By 2020, Half of Us Will Get Cancer During Our Lifetime

Macmillan Cancer Support has recently announced that the number of cancer diagnoses has increased by one third in the last twenty years and that by 2020 half of Britons will get cancer during their lifetime. This is due to our life expectancy increasing.

Even though the number of people getting cancer is rising, due to advances in treatment and research, 4 out of 10 cancer sufferers will survive. This means that there will be a greater number of people living with cancer or having recovered from cancer than ever before. The figures show that there are 2 million cancer survivors in the UK today and this figure rises by more than 3% per year.

The long term effects of cancer

Research by Macmillan shows that one in four people living with cancer experience long term health conditions caused by the cancer or the treatment and never return to full health.

A recent report “Cured- but at what cost” looked at the long term consequences of cancer and the treatment of which there were many. For example women who have had breast cancer are twice as likely to get heart failure and men who have had prostate cancer are two and a half times more likely to get osteoporosis. In addition, 200,000 cancer survivors are left with pain often with nerve changes following cancer treatment.

Ciaran Devane of Macmillan said “The NHS will not be able to cope with the huge increase in demand for cancer services without a fundamental shift towards proper aftercare, without more care delivered in the community, and without engaging cancer patients in their own health.”

Private health insurance

To address the fact that people still need help after their cancer treatment has finished, private medical insurance provider, Bupa, has launched a “survivorship programme” for people living with or recovering from cancer.

This programme allows cancer sufferers to receive ongoing support following treatment to enable them to manage their recovery. Bupa’s specialist oncology support team who will advise people how to cope living with cancer looking at physical factors, but also the social, financial and emotional aspects of living or recovering from cancer.

Income protection

There are other types of insurance which may assist if you have cancer. Income protection insurance pays out if you are too unwell to go to work. The payment is a monthly tax free benefit which you would get until you are either well enough to go back or the end of the term (whichever is first).

This means that if you have been successfully treated but are still not well enough to go to work then you could receive a benefit to help you with your living expenses.

This will allow you to focus on your recovery rather than feeling pressured to return to work for financial reasons. Many insurers also provide support to help individuals return to full health and to the work place.

Critical illness insurance and serious illness insurance

Critical illness insurance pays out a lump sum if you suffer from an extremely serious illness specified on the insurers policy details. Not all cancer is covered; most insurers require it to have spread or reached a certain level of severity.

A serious illness insurance policy will pay out for a wider range of conditions but the level of payout depends on the severity of the condition and could range from 25-100%.

For more information on health insurance or protection insurance please contact one of our advisers on 0208 432 7333 or visit our Health Insurance site or Income Protection site.

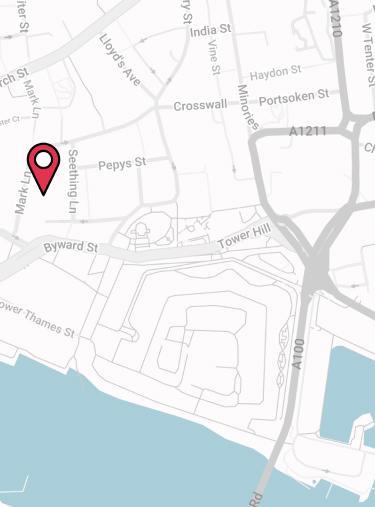

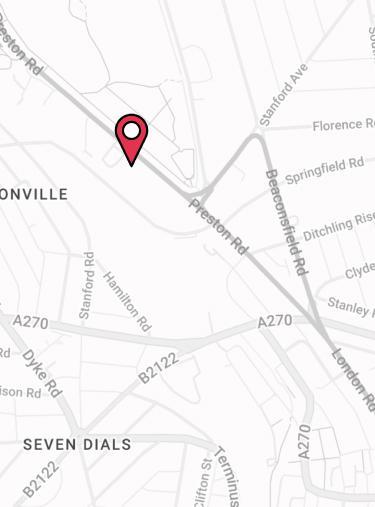

Contact Us

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.

![Bupa Health Insurance [Review] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2FProject-Penguin-Provider-logosBUPA.png&w=480&q=75&dpl=4123)