Top 8 (Legal) Strategies to Avoid Inheritance Tax

Due to rising asset values and the decade-long freezing of the threshold at which you start to pay inheritance tax (IHT), inheritance tax is affecting a growing number of estates.

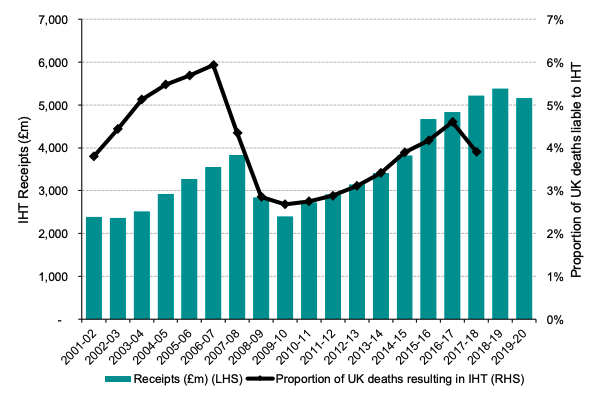

HMRC collected £5.2 billion in IHT for 2019/20. This is down slightly on the record figure seen in 2018/19 due to continued rollout of the Residence Nil-Rate Band.

When you pass away, the sum of everything you own wherever it is in the world — cash in the bank, shares, property, possessions — is all added together. This forms what is known as your ‘estate’.

You are then allowed to deduct your available ‘nil-rate band’ and potentially any available ‘residence nil-rate band‘ to arrive at your taxable estate.

HMRC then charges inheritance tax at 40% on most assets above these nil rate bands. Clearly, this would quickly take a significant bite out of any legacy you were planning to leave your loved ones.

You can get an estimate of your potential liability using our Inheritance Tax Calculator.

Please note that for non-UK domiciles (which is different to residency) different rules apply.

Knowing Your Inheritance Tax Nil-Rate Bands

The nil-rate band is a threshold below which HMRC charges inheritance tax (IHT) at a rate of 0%. Inheritance tax is therefore not due if the value of your estate falls below your available nil-rate band. HMRC taxes anything above this threshold at 40%.

Nil-Rate Band

The current nil-rate band is £325,000 (2020/21). However, it can be much less than this, especially if you have made gifts to individuals or trust arrangements.

Residence Nil-Rate Band

You can use the residence nil-rate band if you leave your home (your primary residence) their children or direct descendants.

The current residence nil-rate band is £175,000 (2020/21). However, this amount can be reduced where the total estate exceeds £2m or where the value of the property is less than the level of the residence nil-rate band.

There are also specific rules around who classes as a “direct descendant”. Moreover, there are also rules around downsizing properties and moving into assisted living and what this means for the residence nil-rate band.

Both the residence nil-rate band and the nil-rate band can be transferred between spouses and civil partners should one pre-decease the other.

As with most taxes in the UK, the inheritance tax rules are very complicated. We’d therefore always recommend seeking expert professional advice, such as that offered by ourselves, if you wish to explore ways to legitimately reduce your IHT exposure.

Jonathan Cooper

Senior Paraplanner at Drewberry

Taking the wrong course of action or doing things in the wrong order can lead to unintended consequences. For instance, you may face potentially losing any attempted tax savings entirely. In some situations, it can even lead to family members and friends having to pay tax in relation to your estate.

Below we explore some of the more common methods of IHT planning. Note that these still require expert advice to ensure that they are suitable and implemented correctly.

- Making a will

- Use and organise your pensions

- Make use of your inheritance tax allowances

- Consider inheritance tax Life Insurance

- Think about making larger gifts

- Consider trusts

- Consider inheritance tax-efficient investments

- Above all: Seek expert advice

1. Make a Will

When it comes to inheritance tax planning, you need to have a will in place.

This will ensure you can choose who you pass your estate onto rather the rules of intestacy deciding (which come into play when you die without a will).

Under the rules of intestacy the government dictates to whom your money passes, which can make avoiding inheritance tax tricky.

For instance, if you leave everything to your spouse / civil partner in your will, not only will there be no inheritance tax to pay at that point but the surviving partner can inherit the deceased’s nil-rate band and their residence nil-rate band.

In the 2020/21 tax year, this combination of doubled nil-rate bands and main residence nil-rate bands means the surviving spouse could leave an estate of up to £1 million before any inheritance tax is due.

However, the rules of intestacy do not allow you to leave everything to your spouse / civil partner as the following flow chart explains, hence the vital importance of making a will.

2. Use and Organise Your Pensions

A pension is a very tax-efficient way of leaving wealth to future generations.

Personal pension arrangements are mostly exempt from inheritance tax and benefit from tax-free returns. Modern arrangements have a range of death benefit options. Meanwhile, you can leave benefits benefits to anyone you choose (for example, in some circumstances it can make sense to leave a pension to a grandchild rather than a child).

Not every pension arrangement will offer this and in some cases it may be advisable to transfer your pension to a new provider to benefit from this inheritance tax efficiency.

It’s vital you take care in how you phrase your written death benefit nominations to ensure they correctly meet your wishes and do not fall foul of legislative technicalities.

Beneficiaries who inherit a personal pension arrangement can also nominate their own beneficiaries, known as successors. This can allow flexible inter-generational wealth planning.

Pensions are subject to their own tax regime. There are therefore rules surrounding what you can put in, what you can accrue over a lifetime and the tax treatment of death benefits. It’s vital to carefully consider all these rules when building your inheritance tax strategy. Still, pensions can form a key tool.

You can find out more information in our article: What Happens to My Pension When I Die?

3. Use Your Inheritance Tax Allowances

There are a range of allowances you can utilise each year to give away cash or assets without attracting inheritance tax by way of exemption from the normal gifting rules.

Whilst they may be small beer in isolation, used together and over a number of years they can be an effective way of tax-efficiently removing significant sums from your estate.

Annual Inheritance Tax Allowances

- Annual gift allowance

Gift up to a combined total of £3,000 in each tax year (6 April to 5 April) to whomever you chose. You can carry over up to £3,000 in unused annual gift allowance from one tax year to the next, but you must use up all of your allowance in that tax year.

- Small gifts exemption

You can make small gifts of up to £250 per person to as many people as you choose. However, you can’t use your annual gift allowance and your small gift exemption on the same person in the same year. - Wedding gifts

Gift up to £5,000 to your children / stepchildren as a wedding gift. Smaller allowances are available for grandchildren (£2,500) and gifts to friends or other relatives (£1,000). - Gifts to charities or political parties

Certain gifts to political parties as well as those to charities and museums etc. are free from IHT. If you leave more than 10% of your net estate to charity, HMRC reduces your overall IHT rate to 36%.

There are strict rules surrounding these gifts and the interplay between them. Before commencing any gifting strategy, seek professional guidance to ensure you do not fall foul of the legislation.

Gifts from Normal Expenditure Out of Income

A further allowance is known as the “normal expenditure out of income” exemption. This does not have a defined monetary limit to it and so can have a wide variety of uses within IHT planning. For example, you might consider funding life assurance premiums, regular gifts or pension contributions for family members or even regular gifts into trust.

However, the legislation surrounding this exemption is detailed and multifaceted. At a high level you must meet three conditions to gain the exemption:

- The expenditure must be part of normal expenditure (i.e. it has a regular and habitual pattern)

- It was made out of income (i.e. it cannot be capital in nature such as lump sums taken from investments)

- There is enough income remaining to maintain your normal standard of living, meaning you cannot give away all or some of your income then rely on capital withdrawals to fund your lifestyle.

It’s vital you keep detailed records of this regular gifting in order to claim the exemption. Furthermore, always seek advice to ensure you aren’t falling foul of the legislation in this area.

4. Consider Life Insurance

Another option is to explore insuring your estate or your gifting liability with Life Insurance.

You have two potential avenues for this, and which (if any) option that is right for you will depend on your circumstances.

Whole of Life Insurance

Whole of Life Assurance pays out a specified lump sum when the lives assured within a policy pass away. It is typically written on a joint life, second death basis (so it pays out when the last remaining partner passes away).

Crucially, as Whole of Life Insurance does not have a term length / end date, providing you continue to pay your premiums it is guaranteed to pay out.

Firstly, of vital importance, you write the policy into trust so the payout does not form part of your estate. The trust’s beneficiaries can then use the proceeds of the policy to pay the inheritance tax liability.

The life cover, in itself, does not reduce an inheritance tax liability nor stop the potential for an inheritance tax liability to increase further in the future. It merely provides a means with which your estate executors can pay the tax due.

However, as mentioned in the previous section, premiums for the life cover may be exempted by way of one of the annual allowances. So, if you can pay the premiums from normal income, paying the premiums could take money out of your resulting estate and then the payout from the policy passes to your loved ones free from inheritance tax via a trust.

Gifts Inter Vivos Insurance

Other types of life insurance policies, such as Gift Inter Vivos Insurance, offer funds to the beneficiary of a gift in order for them to settle the tax bill on a gift they have received.

This scenario can occur where you make large gifts but pass away within 7 years (and potentially up to 14 years) from the date of the gift. See more on this below.

There are many providers offering Whole of Life and Gift Inter Vivos cover. Seek advice to ensure you are buying the right plan for you at the best premium. As a whole of market insurance adviser, we’re ideally placed to help with this.

Sam Barr-Worsfold

Financial Planner at Drewberry

5. Consider Making Larger Gifts

Making gifts to your loved ones above the annual exempt amounts will reduce the value of your estate for inheritance tax purposes.

However, any gift made takes 7 years (and potentially up to 14 years depending on if you’ve made and gifts to certain trusts) to fall outside of the estate and become exempt. If you die within 7 years of making the gift, then your nil rate band applicable to the rest of your estate will be reduced to account for the gift.

This rule means that gifts outside of the usual annual allowances are referred to as Potentially Exempt Transfers or PETs. This is because they only become fully exempt after the set period has elapsed.

This can also create tax charges for beneficiaries of gifts depending on the size and timing of the gifts made (hence the potential need for Gift Inter Vivos Insurance as mentioned above).

Gifting will also mean giving up total ownership of the asset, meaning that you cannot continue to benefit from it, receive an income from it nor access the capital.

Rules apply if you continue to benefit from the gift which mean HMRC will continue to include it within your estate for inheritance tax calculations. One example of this might be gifting your home to children but continuing to live in it rent-free.

It is also vitally important to consider the order of gifting. Gifting in the wrong order, for example gifting PETs before gifts into trust, could have serious tax consequences.

Again, it is vitally important to seek professional advice when gifting to not only ensure you can afford to make the gift but that it is inheritance tax-efficient.

6. Inheritance Tax and Trusts

A trust arrangement can be as bespoke as required. Alternatively, you might use a more ‘off-the-shelf’ arrangement specifically designed with inheritance tax relief in mind.

Trusts can provide ongoing control and access to income and capital (unlike gifts to individuals). Moreover, you can write them to reflect exactly your wishes on how the trust assets should be treated and distributed.

As such, trusts can therefore provide an excellent option for inheritance tax planning during life. Moreover, a trust can ensure your assets are safeguarded after your death and only end up in the hands of who you want them to, when you want them to.

Common Types of Trust

A few of the common types of trust specifically aimed at inheritance tax planning are:

- Gift and loan trusts

Gift and loan trusts may work for individuals who do not wish to give away their capital but are happy for the growth to be held in trust for the intended beneficiaries. - Discounted gift trusts

A discounted gift trust allows you to retain access to some of the capital in the form of an income stream that is set out as part of the trust. - Lifestyle trust

You might use a lifestyle trust of greater flexibility to access capital in the future is needed or to forgo that access if you choose to do so.

When you place a gift into most trust arrangements, this is known as a ‘Chargeable Lifetime Transfer’ or CLT. HMRC treats CLTs differently to Potentially Exempt Transfers (PETs).

If the value of the asset gifted to the trust is higher than the available nil-rate band at the time of the gift, HMRC applies a tax charge of 20% of the value in excess of the band. Other charges, such as periodic or exit charges, may also apply to the trust.

Like with gifting, HMRC considers assets transferred into a trust as part of your estate for a further 7 years. However, any growth on the trust assets will be outside of your estate immediately.

Trusts can be quite complex and sometimes costly to set up and they will require ongoing management. The need for professional help and advice on trust arrangements is essential.

7. Consider Inheritance Tax-Efficient Investments

There are a number of investments out there designed specifically for inheritance tax planning. You can commonly access these through:

- Alternative Investment Market (AIM) ISAs

- Enterprise Investment Schemes

- Business Property Relief Services.

Regardless of the form the investment takes, they all utilise Business Relief legislation.

This legislation was originally written to ensure continuity of family businesses in the event of death. This is still the case; however, the scope of Business Relief has evolved over the years. It has now become a method of investing to reduce potentially large inheritance tax liabilities.

Greater detail on these can be found in our article: Investing in Inheritance Tax Exempt Assets.

Inheritance Tax-Efficient Investments in More Detail

The main feature from an inheritance tax perspective is that the invested assets qualify for exemption from inheritance tax after only 2 years, providing you hold the shares at date of death. You still retain full access and control over the investments. Moreover, investing via this method does not impact on your nil rate band as gifting or trusts would.

Business Relief investment must be made into ‘qualifying trades’. This route is also considered higher risk than other more mainstream investments. However, the investment focus of the majority of providers is capital preservation rather than an aggressive growth strategy.

Alternatively, there are some providers which offer access to the Alternative Investment Market for a more growth targeted strategy.

These investments are higher risk and you should ensure you have the appetite and capacity to accept the risks. You should ensure you take expert advice when considering such investments as part of your IHT planning strategy.

8. Above All Else: Get Inheritance Tax Advice

You might often hear that inheritance tax is “a largely voluntary tax”. Yet the above gives you a taste of just how complex it is. At the risk of over-egging the cake, expert advice from trusted professionals such as your family lawyer and financial adviser is a must!

Here at Drewberry we have the requisite knowledge and experience to help you potentially reduce you inheritance tax bill. We will also always work closely with your other professional advisers (or we can recommend them) to ensure a holistic and joined up planning strategy.

Our inheritance tax advice process is to have an initial call / meeting to discuss your circumstances and goals. Then in a subsequent call / meeting we present strategies that we think you should consider.

Fees are only payable if you would like us to implement any of those strategies. Please contact us on 02084327333 to find out more.

- Topics

- Inheritance Tax

- Retirees

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.