7 Steps to Help Get You Retirement Ready

Whether you’re planning to retire soon or in 5, 10 or even 20 years from now, it’s never too early to start planning.

It takes a long time to build up the assets needed to retire comfortably and achieve the lifestyle you really want. For those who start planning early time is your best friend, but for those that leave it late, it can be your worst enemy.

More often than not, when we first meet clients their assets are, quite frankly, all over the place. They have numerous pensions, ISAs, savings accounts etc. and generally only have a rough idea how much they’re worth, let alone how well they’re helping to achieve their goals.

Why It’s Never Too Early to Get Ready for Retirement

To get your finances shipshape and retirement ready, Drewberry has set out some steps below to help you plan for a more prosperous future. It’s never too early to start getting your financial house in order — in fact, the sooner the better!

The sooner you start planning, the more chance there is of achieving your desired lifestyle when you no longer want to work so hard.

How Do You Want to Spend Your Retirement?

First things first — the place to start any plan is with clearly defined goals, setting out exactly what you want for you and your family’s future. To help, these are some of the key questions we ask new clients during our discovery meeting:

- When would you ideally like to stop working so hard?

- When you start to slow down, what would you like to do? What are your passions?

- Where would you ideally like to live?

- Do you have any big goals or dreams for retirement?

- Is there anyone in your family you’d like to help financially?

Once you’ve set out your desired lifestyle, the next step is map out the future expenditure needed to achieve it.

In addition to day to day living expenses, also consider the bigger ticket items, which could include the purchase of a holiday home, a trip of a lifetime upon retirement or the deposit for a child or grandchild’s first home. This is expenditure that would be met from your various savings, investments and pensions.

Consider Your Current Net Worth and Retirement Assets

Once you’ve mapped out your likely future expenditure to facilitate your desired lifestyle and goals, the next step is to look at the assets available to meet that future expenditure.

Your Current Net Worth

To start with, you’ll need to obtain a current valuation for each of your existing savings plans, pensions, ISAs, buy-to-lets etc. This gives you the value of your current resources that can be used or built upon to fund your goals.

Part of the process should include going back through your working history to look for any old pensions you’ve lost track of. It’s very common to come across clients who have lost track of company pensions which can turn out to be worth a sizeable amount.

This exercise is crucial, but it can take a little bit of time to contact each provider for plan details and a valuation. Some providers are more helpful than others! Fortunately, we take care of this process for our clients.

Your Retirement Assets

Once you have current valuations for each asset type, the next step is to forecast your current asset values forward to determine what they will likely be worth at your desired retirement age. This will require you to make assumptions about likely future returns for each asset type.

In practise this can be fairly complex, so you might want to appoint an adviser to help you. Alternatively, you could obtain forecasts from the research undertaken by an investment house, which often publish their research online.

For our clients, we employ a leading consultancy to obtain most of our long-run forecasts, which we use in conjunction with our financial forecasting software.

If there’s a gap between your projected assets at retirement and what you think you’ll need to retire comfortably, now is the time to think about how to make up the shortfall. If possible, this will likely mean saving more, in the most tax-efficient way.

When forecasting forward, don’t forget to factor in additional contributions you plan to make and how those contributions are likely to grow over the coming years. To get a rough idea of how much your pension might be worth come retirement, you can use our basic Pension Pot Calculator to help.

Meet Steve Lewis…

Corporate lawyer Steven came to us with eight different pensions and little idea of what this meant for his retirement.

We put a plan in place to put him in control of his finances. After consolidating his existing arrangements, Steven was able to align what he wanted to do in retirement with his current provisions and now has a clear plan in place to achieve his retirement goals.

How to Draw a Retirement Income

Now you know how much your assets will be worth at retirement it’s time to work out how you would turn those assets into a retirement income.

Some assets will be readily available to spend, such as cash in the bank, savings accounts and income from the State Pension or a defined benefit pension. Other investments you may need to sell down to turn into cash, such as with stocks and shares ISAs and defined contribution pensions.

With defined contribution (money purchase) pensions, which usually represents the largest asset we have to fund retirement, there are three main ways to turn those pensions into income:

- Buying an Annuity (which pays a guaranteed income for life)

- Entering Income Drawdown (where you remain invested and withdraw money from your pension fund)

- A combination of the two.

At Drewberry, we’re dedicated to making retirement planning as simple as possible. That’s why we’ve built calculators showing how much income you could have in retirement depending on which of the above options you choose. Although simple tools, our Annuity Rate Calculator and Drawdown Calculator should help to aid your thinking.

Could My Pension Run Out?

Income drawdown allows you to keep your pension money invested, allowing for potential investment growth and withdrawals as and when you need them.

However, keeping your pension pot invested in this way does run the risk that your retirement savings might run out (as opposed to using the money to buy an annuity where you have a guaranteed income for life).

Thus, if you’re considering drawdown, it’s essential you calculate how long your pension will last based on your monthly income needs. Our basic Income Drawdown Calculator can help with this.

- When does the money run out?

- How does this compare with your life expectancy?

- Is there a shortfall? If so, we provide some ideas to help in Step 7.

It’s important to bear in mind that we are now living far longer, and although hard to envisage, many of us will live well into our 80s. To get a rough idea of your life expectancy you can use this ONS calculator.

What Happens if the Stock Market Falters?

When it comes to investing, stock market volatility comes with the territory. That’s why every pension investor should conduct analysis to determine if their plans are resilient to stock market fluctuations.

When doing this, it’s essential to have a clear understanding of the level of risk being taken with your investment portfolio. If there is a big market correction, in any one year you could see a fall of around 5-10% with lower risk portfolios and 25-30% with higher risk portfolios (possibly even more without sufficient diversification).

- If there is a correction in the markets the year before you plan to retire which resulted in your portfolio falling by 20%, say, would that throw your plans out the window?

- Once retired, could a fall of that magnitude scupper your wishes for comfortable later years, or even result in you running out of money?

Remember, to make up a loss of 20% in any one year, your portfolio would need to rise by 25%. If you’re making withdrawals at the time it compounds the loss further, meaning the rise needed to recover the loss is even greater.

One of the most common mistakes we see with private investors is trying to target the highest return possible and taking very high levels of risk in the process.

It is often more prudent to work out what return is actually needed to achieve your goals. If you only need an annual return of say, 3%, is there any point taking the risk needed to achieve 6%?

Both when you’re approaching your retirement and during your retirement it is even more crucial to have a solid grip on the amount of risk being taken.

These days there are funds which have been designed for those drawing an income from their pension, often aiming to reduce volatility as much as possible while generating sufficient returns. Please get in touch if you would like to discuss your options.

Boost Your Chances of a Prosperous Retirement

There’s no hard and fast rules to increasing your retirement savings, but broadly speaking you should be asking yourself the following questions:

- Should I be saving more? And if so, how much more?

- Can I make more use of tax-efficient savings vehicles, like pensions and ISAs?

- Does the level of investment risk being taken put my retirement plans at risk?

- Are my investment funds performing as well as they should be for the level of risk being taken?

- Am I overpaying in provider charges, causing an unnecessary drag on my portfolio growth?

- Can I make better use of cash savings that are getting eroded by inflation?

- Are my assets structured to draw an income in the most tax-efficient way?

The Financial Forecasting We Offer Clients

Below is an example of how we help our clients plan for retirement using leading financial forecasting software.

It allows us to truly put our clients in control of their financial future, working together to create a road map which will help put them on track to achieve their life goals.

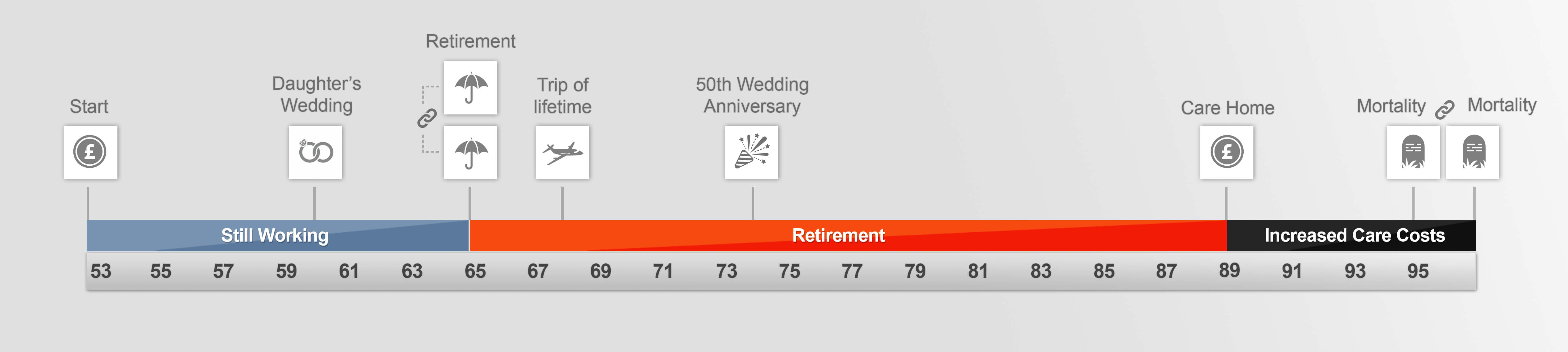

We input client’s financial situation into the software including income and expenditure. We can plan for significant future life events, such as retirement, care needs as well as significant expenditure items (weddings, special holidays etc).

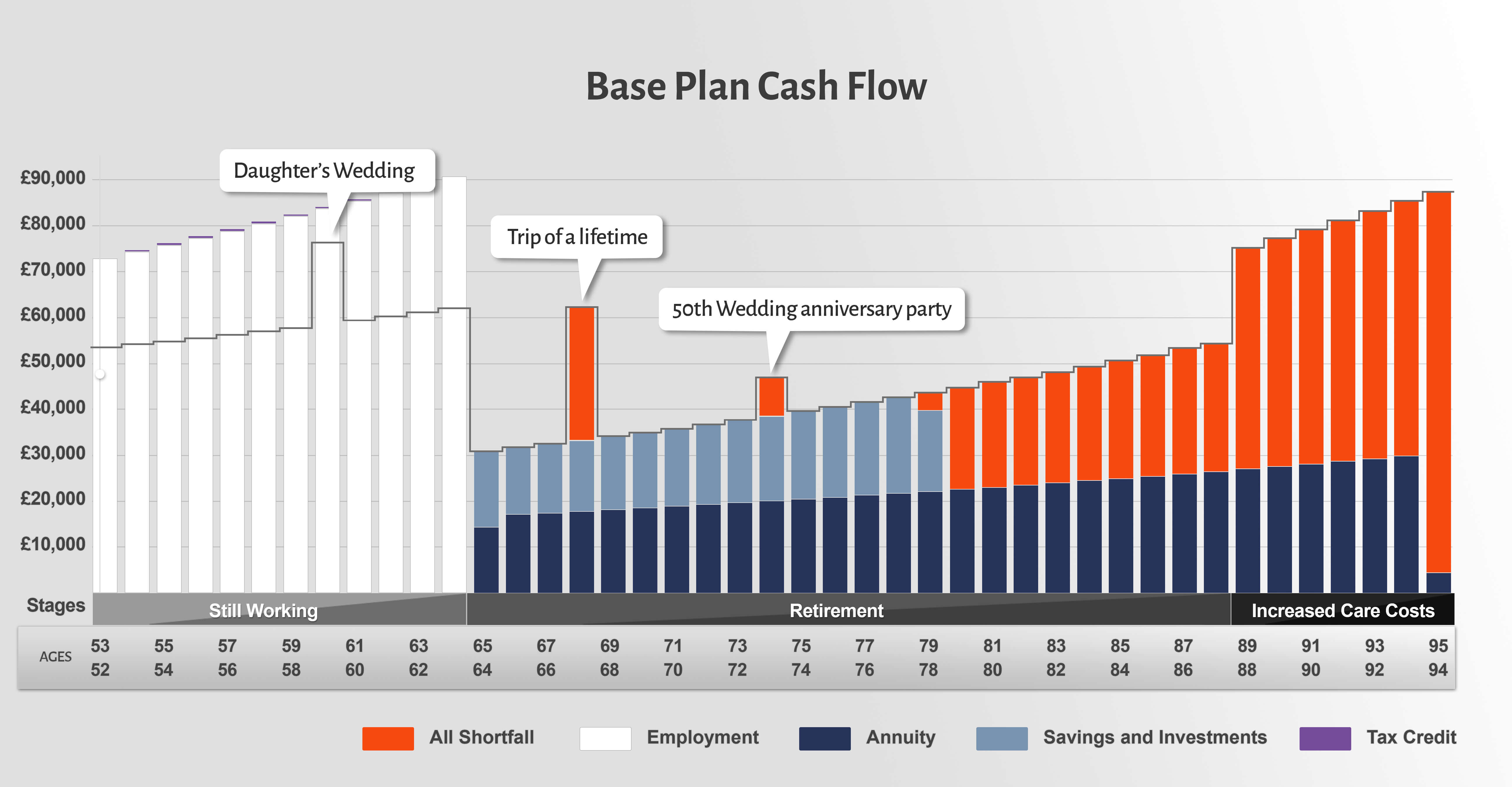

This produces an analysis of the client’s current financial situation, which can be viewed as a cash flow (how and where each year’s expenses are met from). Below you can see an illustration of one couple’s cash flow at the end of their careers and throughout their retirement.

On the graph above, the areas shown in red represent any shortfalls in income required. In the above scenario we can see that the clients work to age 65, then “spend” their accumulated pensions to purchase a lifetime annuity income using cash savings to supplement income as far as they can stretch.

There are significant shortfalls in the plan as you can see from the massive shortfall after they reach age 80. You can also see that their annuity doesn’t allow them to fund big one-off luxuries, in this example being a trip of a lifetime or a big party to celebrate their 50th wedding anniversary.

From our analysis of our clients’ potential financial futures, we can then create “what if” scenarios to stress test different financial planning opportunities.

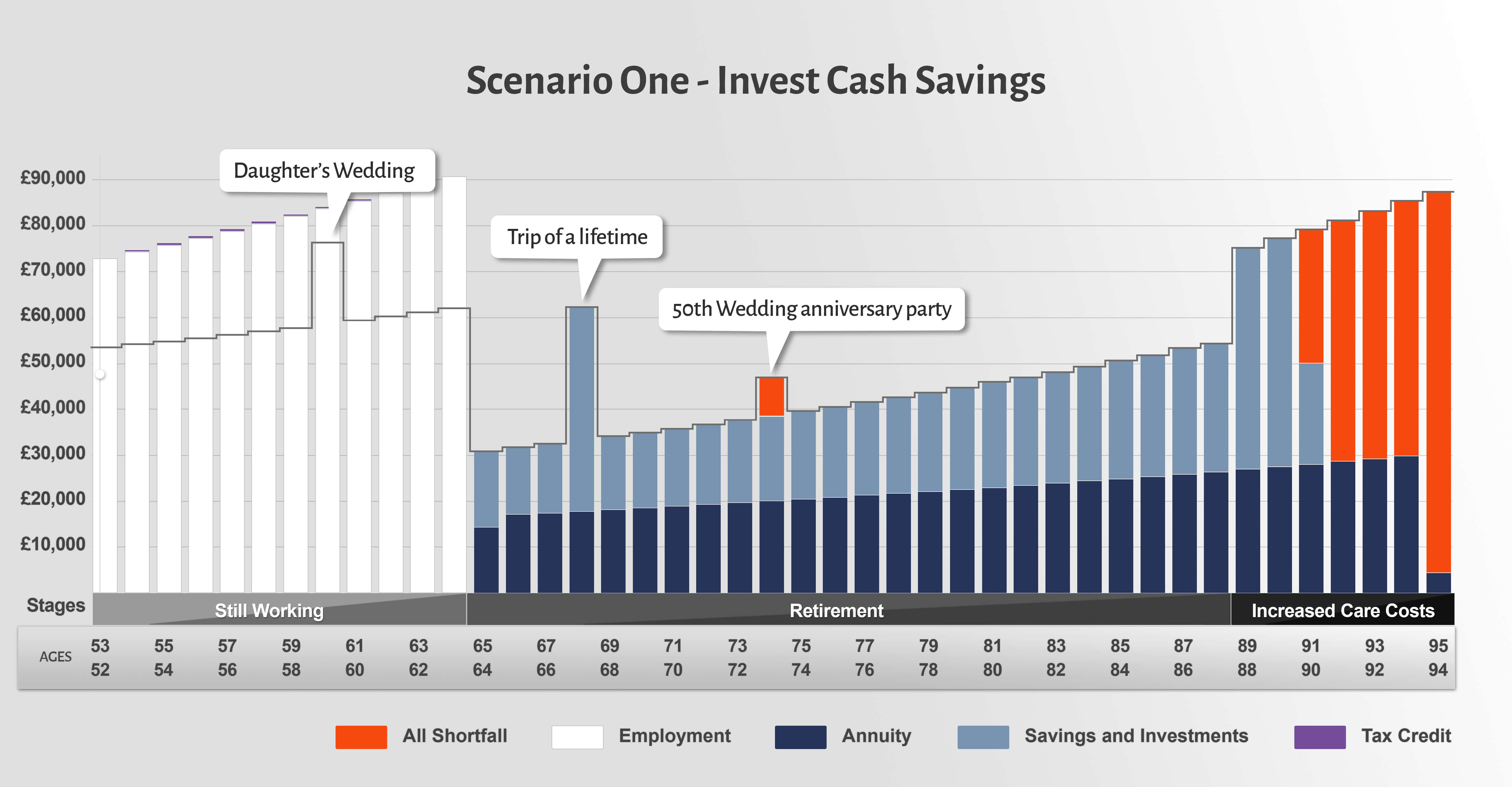

Scenario One: Invest Cash Savings

In the scenario illustrated in the graph above the clients’ cash savings, which were earning a rate of interest less than inflation, were invested for better returns in a diversified portfolio containing bonds, property and equities.

We can see that there are now enough sources of income and other assets to support the desired lifestyle into the clients’ 90s. They can even afford to take that trip of a lifetime, making the most of their retirement. Yet there is still more that we can do.

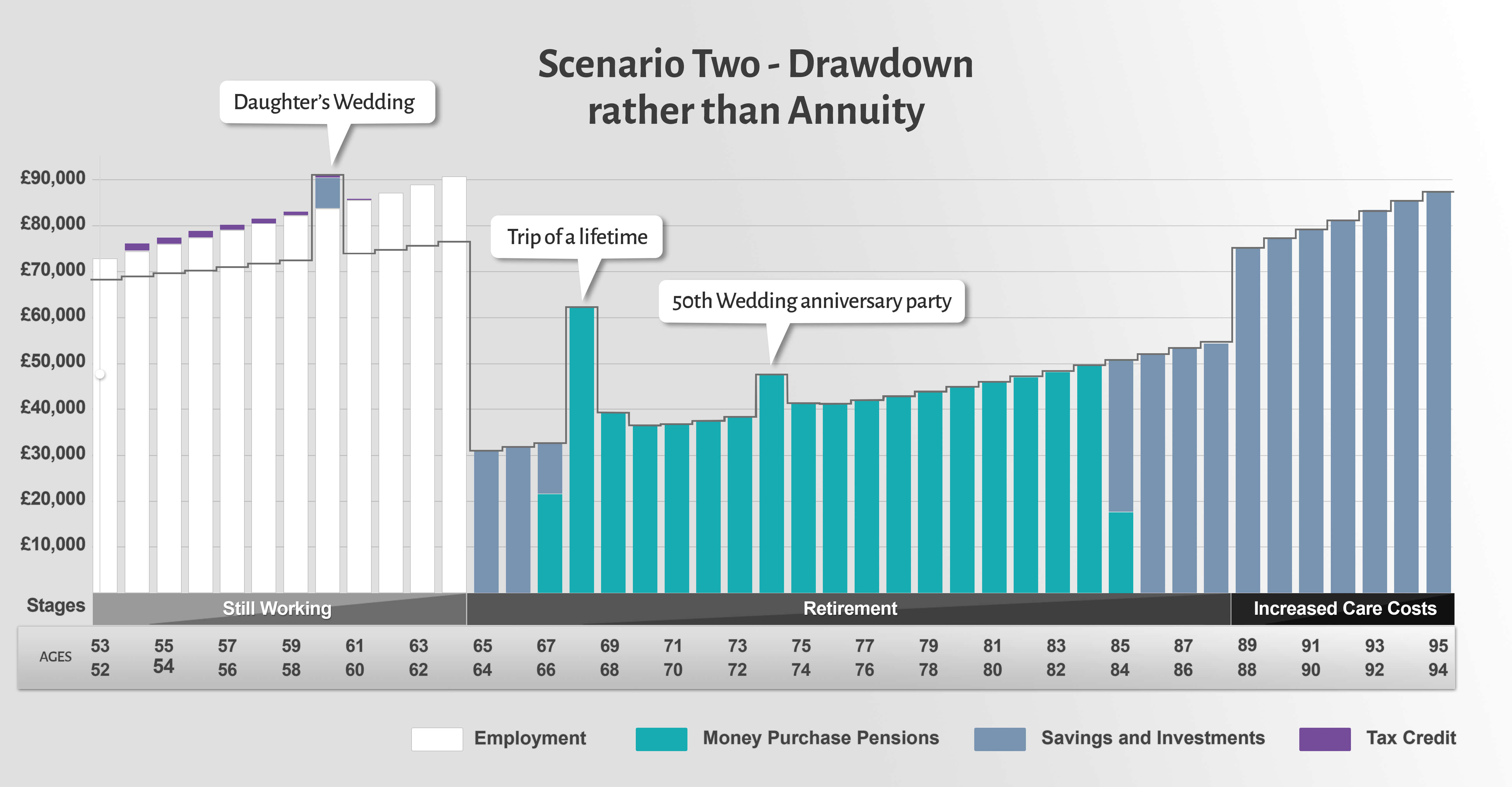

Scenario Two: Drawdown Rather Than Annuity

Taking this case one step further, we conducted some planning with their pensions to maximise contributions and use drawdown in retirement rather than the traditional annuity purchase route (please note this is just an example and may not be suitable for your specific circumstances).

Because of this we can now see that all expenses are met until the clients’ mid 90s and there are even funds remaining at the end of the timeline to pass onto loved ones. The use of drawdown in this example has enabled these clients to gain investment growth on their pension savings during retirement, helping them to meet their income needs and afford the extra desired luxuries.

Please note this is a very simplified case study for illustration purposes only.

Financial forecasting and stochastic modelling is based on several assumptions which may or may not be borne out in practice and outcomes cannot be guaranteed. The purpose of the software is to highlight planning opportunities given stated objectives and allow further in-depth discussion with your adviser on the pros and cons of each.

Repeating this process over a number of years at each regular financial review also helps to ensure you remain on course to meet your lifetime goals and maintain your financial independence.

How a Financial Plan Leads to a Richer Retirement…

If you don’t feel comfortable going through the above process yourself then we can help. As financial planners this is what we do.

In addition to advising on leading investment products, using financial forecasting software we can help to plan out positive financial futures. The graphical nature of the software means we can show you your current trajectory and the potential impact of suggested changes.

For most clients, the starting place is with a comprehensive financial and investment management plan. Please get in touch by calling 02084327334 if you would like to find out more or download our financial plan brochure.

Research from Old Mutual in 2016 showed that the average UK income in retirement is £18,000 per annum. However, the average for those who set goals working with a Financial Adviser is £24,175.

Put another way, by not working with a financial adviser, a client can potentially lose out on an extra 41% or as much as £147,147 over the course of a 21-year retirement.*

*Source: Retirement Income Uncovered – The New Normal 2016.

Why Speak to Us?

We started Drewberry because we were tired of being treated like a number. We want to give you as our client the service you deserve when discussing matters as important as planning your financial future.

Below are just a few reasons why it makes sense to let us help:

- See your financial future

Our sophisticated financial modelling technology visually maps out your financial future. Get a living financial plan that clearly shows what you can achieve depending on the decisions you make — read more here. - Achieve the retirement you deserve

Can you afford that dream round-the-world trip? Can you help your children onto the property ladder? We’ll model your goals and build your financial plan to help you achieve them. - Our expertise saves you time and provides peace of mind

We take care of it all, from organising your pensions, investing your assets, managing risk and making the most of your tax allowances. - We’ve got bargaining power on our side

This allows us to negotiate better rates for you than dealing with providers yourself. - You’ll speak to a dedicated expert from start to finish

You’ll speak to a named expert with a direct phone line and email. No more call centres and machines asking you to press this and that — you’ll speak to someone who knows you. - Benefit from our 5-star service

We pride ourselves on providing 5-star service, as seen in our 3914 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

Our regulated advice service means you are protected. We’re responsible for the decisions we help you make. Doing it yourself or going direct to a provider doesn’t offer this protection, so you won’t benefit from these securities.

- Topics

- Pensions

Our Services & Tools

We use clever technology to bring your financial future to life

- Find, organise and simplify your Pensions, ISAs and other investments.

- Plan your financial future and put a strategy in place to achieve this.

- Regularly review how you are doing to make sure you stay on track.

Contact Us

85 Queen Victoria Street

London

EC4V 4AB

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.