5 Reasons You Should Consider A Financial Adviser

Unfortunately, there aren’t many people who are taking advantage of the knowledge of an experienced financial adviser. Drewberry found that almost 2 out of 3 people in the UK have never received financial advice, with many people wondering whether financial advice is worth the cost.

Why Financial Advice?

According to the findings of the International Longevity Centre and Royal London, many clients have seen considerable improvements in their financial circumstances with the help of an adviser.

The report found that speaking to a financial adviser left people around £40,000 better off over a 2 year period than those who didn’t receive financial advice. This includes £13,000 more in financial assets and more than £27,000 in pension wealth.

“If we could just establish a norm that people take a financial health check at 50, this could significantly boost people’s wealth at retirement…

The challenge is to get people through the door of advice firms. Hopefully these independent findings will help to persuade more people that taking high quality, impartial advice at the right time is the key to a secure financial future.”

Steven Webb

Former Pensions Minister, Director of Policy at Royal London

1 :: Financial Advisers Can See the Big Picture

While keeping track of your finances, there may be certain things that slip your mind that a financial adviser would be able to pick up on, such as making sure you utilise your annual allowances as well as setting key milestones to achieve your long term financial goals.

One of the most common areas advisers add significant value is uncovering and consolidating forgotten pensions, ensuring your retirement accounts get just as much attention as your current account.

More than 50% of people have admitted that they have no idea how much their pension is worth and workplace pensions are notorious for slipping under the radar and getting lost when you move on to a new job role.

However, if you receive a Pension Review from a specialist they can track down your old pensions with a potential view to consolidate them to give you a better idea of how much you have saved for retirement.

By taking a holistic approach to your finances, your adviser can build an accurate picture of your financial situation and provide you with tailored recommendations.

2 :: Get Financial Advice From an Specialist

If there’s one thing that a financial adviser has that you probably don’t have, it’s inside knowledge of the way the world of finance works. The financial world is a rabbit hole; the further you fall, the more complicated it gets, adding twists and turns you never expected into the mix.

For example, more than 4 out of 5 Brits have never assessed their inheritance tax liability, despite 42.4% of people saying that they are keen to leave as much to their beneficiaries as possible when they die.

Many people wouldn’t know where to start in order to assess their tax liability — 59.5% of people have no idea which of their assets are free from inheritance tax. It is exactly these type of scenarios where a financial adviser can provide you with peace of mind knowing your finances are in order.

Advisers can translate all of the industry jargon, direct you to useful personal financing tools, explain all of the financial products and concepts that you don’t understand and teach you about what it takes to nurture your wealth.

3 :: Understand Your Options With Good Financial Advice

By trying to find the right financial products and opportunities on your own, you could be missing out on a plethora of options that you might not have thought or even known about.

Say, for example, you were considering taking out some Mortgage Protection Insurance. There are a fair few different options to choose from when it comes to insuring your mortgage.

However, what you might not have thought about was the possibility that Income Protection may be a more suitable product to meet your needs.

Moreover, a financial adviser can provide you with options that you would not be able to get anywhere else. Some insurers offer exclusive products and discounts that are only available via intermediaries and can’t be found by going directly to the provider.

4 :: Independent Financial Advisers are Carefully Regulated

In the UK, independent financial advisers (IFAs) are regulated by the Financial Conduct Authority (FCA).

This governing body provides a list of minimum requirements that companies and persons providing financial services must meet to ensure that they are providing a fair and quality service to their clients.

Regulated advisers approved by the FCA must meet minimum qualifications. In order to be approved by the FCA, they must demonstrate their honesty, integrity, competence, capability and knowledge of financial products and services.

So when you speak to a regulated financial adviser you can rest assured that they will provide you with informed, experienced advice and be a reliable source of information if you have any questions.

Being regulated by the FCA is, in effect, a stamp of approval that tells people that financial planners provide a professional and ethical service.

You can find a list of companies approved by the FCA on the FCA Financial Services Register, which is where you’ll find the Drewberry name as well.

Casey Goodwin

Paraplanner at Drewberry

Going through a financial adviser also offers you protection that you won’t get if you go direct. Whether you’re looking for insurance or to plan your pension, FCA regulations mean you’re protected and always have recourse to the ombudsman should you not be satisfied with the service you’ve received.

5 :: Hire a Financial Planner to Do the Hard Work for You

One of the key reasons why people use an adviser is to save themselves time. The world of financial services has a huge range of products and services for you to choose from and it’s not always easy to browse through them all to find the right one.

Rather than spending hours, days, or even weeks trawling through financial products and providers as well as pondering which one is the best, you can hand the task over to a financial planner.

They can do all of the research and summarise their findings for you along with their recommendations and comments, making the whole process quick and easy.

An insurance adviser, for example, will take on the task of reviewing the many different insurance policies and collecting quotes from insurance providers to get you the protection products you need.

Our wealth advisers can undertake cash-flow modelling with their financial planning reports which maps out your financial future and helps you visualise what you need to do to achieve your financial goals.

Similarly, a financial planner can take on the difficulties of investing on your behalf. Advisers have the time to review the market and map out a sound investment strategy in areas such as pensions.

This means you can reap the benefits of something like Pension Drawdown without the hassle of setting up and managing your own investment portfolio, for instance.

Why Speak to Us?

We started Drewberry because we were tired of being treated like a number. We want to give you as our client the service you deserve when discussing matters as important as planning your financial future.

Below are just a few reasons why it makes sense to let us help:

- See your financial future

Our sophisticated financial modelling technology visually maps out your financial future. Get a living financial plan that clearly shows what you can achieve depending on the decisions you make — read more here. - Achieve the retirement you deserve

Can you afford that dream round-the-world trip? Can you help your children onto the property ladder? We’ll model your goals and build your financial plan to help you achieve them. - Our knowledge saves you time and provides peace of mind

We take care of it all, from organising your pensions, investing your assets, managing risk and making the most of your tax allowances. - We’ve got bargaining power on our side

This allows us to negotiate better rates for you than dealing with providers yourself. - You’ll speak to a dedicated specialist from start to finish

You’ll speak to a named specialist with a direct phone line and email. No more call centres and machines asking you to press this and that — you’ll speak to someone who knows you. - Benefit from our 5-star service

We pride ourselves on providing 5-star service, as seen in our 4074 and growing independent client reviews rating us at 4.92 / 5. - Gain the protection of regulated advice

Our regulated advice service means you are protected. We’re responsible for the decisions we help you make. Doing it yourself or going direct to a provider doesn’t offer this protection, so you won’t benefit from these securities.

Contact Us

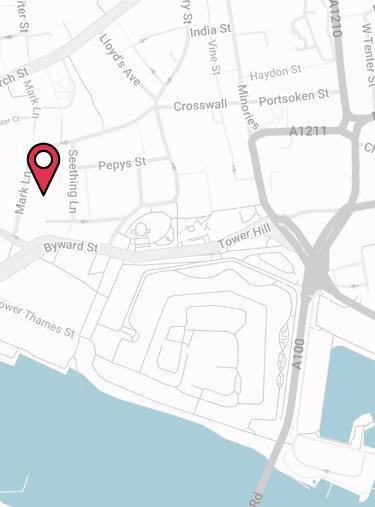

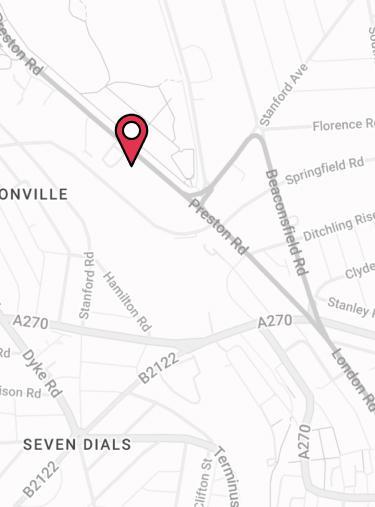

125-135 Preston Road

Brighton

BN1 6AF

Cookies

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy.