What Different Types of Life Insurance Exist?

We are just starting out in a new home and I have come across different types of life insurance products and am really not sure which way to turn? What is available and what are they designed to do?

There are a range of life insurance policies available which are designed to protect you at different stages in your life whether it be protecting your mortgage, children or funeral costs.

It is important to understand the difference so you can ensure you choose the most suitable policy at these life stages.

All life insurance policies are designed to pay out a benefit on death. However, some pay a lump sum while others pay an annual or monthly income. The main types of life insurance you will come across are as follows:

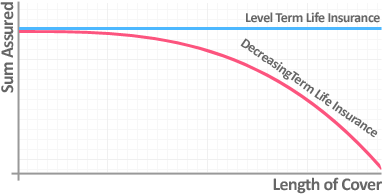

Level Term Life Insurance

Level term cover is one of the simplest forms of life cover, you set a length of time you want to be covered and decide on a level of cover you would want your loved ones to receive should the worst happen.

During the policy term should you pass away your loved ones will receive the cash lump sum to help them financially during such difficult times.

The lump sum can be used however they wish, whether that is to pay off a mortgage, other debts or simply to help maintain their lifestyle moving forward.

Decreasing Term Life Insurance

Similar to Level Life Insurance this term assurance product provides your loved ones with a lump sum cash payment on death.

The difference is that the level of cover which you choose from the outset will decline over the life of the policy. The most common use for decreasing cover is to protect a repayment mortgage as the level of life cover will decline over time in line with the reducing mortgage loan.

Whole of Life Insurance

Whereas level and decreasing terms assurance only pay out if you pass away during the term of the policy, Whole of Life Insurance will pay out whenever you pass away providing you maintain your premiums.

The most common uses of whole life insurance include covering funeral costs and inheritance tax planning.

Family Income Benefit

Probably the most under-utilised of Life Insurance products, Family Income Benefit pays a monthly or annual income to the deceased’s beneficiaries should the policyholder pass away during the term of the plan.

It is the most cost effective way of maintaining your loved ones standard of living.The most common use is to protect your children’s standard of living to an age where you would expect them to be financially self-sufficient.

Mortgage Life Insurance

This is a specific form of term assurance designed to protect an outstanding mortgage, whether this be an interest only or repayment mortgage.

Mortgage life cover provides a number of additional benefits specific to mortgages, such as moving day rescue services covering emergencies and free life cover between exchange of contracts and completion of your property.

Relevant Life Insurance

This is a tax efficient policy for a single employee or director. It is a simple level term life insurance product which is placed in a specific trust to ensure it’s tax efficient. The premiums are tax deductible and any benefit payable should a claim arise is paid out tax free.

- Topics

- Life Insurance

Frequently Asked Questions

Can I Get Life Insurance if I am Overweight?

Does Life Insurance Cover Diving?

What Should I Do if I've Been Declined Life Insurance?

Can I Get Life Insurance With a Family History of Cancer?

What Is Terminal Illness Benefit With Life Insurance?

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.