Meet Colette

Colette is Drewberry’s resident wordsmith. Day in, day out, she’s transforming technical jargon into relatable stories that help businesses get the best out of their employee benefits.

As a result, she spends most of her day looking at screens while she crafts the helpful content we know and love. Whether it’s eight hours of writing at work, or an hours-long Sims session in the evening, all that screen time was bound to present issues sooner or later.

Here’s how Colette sorted her eye health issues with ease – thanks to her Medicash benefit and My.Drewberry platform.

Introducing The Corporate Health Cash Plan

Colette spends a big portion of her workday writing about the various health and wellbeing benefits that employers can offer their people. And ironically, she’d just completed a Guide To Corporate Health Cash Plans when she remembered she had access to this very benefit as part of her Drewberry rewards.

What Is A Cash Plan?

But what is it, exactly? Well, a Corporate Health Cash plan is a popular employee benefit, offering a cost-effective alternative to Group Private Medical Insurance. Plans are designed to support the cost of routine healthcare, offering a set yearly budget for different treatments which employees can then claim back. Think money for dental checkups, physiotherapy, and eye tests.

Company Cash Plans encourage workers to prioritise their wellbeing, preventing minor issues from escalating into problems that require sick leave. It also helps employees get back to work quicker if they do need time off.

Medicash To The Rescue: How Colette Made The Most Of Her Benefit

Drewberry and Medicash go way back. We’ve been helping businesses implement their Cash Plans for years, with fantastic results. And as one of the UK’s most popular providers with over 600,000 customers across the UK, offering this benefit to the Drewberry team was a no-brainer.

Getting The Details 📝

![]()

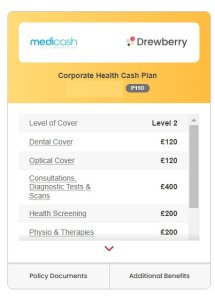

Colette’s first stop? Finding out what optical treatment was actually covered under her plan – and for how much. Rather than searching through paperwork from her onboarding, Drewberry’s innovative employee benefits platform made finding details a breeze. All she had to do was log into her portal to access the info.

After checking the Medicash card in her portal, Colette saw she had access to £120 worth of optical treatment for the year, covering eye examinations, lenses, and frames. Perfect! She downloaded the Medicash app, scanned Drewberry’s unique QR code, and she was ready to get started.

Getting The Treatment 👁️

The next stage was totally in Colette’s hands. The beauty of a Cash Plan is in its flexibility. You can undergo health appointments when and where it’s convenient, and as long as your plan covers said treatment, you can claim back as much or as little of your budget as you want.

Colette booked a lunchtime eye test at a local Specsavers to get checked out. After a full exam, she was told she had astigmatism in one eye and would need to wear glasses for reading and working.

Getting The Cash 💷

![]()

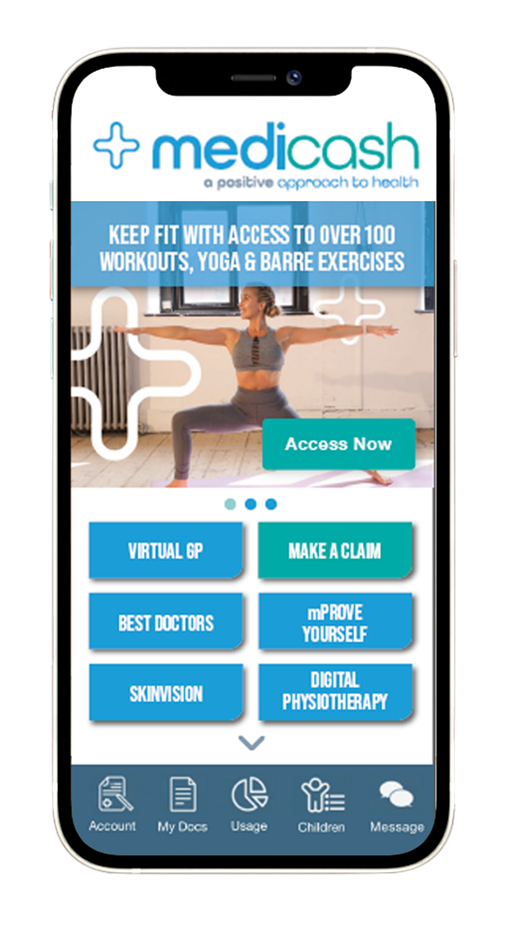

After her appointment was finished and frames were ordered, Colette paid for everything in full, making sure to get a receipt. She opened the Medicash app, uploaded a photo of the receipt and hit send.

Five days later, £120 was sitting in her bank account. Job done.

If you’re already paying for regular physiotherapy appointments for back pain, yearly eye tests, or wincing at the price of your dental checkups, making use of your Cash Plan is an absolute must.

The Impact of Medicash: Supporting Colette’s Wellbeing and Productivity

Colette’s new specs have helped considerably with the symptoms she was experiencing. She no longer suffers with migraines after the working day, and her neck pain is greatly reduced.

It’s a win-win for both employee and employer. Colette enjoys brand new specs while being more productive at work. This is exactly what Health Cash Plans are designed for – to tackle health issues before they become a bigger problem.

Need Help Putting A Corporate Cash Plan In Place?

If you’d like to offer your team the same valuable support Colette experienced through her Health Cash Plan, we’re here to help. Call us on 02074425880 or email help@drewberry.co.uk to explore your options.

Corporate Health Cash Plans are a simple, cost-effective way to support your employees’ wellbeing. They help your team access routine healthcare with ease, reducing the likelihood of minor issues becoming major problems. For employers, it’s a practical solution to improve engagement, boost productivity, and show your workforce you value their health.

Let us help you find the right plan for your business. Get in touch today to get started!

Why Speak to Us?

Employee benefits can be a headache. But our specialists do this day-in, day-out, offering first class service when you need it most. Here’s why you should talk to us:

- Award-winning independent employee benefits consultants, working with leading UK insurers and benefit providers

- Assigned specialist on hand to help – every step of the way

- 4067 and growing independent client reviews rating us at 4.92 / 5

- Authorised and regulated by the Financial Conduct Authority. Find us on the financial services register

- Claims support when you need it most.