Drewberry survey finds 1 in 5 Britons risk financial ruin…

According to Drewberry’s 2016 Wealth and Protection Survey, 20% of UK workers have no idea how they would cope financially if ill health forced them to stop working for six months or more.

Based on current employment data, this means more than six million Britons are financially vulnerable, without a back-up plan to tackle the financial impact of long-term incapacity.1

Breaking the piggy bank

Even among those who did have some kind of plan in place to cover themselves if they were too ill to work, there is still some cause for some concern. For instance, 44% of respondents planned to live off their savings if they couldn’t work due to long-term incapacity, but only 25% of those surveyed in Drewberry’s 2015 Protection Survey said they had enough in savings to cover their monthly outgoings for more than six months.

Clearly, there’s a considerable mismatch between the number of Britons planning to dip into their savings in the event of illness or injury and the number who could actually rely on this as a long-term strategy.

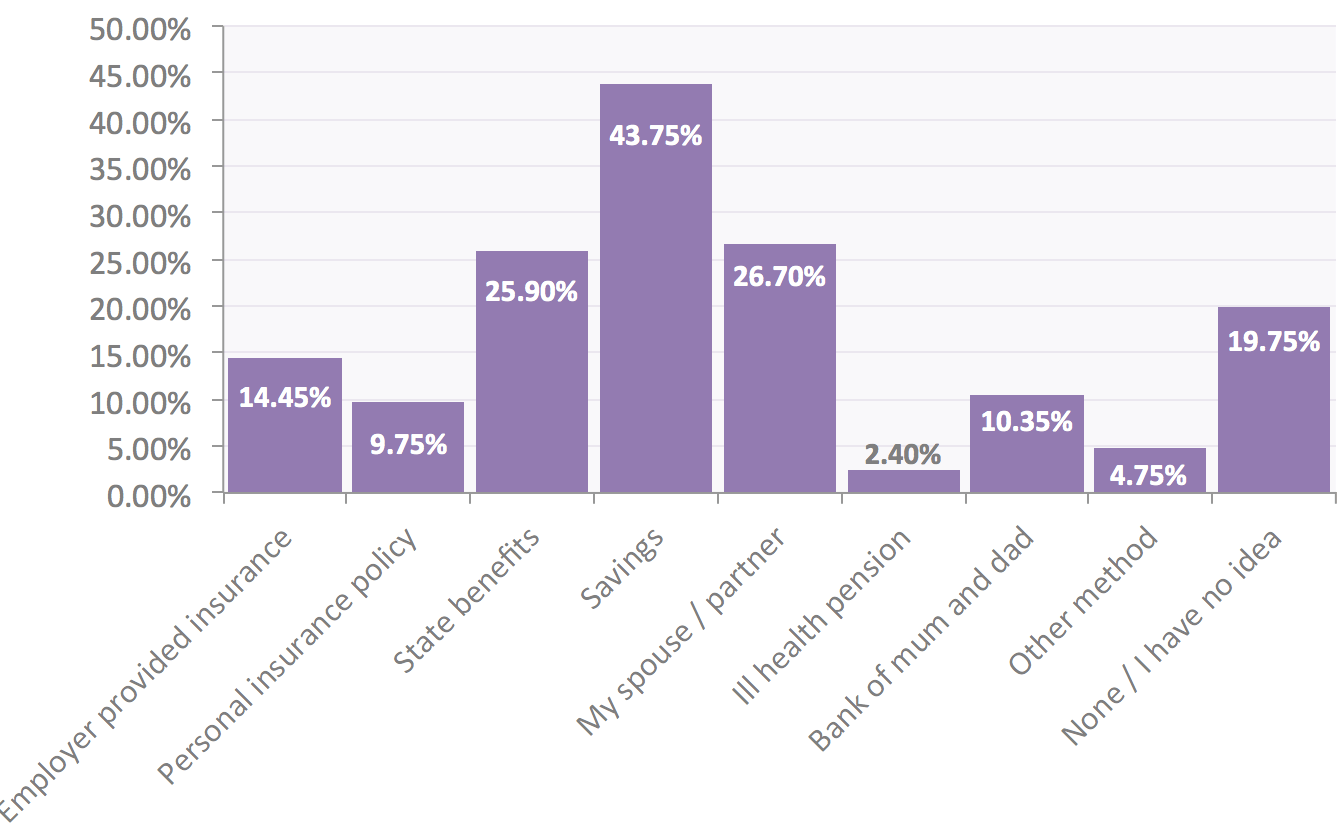

How would you cope financially if you couldn’t work for six months?

1 in 5 people have no idea how they would cope financially if they suffered long-term incapacity.

Other than savings, there were three other notable means of coping during long-term incapacity:

- 1 in 4 would use state benefits

- 1 in 4 would rely on their partner’s income

- 1 in 10 would need to ask their parents for help.

Some of us are more vulnerable than others

While the nation as a whole is worryingly unprepared for the event that they are unable to work due to long-term incapacity, a deeper examination of the data shows that some sectors of society are in a more precarious position still.

Women at risk

Women are less likely than men to have work-related benefits to call upon in the event that they’re unable to work due to ill health. They’re also less likely to have a personal insurance policy to fall back on.

These factors mean that women are more reliant than men on state benefits such as Employment and Support Allowance — currently an absolute maximum of £109.30 per week — if they can’t work due to incapacity.

Younger Britons still expect their parents to bail them out

Younger respondents also stood out as being far less likely to have a backup plan in place. Although this partly reflects that many adults aged 18 to 24 are studying and don’t yet have a need for Income Protection, when asked how they would cope financially if they couldn’t work for six months due to illness or injury, 29.6% said they’d need to make a withdrawal from the bank of mum and dad.

Self-employed are living dangerously

Sole traders were in a particularly perilous position. Respondents in these groups were the most likely to say they had no idea how they’d cope financially if they couldn’t work for six months. With plans available for the self-employed, Income Protection can be a key factor in relieving these worries.

Pampered pooches take priority over their owners’ incomes

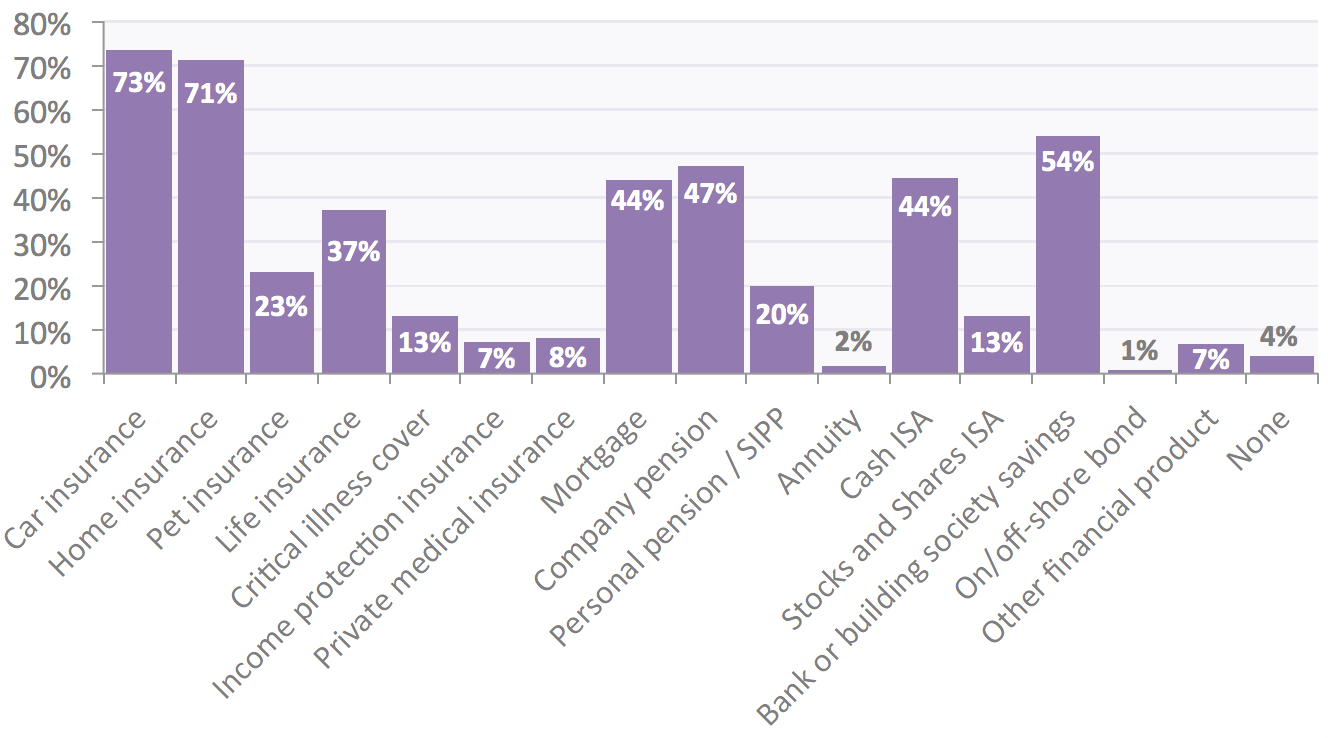

Clearly we’re all used to insuring our cars and homes: more than 7 in 10 people surveyed saying that they did so. But insuring our incomes, which is what pays for these things at the end of the day, appears to come lower on the list of priorities.

Fewer than 1 in 10 Britons said that they had a personal insurance policy to fall back on if they fell ill and couldn’t work, although almost 1 in 4 had arranged cover to protect against illness — their pets’ illnesses, that is!

Respondents were around twice as likely to have covered their pets as themselves, with 22.9% having pet insurance compared with 13% holding Critical Illness cover and just 7% having Income Protection.

Which of these financial products do you have?

Think seriously about your back-up plan…

With the majority of Britons only having enough savings to cover their essential outgoings for a couple of months and state support in the form of the Employment and Support Allowance only paying just over £100 per week, it’s vital that people think seriously about how they’d cope financially if they were to suffer a long-term illness or injury.

“Statistically, there’s a 1 in 5 chance of having to take three months or longer off work due to ill health so it’s an issue that shouldn’t be taken lightly. Fortunately, there are some great Income Protection products around that can neutralise this risk and prevent so many people from having to gamble on their financial future.”

Tom Conner

Director at Drewberry

1) Drewberry calculations based on 31.77 million people being in work as reported by the ONS in July 2016. The ONS data can be found here.

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.