How Does Decreasing Term Life Insurance Work?

What Is Decreasing Life Insurance?

Decreasing Term Life Insurance is one of the most common types of life insurance policy you can buy. It is designed to pay out a tax free cash lump sum on death to ensure your loved ones are financially secure should the worst happen.

Term insurance is any form of life insurance that lasts for a set length of time which is defined at the outset of policy. Most people align the term of their life insurance with their mortgage to ensure cash will be available to repay the outstanding debt if they die before it is paid off.

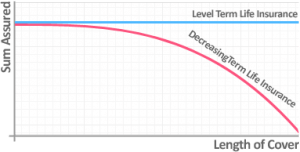

The decreasing element refers to the fact that the benefit – i.e. the amount paid out on death – falls each year until it reaches zero at the end of the policy term.

For this reason decreasing cover is the most cost-effective form of Mortgage Life Insurance as the benefit can be set to fall in line with the outstanding mortgage balance.

How Does Decreasing Life Assurance Decline Over Time?

Much like the capital outstanding on a mortgage, the amount of cover provided by a Decreasing Mortgage Life Assurance policy falls very slowly in the early years and declines much faster in the latter years.

By mirroring the rate at which your mortgage reduces you’ll always know that you’ll have enough to pay off the balance of the debt in full should you unfortunately pass away.

Make sure your Decreasing Life Insurance has a maximum interest rate that is high enough above your mortgage rate that you have a buffer for fluctuations.

If your mortgage interest rate was to rise above the maximum you could be left with a shortfall if you die during the policy’s term.

Samantha Haffenden-Angear

Independent Protection Expert at Drewberry

As mentioned, not all plans assume the same interest rate. Although plans with lower assumed rates come with lower premiums, they provide much less security in the event of interest rate fluctuations.

Can I Include Decreasing Critical Illness Insurance?

As with all Life Insurance policies, you can add Critical Illness Cover to Decreasing Term Life Insurance. This increases your mortgage protection as the policy will pay out not only on death, but also if you develop an insurer-specified critical illness.

Many Critical Illness Insurance policies will cover the ‘big three’ illnesses:

- Cancer

- Heart Attacks

- Strokes

In addition to the big three, most policies cover up to 40 or so other serious illnesses. The definitions of these illnesses are really important as they can vary from one insurer to the next. We have tools in-house to compare how comprehensive these definitions are so you can make an informed decision when it comes to the most suitable policy.

When you choose Decreasing Term Mortgage Life Insurance with Critical Illness Cover, the level of Critical Illness Cover will decline over time at exactly the same rate as the Life Insurance element.

Could Income Protection Be a Better Option?

If you’re taking out a Critical Illness policy for protection against ill health, you may be better served with an Income Protection policy, which covers a wider array of conditions and can be more cost-effective.

Advantage of Decreasing Life Insurance

One of the biggest advantages of Decreasing Mortgage Term Assurance is that the policy can be aligned with your mortgage, falling as the value of your outstanding mortgage debt falls over time.

As the benefit reduces with Decreasing Term Life Insurance, the risk to the insurer falls alongside it. Given this, premiums are cheaper than Level Life Insurance, where the payout remains constant over time and the risk to the insurer remains the same across the term of the policy.

Level Life Insurance policies are most suited to repaying interest-only mortgages, where the amount of capital doesn’t fall across the term of the mortgage as you’re only repaying the interest.

Level Life Insurance vs Decreasing Life Insurance

In some cases, Level Life Term Insurance might be a better choice for you than Reducing Term Life Insurance. This depends on your needs.

If Reducing Term Life Assurance is aligned to fall alongside your mortgage, it won’t provide your loved ones with much of a lump sum in excess of the cash needed to repay the loan.

This could lead to a situation where although your beneficiaries have repaid the mortgage and own their home outright, they might not have sufficient cash to run the home, i.e. covering bills and maintenance etc.

Additionally, you may also want to some cash left over to cover funeral expenses, or to help cushion the blow from a sudden loss of income.

For this, a Level Term Life Assurance policy would be far better suited because the payout will remain fixed over time. So if you die halfway through the mortgage, the payout will be enough not only to cover the rest of your mortgage but also provide a lump sum with the remainder of the insured benefit.

Get Decreasing Life Insurance Quotes & Expert Advice

With Decreasing Term Life Insurance, you’ll need to ensure that the rate of decrease doesn’t exceed your mortgage interest rate. An adviser can double check this for you.

Given that many people buy their home as a couple and have joint mortgages, it may seem logical to get a joint Reducing Life Insurance policy. However, this is also worth discussing with an adviser – in many cases two single Life Insurance policies might be better suited to your circumstances.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated expert from start to finish

You will speak to a named expert with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 3928 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

At Drewberry we help clients with Decreasing Term Life Insurance every day, so we know the market like the back of our hands. We’re more than happy to help you with your enquiries and get you a policy in place – just drop us a line on 02084327333 for expert advice.

Tom Conner

Director at Drewberry

- Topics

- Life Insurance

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.