A large proportion of our clients are business owners themselves similar to myself and Andrew.

We know the amount of time and effort that goes into establishing a business and we have designed our business owner services with this in mind.

As a trusted partner we want to take these responsibilities off your desk and allow you to focus on growing your business and living your best life.

We have looked at our own situation and thought about the areas which have made the most difference to our own business and wealth. Not that these are in any particular order but if you are anything like us your own situation and future often ends up at the bottom of the pile 🤦.

Guide to Our Services

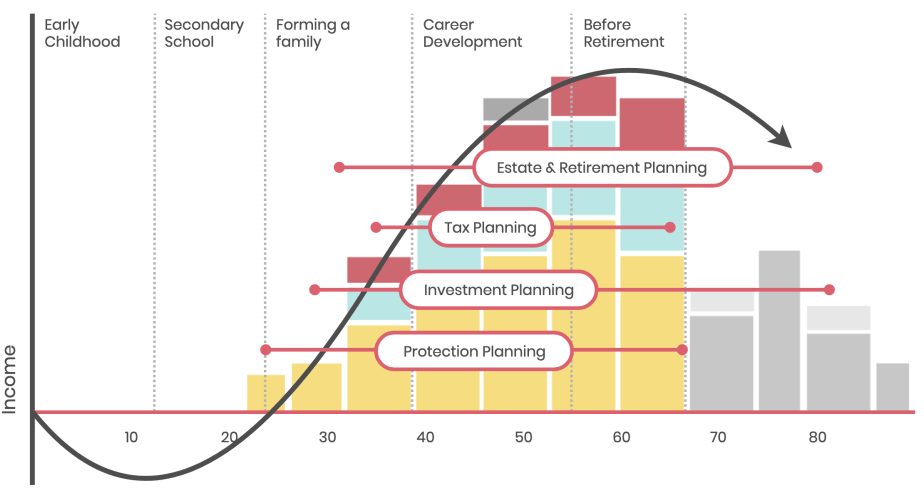

We have split out these services into 4 key areas:

- Looking after your employees

Implement a competitive employee benefits package to attract and look after the great people who will help you grow your business.

- Protecting your business

Ensure your business will survive if you or a key member of staff were to suffer a serious illness or pass away.

- Protecting yourself and your family

Provide your loved ones with a financial safety net should be unable to work, suffer a serious illness or die.

- Growing your wealth and planning for retirement

Organise your finances now to ensure you are making good decisions for your future.

Protecting Your Employees

Recruiting and keeping top employees is vitally important because you want the best talent working for you.

We help many of our business owner clients set-up a competitive employee benefits package for their staff. We look after the process from end-to-end, having access to all the leading insurers.

As with ourselves it often starts with Group Life Insurance, a very cost effective benefit. It also often comes with a number of really useful additional benefits such as virtual GP services — read Andrew’s experience of using it here.

As the company grows and establishes itself other benefits such as business health insurance or group income protection often get considered.

Group Life Insurance

Death in Service Insurance pays out a multiple of salary on the death of an employee, providing financial support to their family.

However, rather than covering a single individual, Group Life Insurance covers multiple employees under the umbrella of a single policy.

Consequently, a group policy often works out favourably — and cheaper — than individual Life Insurance policies because underwriting is on a group basis.

Individuals are usually put on risk without any medical questions providing the amount of cover you’re applying for on their behalf doesn’t exceed the policy’s free cover limit.

This can lead to better terms than if an individual had to be medically underwritten for an individual policy.

Setting Up A Trust

A trust is an important part of a Group Life Insurance policy. You can either choose to set up your own trust as a business or use the Master Trust the insurer offers. Which is best will depend on your needs as a business — this is something the team at Drewberry can help with.

Company Health Insurance

Business Health Insurance pays for healthcare in private hospitals in the UK. Your employees get access to private healthcare in some of the best hospitals the UK has to offer in exchange for monthly premiums.

The benefits of having Private Health Insurance include:

- Skipping NHS waiting lists

- Potentially access to better treatments, such as cancer drugs not yet approved for NHS use due to cost

- Faster treatment for eligible medical conditions for your workers, allowing them to get back to work quicker.

Private Health Insurance is the most sought-after paid-for benefit according to a recent Drewberry survey, which means it’s popular with employees.

Group Income Protection

Group Income Protection can benefit both your business and your employees. As an employer, you’re legally bound to pay sick pay in the form of Statutory Sick Pay at £118.75 per week for the first 28 weeks of the employee’s illness / injury.

Group Income Protection pays a proportion of an employee’s pre-tax salary into the business if they’re ill or injured for longer than the policy’s deferred period.

The employee can be absent for any medical reason. However, the most common causes are mental health issues and musculoskeletal problems. Recognising these as top causes of absence, the major Group Income Protection providers offer additional benefits with their policies.

These aim to get people claiming for mental health issues and musculoskeletal problems back to work faster. Insurers use counselling sessions or physiotherapy to achieve this, reducing employee absence pressure on you as the business.

Why Group Income Protection?

As a business owner, the payout offers employees more generous sick leave than Statutory Sick Pay.

This is obviously beneficial for the employee as they receive more than the minimum government sick pay. However, it can also save the company money in the form of lower Statutory Sick Pay payments over time. These savings will arise as you’re meeting your obligations through Income Protection rather than Statutory Sick Pay.

Group Critical Illness Cover

If an employee becomes critically ill (with an illness stipulated in the policy’s terms and conditions), Group Critical Illness Cover pays out a lump sum equivalent to a multiple of that employee’s salary. Cancer, heart attacks and strokes make up the majority of claims.

Your employees may find it harder to claim successfully under Group Critical Illness than Group Income Protection. If any medical condition stops you working, Group Income Protection pays out. It doesn’t have to be an insurer-specified critical illness to make a successful claim.

Protecting Your Business

There could be a number of people the business relies on to succeed and achieve profitability. Alternatively, it could just be you, the chief cook and bottle washer who does more than a bit of everything!

However your business operates, it’s important to consider protecting it from anything that comes your way. Some of the most common reasons businesses fold is the absence of a key person through death or illness.

Legal & General reveals 2 in 5 businesses have no plan in place in case they lost a key person.

Keyman Insurance

Key Person or Keyman Insurance is there to pay a lump sum into the business to offer financial continuity should a key person within the company pass away or become critically ill.

According to research from major insurer Legal & General, 52% of small UK businesses would cease trading in less than a year should a key employee die or be diagnosed as critically ill and unable to work.

How would your company cope?

What is a Key Person?

A key person could be anyone key to the ongoing success of the business. It could be you, the business owner, or any other people the business would suffer without.

Key Person Insurance offers the company a payout should the insured key individual pass away or become critically ill. In the first instance, the business can then use this cash however best suits its needs at the time, such as:

- Providing a buffer against loss of profits

- Paying for recruitment and training of a replacement

- Repaying outstanding loans

- Making up for loss of important personal or business contacts

- Helping to recover loss of confidence from suppliers and customers

- Supporting the company through difficulties in raising finance for new developments

- Protecting against loss of detailed knowledge of the business’ processes and systems.

Shareholder Protection Insurance

Shareholder Protection Insurance is used where there are two or more shareholders within a company.

Just as with Keyman Insurance, it also provides business protection. However, it also offers an element of personal protection for a business partner.

Shareholder Protection pays a lump sum to the business on the death or critical illness of a shareholder. This payout allows the business to buy back the absent shareholder’s shares. Meanwhile, the share-owning partner / their family achieves a fair price for those shares.

The sale and purchase occurs through a system of agreements known as cross-option agreements. These work in tandem with your company’s articles of association.

Why Shareholder Protection?

Shareholder Protection allows for smooth succession planning for a company that may otherwise flounder if a shareholder fell ill or even sadly passed away. It therefore provides cover for the business, the partner and their family.

Legal & General says nearly 50% of businesses have no arrangements for their shares if a shareholder died. Without a plan, in most cases shares pass to the family of the shareholder, meaning you the business owner and any partner(s) could lose control of part of the business.

Without Shareholder Protection, if a shareholder dies and the shares pass to the family, you could get a new sleeping partner in the business. Consequently, you may get find yourself with a new owner of the shares who’s entitled to a slice of the profits but doesn’t have the ability to help run the business themselves.

Even more concerning, they could alternatively sell their shares to a competitor to realise their value if the business can’t come up with the money to buy them back itself.

Business Loan Insurance

Many companies take on debt in their path to success. Consequently, corporate overdrafts, commercial loans, venture capital funding, commercial mortgages or any other type of debt are relatively common.

The average debt of a UK SME stands at £176,000 says Legal & General. However, just 1 in 5 firms have insurance for their debt.

What would happen to your company debt if a person key to repaying it died or exited the business through critical illness?

You may find that the lender / venture capital provider becomes jittery about the ongoing extension of credit without that key person there to assist the business in driving profits to repay the debt / funding.

That’s where Business Loan Insurance can step in. It repays the outstanding corporate debt balance in the event of a key person’s absence from the business through death or critical illness.

Protecting You and Your Family

As a business owner, we understand that you’re probably incredibly busy and often the business comes first.

However, that doesn’t mean that you shouldn’t take time to protect yourself and your family as well as the company.

Moreover, you can actually take advantage of your status as a company director to protect your loved ones more cost-effectively and tax-efficiently by running cover through the business.

Relevant Life Insurance

If you died, how would your family manage financially? Is there a mortgage, essential bills and other expenses?

For this reason, many people consider Life Insurance that pays their loved ones a lump sum should they pass away.

In this vein, Relevant Life Insurance is a special, tax-efficient Life Insurance for company directors.

Just like personal Life Insurance you pay for from your own bank account — i.e. it pays out a lump sum should you pass away — your family can use it however they see fit to help them cope financially after you’re gone.

However, as your limited company owns and pays for the policy, you can achieve tax savings on premiums compared to a personal policy. Income tax, National Insurance and corporation tax relief on those premiums means savings can be as much as 49% compared to a personal plan.

Don’t Forget the Trust…

You cover yourself for a multiple of your earnings (which includes both salary and dividends). Then, should you pass away, the policy pays out into a trust set up with the help of your adviser when you set up the cover.

Relevant Life Insurance hinges on having a trust to accept the funds should you pass away. Otherwise the payout goes into the business (which owns and pays for the policy) and that has nasty tax implications.

Trusts can be tricky, which is why the team here at Drewberry walks you through setting up the right trust. We’ll also ensure your policy is entirely tax compliant.

Executive Income Protection

What would happen if you were off work sick?

As a company director you probably don’t get sick pay from the business. Could the company afford to keep paying your income while you were sick if you weren’t generating profit?

Here, Exceutive Income Protection can step in to pay out up to 80% of your pre-tax earnings while you’re unable to work.

How Executive Income Protection is Taxed

Again, your limited company also owns and pays for such a policy. HMRC therefore taxes it slightly differently from personal policies.

Policies paid for from a personal bank account are paid with income that’s already had income tax and national insurance contributions deducted. As such, this means the benefit can be paid tax-free.

However, with Executive Income Protection, the company pays premiums before taxation and so the benefit is taxed upon a claim, just as if you’d been receiving your usual remuneration from the company.

The bottom line is that Executive Income Protection allows the company to continuing paying you should you be off sick and not generating an income. You therefore get a level of sick pay not usually found among company directors.

Private Health Insurance

As mentioned, Private Health Insurance is a way to get medical care in private hospitals funded by an insurer.

In exchange for monthly premiums, you’ll receive the opportunity to be treated privately in some of the best UK hospitals for eligible, acute medical conditions. Cover is available just for yourself or you can extend it to your partner and children. That way, you can all benefit from private care.

Can I Pay for Private Health Insurance Through My Business?

Many of our business owner clients ask whether they can pay for their Private Health Insurance through their business. The answer is yes but there are tax implications — it’s a P11D benefit in kind. You will therefore have to pay tax on the premiums the business pays on your behalf.

This means your tax code will be adjusted downward by the same amount as the premiums, so you can earn less before paying tax. As the business owner, you will also need to pay National Insurance contributions.

However, your business will benefit from corporation tax relief.

While corporation tax relief usually means most people will be marginally better off paying for the policy through the business than paying for it personally, this will depend on your circumstances. If you’re unsure, the best course of action is to check with your accountant to be certain.

Growing Your Wealth

We recognise how important your business is to you.

However, sometimes people put the financial success of their business even over and above their own. They don’t consider that business and personal financial achievement can actually be a single goal.

This doesn’t have to be the case.

Research has shown that one of the best ways to increase your wealth is to work with a financial adviser to create clear financial goals.

Once you have these goals to work towards, you’re better equipped to meet them than if your financial future is a hazy concept just over the horizon.

![pension advice increases retirement income]()

With our advanced financial modelling software we are able to build out your financial future and model the important questions you want answering 🤓

![lifetime financial planning]()

Watch Sam Barr-Worsfold one of our Financial Planners give a short demonstration of how we use this technology with our clients to cover some of the most common problems we find.

No two people are the same and as a result good financial planning can be quite broad. We have summarised our core services in the tabs below.

General Financial Planning

Basic financial planning comes down to making good financial decisions based on current legislation.

We want to maximise your earnings whilst ensuring you are invested appropriately to meet your financial goals.

Common areas we help in include:

- Maximising the use of your tax allowances

- Tax-efficient investment options

- Optimising the diversification of your investments

- Modelling what ‘good’ looks like and making sure you stay on track.

For some of the most common questions we get asked by our business owner clients we have created guides to support our philosophy:

Pension Planning

Business owners often consider their business to be their pension (here’s some reasons why that’s not always a great idea). Yet what about an actual pension pot?

We organise our business clients’ personal pensions (which often tend to start in a bit of a muddle) where possible into a single arrangement held online. This provides the visibility to plan effectively as we can both see:

- How your pension is performing

- How much your pension costs

- Historical performance

- Whether we are on track for retirement

Being a business owner you have the benefit of being able to fund pension contributions through your limited company, which is a great way to be as tax efficient as possible.

Inheritance Tax Planning

Perhaps you’re at retirement now and have sold your business.

With a sizeable estate you may have come to the realisation you could leave your loved ones with a large inheritance tax bill.

However, good forward planning means there are many ways to help mitigate an inheritance tax liability whether that is through gifting, insurance or business property relief.

Utilising our technology we build financial models to help you pass on your estate in the most efficient way.

We’ve even put a guide together as an overview of how business owners who have sold their company which you can read here.

Why Drewberry?

We started Drewberry because we were tired of being treated like a number and not getting the service we all deserve when it comes to things as important as planning our finances.

A good financial plan can help you make the right decisions when it comes to your finances. Make the right decisions today to build a more prosperous future.

Below are just a few reasons why it makes sense to let us help.

Simply pop us a call on 02084327333 or email help@drewberry.co.uk to take advantage of our knowledge today.

Speak To Our Specialist Advisers

![How to Extract Cash from Your Business Tax-Efficiently [VIDEO] Image](/_next/image?url=https%3A%2F%2Fmedia.drewberry.co.uk%2Fbusiness-cash-webinar.png&w=480&q=75&dpl=4135)