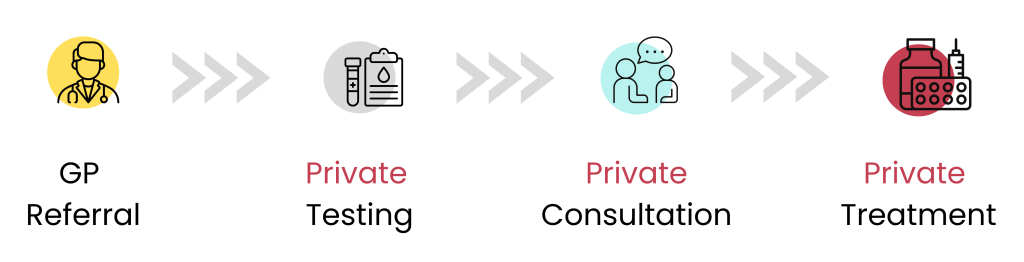

With Outpatient Cover

If you did have out-patient cover, your journey looks a little different. Rather than your GP referring you to the NHS for tests, you’d be referred straight to a private facility. You would also receive your treatment there too.

![Private Health Insurance Treatment Process]()

SPECIALIST TIP 🤓

Although you still need to be referred by your GP for private healthcare, in most cases, you can do this via virtual GP services.

At this point, it’s important to highlight that regardless of how comprehensive your cover is, not all conditions will be covered. In some scenarios, you’d still receive full medical treatment from the NHS.

Chronic Vs Acute Conditions

In the medical world, there are two types of health conditions you could develop. These are:

- Chronic conditions

These stick with you for life. They won’t go away with time or medical attention. Doctors can only manage them, not cure them. For example, diabetes and asthma

- Acute conditions

These pass with time and medical care. Cataracts needing surgery or joint pain requiring a joint replacement are both acute conditions, for instance.

Private Medical Insurance will only cover you for acute conditions. So, if you do have a chronic health issue, all ongoing management will be provided by the NHS, along with any emergencies.

This is why we say that Private Directors Health Insurance works alongside the NHS and doesn’t replace it, as it doesn’t cover everything.

What Does Directors Health Insurance Cover?

We now know how Directors Health Insurance works and that it doesn’t cover chronic conditions. So what does it cover?

Level Of Cover

As mentioned above, what your GP will refer you to a private facility for will depend on the level of cover you have. Typically, treatment gets split out into two categories, Inpatient or Outpatient:

- Inpatient / day-patient care

Any care where you need a hospital bed, either overnight (inpatient) or just for the day (day-patient). This would most commonly be after surgery

- Outpatient care

All care and procedures where you don’t require a hospital bed. This includes diagnostic tests, scans and treatment, such as physiotherapy.

All Directors Health Insurance policies cover inpatient and day-patient treatment as standard. This means all policies cover surgical procedures.But outpatient cover is optional extra for a higher premium.

The more comprehensive your policy, the greater cover you will get. As standard, most UK providers will cover:

- Diagnostic / medical tests such as blood tests, CT and MRI scans

- Surgery as inpatient or day-patient

- Hospital stays and nursing care

- Extensive cancer care and treatment.

Depending on the level of cover you choose, you may also get:

Cancer Cover

Another good thing to know is that most plans now include Cancer Cover as standard. This is one of the most valuable aspects of your policy.

It provides access to drugs, therapies, and treatments the NHS may not offer due to cost. Also, depending on the insurer, cancer care can offer new experimental medicine. Generally, it’ll cover:

- Chemo / radiotherapy

- Biological therapies

- Cancer surgery / reconstruction

- Cash towards prosthetics / wigs you need as a result of cancer treatment.

SPECIALIST TIP 🤓

As well as the above, you may also be able to add additional cover, such as dental and optical care, to your policy as an optional add-on.

What Doesn’t Health Insurance For Directors Cover?

All Directors Health Insurance policies have standard exclusions. These apply to everyone, not just directors.

You can expect to see the following excluded:

- Alcohol & substance abuse

- Pre-existing conditions

- Pregnancy

- Kidney dialysis

- HIV & AIDS

- Cosmetic treatment

- Fertility treatment

- Mobility aids, such as wheelchairs & mobility scooters

- Self inflicted injuries.

Do I Need Directors Private Medical Insurance?

As a company director, we know how busy you are. What’s more, your limited company no doubt relies on you firing on all cylinders. A health problem can therefore throw a serious spanner in the works.

In some cases, NHS waiting lists mean you may not get treatment for weeks. At the end of January 2023, there were 7.2 million people on NHS waiting lists in England. And the stark reality is that the NHS hasn’t met its 18 week treatment target since 2016. This means many, many patients are awaiting treatment.

You should consider Directors Health Insurance if you:

- Want access to private healthcare

- Prefer flexibility over where and how you receive treatment

- Want peace of mind that you can get the care you need as quick as possible

- Want to skip long NHS waiting lists

- Don’t have any pre-existing chronic health problems

- Can afford monthly insurance premiums.

Whether you need Directors Medical Insurance depends on your personal circumstances and reasons for buying it. From our experience with clients at Drewberry™, directors are busy, busy people.

Having to take time off work due to poor health may have a negative impact on your business. As a director, Private Medical Insurance can help you get care and treatment faster. It can ensure your limited company doesn’t experience too much disruption and you can go back to work as soon as possible.

How Much Does Health Insurance For Directors Cost?

How much your Directors Health Insurance costs will depend on a number of factors. Some of these are within your control, however, others, such as age, aren’t.

To give you a better idea of how these factors can affect the cost of a policy, we’ve provided example quotes below.

Providers

Every provider will charge different premiums. This is due to the fact each has a different appetite for risk and can offer different services. Due to this, it is always good to shop around.

To highlight how costs vary from provider to provider, we’ve provided an example below, based on:

- A healthy 35 year old

- Comprehensive cover

- £250 excess

- Non-smoker.

Level Of Outpatient Cover

If you want to include outpatient treatment on your Directors Health Insurance, you can expect to pay more. A mid-range plan might provide you with up to £1,000 worth of outpatient cover. A comprehensive plan would provide will full cover.

Using the same example from above, we’ve provided quotes so you can see how different levels of outpatient cover affect cost.

Excess

An excess is the amount you agree to pay upfront towards your care before your Directors Health Insurance kicks in to cover the rest. In most cases, you pay the excess once per policy year.

The higher your excess, the lower your premiums. You’ll be paying a greater amount of the cost of private healthcare yourself, so you’ll pay less for cover.

Excesses start at £100 and go all the way up to £5,000, depending on the care you need and the provider you choose. Aviva offers the highest excess amount on the market at £5,000, while Bupa’s highest excess is £500.

To give you an example of how this can impact premiums, we’ve got some examples. This is based on the same healthy 35-year-old from above.

Age

Unfortunately, none of us are getting any younger and the sad fact is, the older we become, the more likely we are to get unwell. Age plays a big factor in the cost of Private Health Insurance premiums, not just for directors, but for everyone.

Using the same example from above, here are some costs based on different ages.

Smoking

Some providers, not all, will charge smokers more than non-smokers. This is due to the health risks associated with consuming nicotine.

We’ve provided an example from AXA to give you an idea of how costs differ. This is based on a healthy 35-year-old director, wanting comprehensive cover and a £250 excess.

Hospital Networks

Just because you have Directors Health Insurance doesn’t mean that you can get treated anywhere. When taking out a policy, you will have the choice of a hospital network. This will determine the facilities you have treatment in.

The more comprehensive your network and the pricier the facilities, the more you’ll pay for cover. If you’re not too fussed about receiving care in a top facility, you can limit your hospital network and reduce the cost of your premiums.

Location

Location is another factor taken into consideration when it comes to Private Health Insurance. If you live somewhere with high-profile private hospitals, such as Central London, premiums will rise to reflect this.

SPECIALIST TIP 🤓

There are some providers, such as Freedom, that don’t base premiums on location. Providers such as this could be more suitable if you live in London, as they won’t rate premiums on your postcode, unlike others.

6 Week Wait Option

Some providers will give you an option of adding a six week wait option to your policy. If you aren’t opposed to getting treatment on the NHS, then it’s worth considering as it can reduce the cost of your premiums.

Your insurer will first examine the NHS waiting list in your area before you receive private inpatient care. If the waiting list is less than six weeks, you’ll get treatment from the NHS rather than through a private facility.

It’s important to note that this only applies to inpatient care. If you add outpatient treatment to your plan, your insurer will take care of this privately as normal.

IMPORTANT NOTICE 🧐

Due to the current length of NHS waiting times, some insurers such as AXA aren’t offering this option. The market changes regularly, so if you’re unsure, give us a call on 02074425880 or email help@drewberry.co.uk to find out your options.

How Is Directors Health Insurance Taxed?

How Directors Health Insurance is taxed is where it differs to a personal policy. As we mentioned before, as a product, it’s pretty much the same. However, your limited company can pay for the premiums and this is viewed differently by HMRC.

With a personal policy, you’d pay premiums out of your net pay. This means that you pay tax and NI before paying them. As Directors Health Insurance is seen as an allowable business expense by HMRC, your business can pay for your premiums on your behalf.

Thanks to corporation tax relief, this is often up to 50% cheaper than paying for a personal policy. Not only this, it can also reduce the corporation tax bill of your limited company.

Group Health Insurance

An alternative to Directors Health Insurance is Group Health Insurance. With this policy you can insure more than one person at a time.

Policy premiums are also classed as an allowable business expense, which means your company can pay for them.

One thing you do need to be aware of though, in order to take a policy out, you’ll need at least three employees. With many of our clients operating as solo limited company owners or running a small business, we know this isn’t always a viable option.

Is Private Health Insurance A P11D Benefit?

Private Health Insurance is a P11D / Benefit in Kind when your limited company covers payments. In simple terms, HMRC sees it as a benefit that bumps up your take-home pay without you having to pay additional tax.

You will then pay income tax on the value of the benefit, which equals the cost of your premiums. You’ll also need to pay Class 1A National Insurance.

As a company director, you must report your Private Health Insurance policy to HMRC at the end of the payroll year as part of your P11D forms. HMRC then reduces your personal allowance to account for the additional tax due.

IMPORTANT NOTICE 🧐

We recommend speaking to your accountants before paying premiums through your limited company to check your personal tax position. Tax regulations are dependent on individual circumstances and are subject to change.

Which underwriting should I choose?

There are two underwriting options for Private Health Insurance: Moratorium and Full Medical Underwriting. Which one is best for you depends on your medical history—not just on the conditions you’ve had, but also how severe those conditions were.

- Moratorium Underwriting (MORI)

This is the most common form of underwriting. Moratorium means your insurer will exclude any medical condition you’ve had advice, medication or treatment for in the past 5 years

- Full Medical Underwriting (FMU)

With full medical underwriting, you fill in a form declaring any pre-existing conditions. The insurer will then typically exclude those conditions. While you’ll know what you’re covered for from the start, there’s often very little opportunity to remove exclusions. FMU provides a faster payout due to the fact you don’t need to provide medical proof as you would on a moratorium basis. Your insurer already knows your health history.

It’s critical you get the underwriting of your policy right, so if you have a pre-existing condition, call us on 02074425880 for advice. You can also email us at help@drewberry.co.uk if you’d prefer.

Do UK insurers cover directors abroad?

If you buy a UK Private Health Insurance policy, it’s rare the plan will cover you while you’re travelling abroad. UK policies provide private medical treatment in the UK only. If you need emergency care while travelling, your Travel Insurance should cover it.

You can add international cover to some Private Health Insurance policies for a higher premium, but not every provider will offer this.

Your alternative is to buy International Health Insurance. This is far more comprehensive than a UK-only policy, as a domestic UK plan is only designed to supplement the healthcare the NHS provides.

A global insurance policy aims to meet all your healthcare requirements while overseas. It covers routine maternity care, emergency treatment and often chronic conditions.

Should I review my Directors Health Insurance every year?

Private Medical Insurance, is like Car Insurance, it renews on an annual basis. Every year, your insurer will write to you about your premiums for the upcoming year.

You may find that your premiums rise. This is typically down to medical inflation. Your premiums need to reflect the increasing costs of the latest, cutting-edge medical advances, drugs, and treatments. However, it’s always best to review your policies to make sure you’re getting the most competitive price and cover.

If you’re unhappy with the costs and want to check you’re still getting the most competitive price, an adviser will be happy to help. We’ll compare the whole market on your behalf, like we did when you first applied.

If we find another insurer is offering lower premiums, we’ll be able to assist in switching providers. Our team will ensure you get the right underwriting terms and continue receiving the same level of cover. You can read about one of our clients, Haydn’s, experience of switching providers with one of our financial advisers for more insight.

Who Are The Best UK Private Medical Insurance Providers For Directors?

Although there are a few specialist insurers, the majority of the UK market consists these five major providers:

Costs do differ from provider to provider, and the aforementioned personal factors will influence the price. The best health insurer for you will depend on your circumstances and needs. So, it’s vital to compare quotes from all the insurers before taking out cover. This can help ensure you get the best value for your money.

Additional Benefits

When buying Directors Health Insurance you’ll get more than your core cover. Many providers offer a range of free additional benefits, including:

- Remote GP services

- Second medical opinion

- Health checks

- Gym discounts

- Stress & mental health support

- Physiotherapy.

Our specialist in-depth review of each of the UK's leading providers

Compare Director Health Insurance Quotes & Get Specialist Advice

Private Health Insurance is already fairly complex due to all the ins and outs, and options to choose. But this rings true even more so for directors, who must choose whether to buy a personal plan or pay premiums via their limited company.

To find out more about the best way to buy cover or to review your existing Health Insurance, give us a call on 02074425880 or email help@drewberry.co.uk.

Why Speak to Us?

When it comes to protecting your health, you deserve first-class service. Here’s why you should talk to us:

- There’s no fee for our service

- We’re an award-winning independent insurance broker, working with the leading UK insurers

- You’ll speak to a dedicated specialist from start to finish

- 4074 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4121)