Self-Employed Gas Fitter Gets Warm Feeling from Income Protection

Adrian’s Story

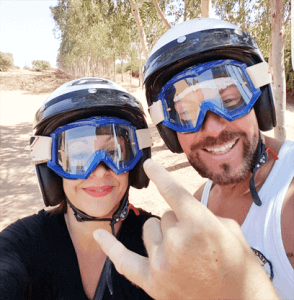

Adrian, 46, is a self-employed sole trader. Born in the York area, where he lived for 20 years, he’s now made his home in Leeds.

Adrian’s been a gas fitter for 22 years; he specialises in fitting bespoke fireplaces to really give your living room an atmospheric glow. He currently runs Gas Tech, a Leeds-based gas fitting and engineering company that works throughout Yorkshire.

Rethinking Income Protection

Adrian used to have a Sickness Insurance policy, but he cancelled the cover a while back in a push to simplify his outgoings.

As he got older, though, he decided it was time to think again.

“You start to realise that as you get older, the risk of getting injured goes up. So I thought it was time I protected my income to ensure all of my outgoings would be covered if I couldn’t work.”

Paying the mortgage was Adrian’s primary concern, but the Income Protection policy he now has in place means this worry is now lifted from his shoulders.

Who is Adrian?

From racing downhill to hiking up them

Adrian keeps active in many ways. However, with his services in high demand, he frequently works extended hours and later into the evenings. This can cut into his personal time and means his faithful gym bag can sometimes go untouched.

Even so, Adrian and his partner Alison, a recruitment director, still manage to go walking regularly. The Lake District and its many trails is a favourite location of theirs and quite a change of pace from the more hectic hobbies Adrian pursued in the past.

Back then, he was more commonly found tearing up the track on a mountain bike, entering high-level amateur downhill and 24-hour races right across the UK.

“I still miss it,” he says, “but it was a big commitment with frequent weekends away and when your kids are growing up, it’s more important to make time for your family.”

Making time for the family…

“Of course,” says Adrian, “my girls are both grown up now. My eldest, Charlotte, lives down in Epsom after graduating from fashion school there while my youngest daughter is now 20 and works as an apprentice in a salon near home,” he says.

However, Adrian’s quick to rule it out the prospect of free haircuts anytime soon. “I’m trying to reduce the risks in my life right now!” Adrian jokes. “Once she finishes her training we can talk!”

Born Free: The Benefits of Self-Employment

Most of Adrian’s time as a gas fitter has been spent as a self-employed sole trader, which is something he wouldn’t exchange for anything.

“The freedom has got to be my favourite thing about being self-employed,” says Adrian. “Although I sometimes think that when you’re self-employed, you work even more hours than when someone else is your boss!”

That certainly seems to be the case when we caught up with Adrian; it was past 7:30pm and he’d only just sat down after getting in from work.

Putting in all of the hours he does, Adrian was pleased with the ease and speed with which Drewberry got his self employed Income Protection cover in place. He found Drewberry through an online search for Income Protection, and was soon underway.

“I spoke with a couple of Drewberry advisers and both were friendly and really on the ball,” says Adrian. “The initial application was really fast; they took me through all the details needed to get my policy in place.

“Having an adviser do the comparison and arrange the cover for me saved loads of time, so I was really happy with the process.”

Income Protection on a Budget? No Problem

Drewberry adviser, Oliver Evans, arranged Adrian’s Income Protection policy for him, placing Adrian with a well-known UK friendly society. Adrian, like many of Drewberry’s clients, had a monthly budget he wanted to stick to for his self-employed sickness insurance cover, but that was no problem for Oliver.

“I was confident in recommending this insurer to Adrian because of their excellent claims data in 2015,” says Oliver.

“Also, like many of our clients, Adrian had a fixed budget in mind for the Income Protection cover he wanted. That was no problem as it’s something we’re used to dealing with.

“I arranged a shorter-term sickness insurance policy for him to fit in with his budget and the policy came in under his desired monthly maximum spend, despite the fact that he’s a manual worker, which can attract higher premiums.

“However, as Adrian told me he exercises regularly, this helped bring the premiums down too, as people who take care of their health are naturally less of a risk for insurers.”

Need Income Protection Advice?

If you find yourself in a similar position to Jo and are looking to set-up suitable financial protection to look after you and your loved ones then please don’t hesitate to get in touch.

Why Speak to Us…

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as protecting our health and our finances. Below are just a few reasons why it makes sense to let us help.

- There is no fee for our service

- We are independent and impartial

Drewberry isn’t tied to any insurance company, so we can provide completely impartial advice to make sure you get the most appropriate policy based solely on your needs. - We’ve got bargaining power on our side

This allows us to negotiate better premiums for you than you going direct yourself. - You’ll speak to a dedicated expert from start to finish

You will speak to a named expert with a direct telephone and email. No more automated machines and no more being sent from pillar to post – you’ll have someone to speak to who knows you. - Benefit from our 5-star service

We pride ourselves on providing a 5-star service, as can be seen from our 3954 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

You are protected. Where we provide a regulated advice service we are responsible for the policy we set-up for you. Doing it yourself or going direct to an insurer won’t provide this protection, so you won’t benefit from these securities. - Claims support when you need it the most

You have support should you need to make a claim. The most important thing when it comes to insurance is that claims are paid and quickly. We are here to support you during the claims process and make sure it’s as smooth and stress free as possible.

If it is all getting a little confusing and you need some help we are only at the other end of the phone.

Please don’t hesitate to pop us a call on 02084327333 or email help@drewberry.co.uk.

Tom Conner

Director

- Topics

- Income Protection

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.