Reducing Your Tax Bill With VCTs (Venture Capital Trusts)

What is a Venture Capital Trust?

A venture capital trust (VCT) is an investment vehicle set up to invest in small, fledgling companies. These small companies are often, although by no means always, small startups needing capital to get off the ground and VCTs look to make money by providing the funding to grow and develop such companies.

There are strict regulatory and legislative rules surrounding how venture capital trusts work and just how they can invest your money. If they don’t follow these rules, they are unable to qualify as venture capital trusts and earn tax relief on your investment.

These rules were updated in 2012 to increase the size of the businesses you can invest in via a VCT, with the new rules meaning:

- The maximum number of employees a business can have to qualify for VCT investment has increased from 49 to 249

- The maximum total gross assets before investment rose from £7 million to £15 million

- The maximum total gross assets after investment increased from £8 million to £16 million

- The total amount that can be raised from VCT investment by a single company increased from £2 million to £5 million.

- The annual £1 million limit on VCT investment in a single company was removed.

A major rule is that VCT investments must be made in companies with the objective to grow and develop. Another point is that there should also be a significant risk of loss of capital after allowing for tax relief, to prevent an emphasis on capital preservation.

While there are risks involved with venture capital trusts, which must be discussed with your adviser and clearly understood before you enter into such an investment, there is also the potential for rewards. These include:

- An upfront reduction in your income tax bill

- The opportunity for your investment to grow free of capital gains tax

- The potential for tax-free dividend payouts.

How Do Venture Capital Trusts Work?

The reason VCTs offer tax relief is to encourage people to invest in smaller, higher-risk companies requiring funds to get off the ground. These companies may find it difficult to raise funds because of the risk presented by their newness and small size, so the tax relief serves as an incentive to invest.

You receive tax relief at 30% on investments of up to £200,000 per year, meaning if you invest £10,000, you’ll get £3,000 back from the taxman. You only get to keep this tax rebate if you hold your VCT shares for at least 5 years.

When you invest in a VCT, you are pooling your funds with other investors. The venture capital trust itself will decide which companies to buy stakes in.

A venture capital trust is a listed company in its own right, so it’s important to note that if you invest in a VCT your shares are not in the companies the VCT has invested in but in the actual VCT itself.

By pooling your investments with those of other customers, VCTs allow you to spread the risk over a number of small companies, which can act to diversify your investment portfolio.

How Do I Invest in a Venture Capital Trust?

You can buy into a venture capital trust by subscribing to new shares when a new venture capital trust is launched or buying shares from other investors once the trust is already established and those investors are looking to sell.

Note that you won’t get the immediate upfront tax relief if you invest in existing VCT shares.

VCTs are complicated with risks attached, such as the risk of capital loss and the fact that your shares can be illiquid and hard to sell.

You need to ensure you understand these risks before purchasing shares in a VCT. An adviser is in the best position to explain these to you.

Jonathan Cooper

Senior Paraplanner at Drewberry

Which Companies are Eligible for VCT Investment?

To receive VCT funds, a company must have a permanent establishment in the UK and carry out what HM Revenue & Customs (HMRC) deems a ‘qualifying trade’.

In practise this covers most trades, although there are exceptions that HMRC does not believe are in need of the additional financial support that VCTs can offer small firms. The sectors / businesses that are not eligible for VCT investment include:

- Land dealing

- Financial activities

- Forestry

- Farming

- Running hotels

- Energy generation.

Tax Relief on VCTs Explained

If you choose to invest in a new venture capital trust, you’ll receive upfront tax relief of 30% on your investment. The maximum you can invest in a VCT in a single financial year is £200,000, although you can’t receive more in tax relief than your total income tax liability for that tax year.

In most cases, you only get to keep this tax relief if you hold your VCT shares for at least 5 years. (Two exceptions to this rule are if you sell the shares to your spouse or pass away within 5 years of the purchase.)

VCT shares bought on the secondary market — i.e. already-existing VCT shares you purchase — don’t get the upfront tax relief. However, they do count towards the £200,000 allowance for the tax year in which you buy them, despite the fact you don’t get the income tax break.

How to Claim Income Tax Relief on VCTs

On investing in a VCT, you receive two certificates: a share certificate for the amount you’ve invested and a tax certificate that allows you to claim the 30% upfront income tax relief from HMRC.

Both are important documents that you should keep safe, as you’ll need the share certificate if you go on to sell your investment and the tax certificate to claim the tax relief.

If you pay tax under PAYE, then you have two options depending on the timing of the purchase. You can call HMRC and have your tax code adjusted immediately and start paying less tax each month. Alternatively, you can simply claim the income tax relief via your Self Assessment Income Tax form at the end of each tax year in which you’ve made an investment in a new VCT.

5 Year Rolling Tax Relief on VCTs

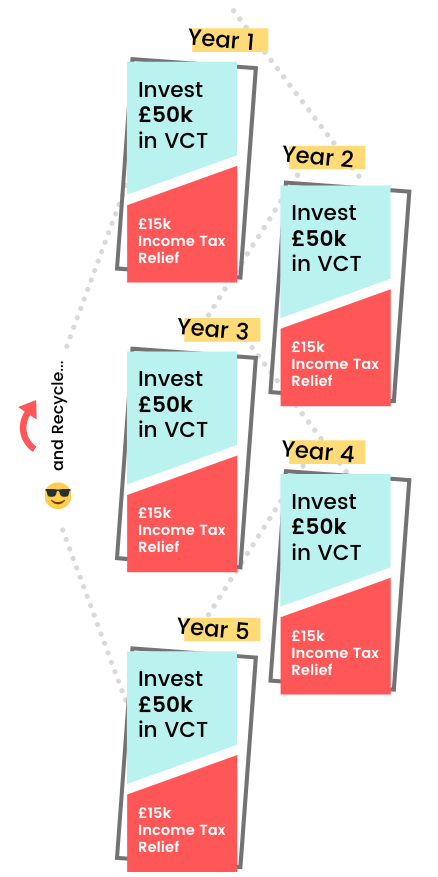

Jenny is a financial controller who has already maximised her ISA and pension contributions for this and all previous tax years. As such, she’s looking for other government-supported methods of reducing her income tax bill and is comfortable with investing in smaller UK companies with all the associated risks that involves.

Over 5 years of investing, Jenny could reduce her tax bill by £75,000. She could also adopt a cyclical approach, which would see her reinvesting the proceeds from year 1 in year 6, year 2 in year 7 and so on, claiming further tax relief each year, and all without investing more than the sales proceeds from her initial £250,000 stake.

This is a simplified example which assumes no loss or gain on the initial investments and does not take into account fees, charges or transaction costs. For more information on how this may work for you in principal, contact your adviser today.

Capital Gains Tax Relief on Venture Capital Trusts

You don’t pay capital gains tax (CGT) on profits from selling your VCT shares, regardless of how short a period you’ve held them, assuming the company maintains its VCT status.

It should be noted, however, that if your VCT investments make a loss, you can’t use this to reduce your CGT bill from other investments.

Tax Relief on Dividend Payments from a VCT

Dividends from investments in VCTs do not attract income tax provided the original investment was made within the permitted maximum of £200,000 per year.

Should I Invest in a Venture Capital Trust?

Whether or not you should invest in a venture capital trust depends on your circumstances and your appetite for risk. There are other ways for high earners to reduce their tax bill which typically make more sense to consider first, such as ISAs and pensions. VCTs are high-risk investments and not for the faint of heart or those unable to withstand the potential for capital loss.

Why Purchase Shares in a VCT?

- You’re looking for upfront tax relief to reduce your tax bill

- You have an appetite for higher-risk investments and are able to withstand the potential for losses

- You’ve used other tax-efficient investment alternatives already, such as your annual pension and ISA allowances

- You’re looking for investments that can grow and then be sold free of capital gains tax

- You’re looking for a source of tax-free dividend payouts

Is a Venture Capital Trust Right for Me?

There are risks involved in investing in venture capital trusts as well as rewards, such as:

- Investments in small / new companies can be harder to sell

By their very nature, VCTs invest in small companies looking for funding to grow, including unquoted companies and those listed on AIM (the London Stock Exchange’s growth market). Shares in these companies can be illiquid and may therefore be hard for the VCT to eventually sell. - VCTs invest in very new companies

VCTs are only permitted to make investments in companies that are no more than 7 years from making their first commercial sale (or 10 years for ‘knowledge intensive’ companies). Investments in younger companies are far riskier than investments in established firms with long trading track records and established revenue streams — one risk being that they may fail. - VCTs are long-term investments

You only get to keep your upfront 30% tax relief if you hold your VCT investments for at least 5 years. If you sell before this, you’ll have to pay it back. If you therefore cannot remain invested for at least 5 years or may need access to the funds before then, a VCT is unlikely to be right for you. - Tax relief is dependant on individual circumstances and is subject to change

The government can change the legislation surrounding VCTs at any time, which could impact the suitability of a VCT as an investment option for your circumstances.

Need Help with Venture Capital Trusts?

Venture capital trusts are complicated financial instruments which, by their very nature, must carry a notable risk of loss in order to qualify for the tax relief on offer from HMRC.

As such, we don’t recommend going it alone or purchasing through a stockbroker without advice — instead, use an adviser such as one of the team at Drewberry.

Please don’t hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Why Speak to Us?

We started Drewberry because we were tired of being treated like a number. We want to give you as our client the service you deserve when discussing matters as important as planning your financial future.

Below are just a few reasons why it makes sense to let us help:

- See your financial future

Our sophisticated financial modelling technology visually maps out your financial future. Get a living financial plan that clearly shows what you can achieve depending on the decisions you make — read more here. - Achieve the retirement you deserve

Can you afford that dream round-the-world trip? Can you help your children onto the property ladder? We’ll model your goals and build your financial plan to help you achieve them. - Our knowledge saves you time and provides peace of mind

We take care of it all, from organising your pensions, investing your assets, managing risk and making the most of your tax allowances. - We’ve got bargaining power on our side

This allows us to negotiate better rates for you than dealing with providers yourself. - You’ll speak to a dedicated specialist from start to finish

You’ll speak to a named specialist with a direct phone line and email. No more call centres and machines asking you to press this and that — you’ll speak to someone who knows you. - Benefit from our 5-star service

We pride ourselves on providing 5-star service, as seen in our 4072 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

Our regulated advice service means you are protected. We’re responsible for the decisions we help you make. Doing it yourself or going direct to a provider doesn’t offer this protection, so you won’t benefit from these securities.

- Topics

- Business Owner

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.